UBI Discount Calculator

Calculate Your Potential Savings

What Usage-Based Auto Insurance Actually Tracks

Usage-based auto insurance (UBI) isn’t just a fancy term for discounted rates. It’s a system that uses real driving data to set your price. If you drive safely and rarely, you pay less. If you’re a night owl who floors it at red lights, your premium might go up. That’s the core idea. Unlike traditional insurance, which guesses your risk based on age, zip code, or credit score, UBI watches what you actually do behind the wheel.

Most programs track at least five key behaviors: how hard you brake, how fast you accelerate, how sharp you turn corners, how many miles you drive, and when you drive. Some newer systems, like Progressive’s Snapshot, now also factor in weather conditions and road conditions. If you’re driving on icy roads at 8 p.m. during a snowstorm, that’s logged - and it affects your score.

The data comes from one of three sources: a smartphone app, a plug-in device that connects to your car’s OBD-II port (usually under the dashboard), or a built-in system like GM’s OnStar. You don’t need to be tech-savvy. Installing a plug-in device takes less than a minute. Apps just require you to download the insurer’s software and keep your phone in the car.

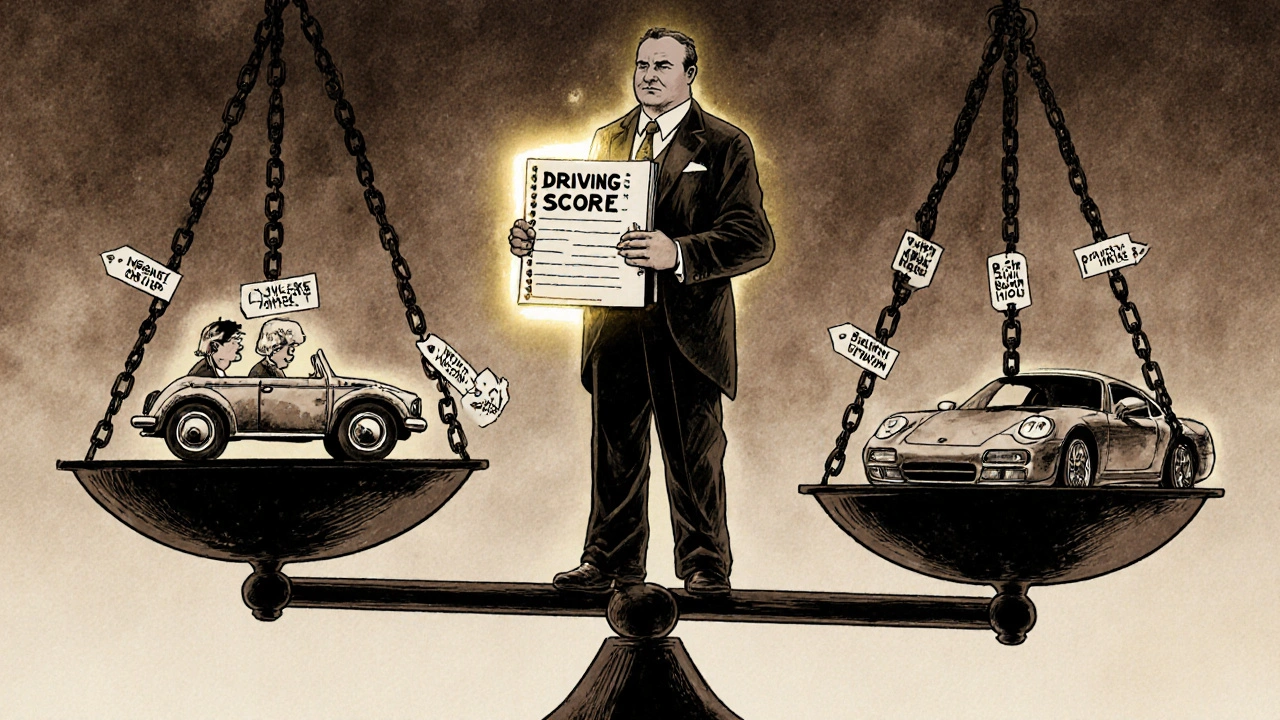

How Your Driving Score Is Calculated

Your score isn’t a mystery. It’s broken down into three main buckets: behavior, mileage, and timing.

- Behavior (50-60% of score): This is where most people lose points. Hard braking (slamming the brakes), rapid acceleration (peeling out from a stop), and sharp cornering (taking curves like you’re in a race) all hurt your score. It doesn’t matter if you never got a ticket. If you’re braking hard five times a week because you tailgate, your score drops.

- Mileage (20-30% of score): The fewer miles you drive, the lower your risk. A retiree driving 3,000 miles a year will almost always score better than a commuter driving 15,000. Some plans even offer pure mileage-based pricing - you pay per mile, no behavior tracking needed.

- Timing (10-20% of score): Driving between midnight and 4 a.m. is riskier. So is driving during rush hour in heavy traffic. Even if you drive smoothly, frequent stop-and-go driving in the city lowers your score. That’s not a flaw - it’s a fact. Traffic jams mean more chances for fender benders.

Most insurers give you a score out of 100. A score above 80 usually means a discount. Below 60? You might pay more. Progressive says drivers with scores above 80 get an average discount of 25% after six months. State Farm’s Drive Safe & Save program reports similar numbers.

Real Discounts You Can Actually Expect

Let’s cut through the marketing. How much do people really save?

Most drivers who qualify get between 10% and 30% off their premium. Some get more. One Reddit user, u/MileageMinimizer, drove only 3,000 miles a year as a retiree. After six months in Snapshot, they got a 27% discount right away - then another 12% after the trial. That’s nearly 40% off.

But here’s the catch: not everyone saves. About 20-25% of participants see their rates go up. Why? Because UBI doesn’t care if you think you’re a good driver. It cares about what the data says.

For example, a young driver with a clean record might pay $1,800 a year under traditional insurance because they’re under 25. But if they drive 12,000 miles a year, mostly during rush hour, with frequent hard stops, UBI might show they’re riskier than average. Their new rate? $2,100. That’s not a scam. That’s the math.

People who win with UBI are usually:

- Retirees or remote workers who drive under 5,000 miles a year

- Commuters who avoid rush hour and drive during daylight

- Drivers who rarely brake hard or speed up fast

- People who don’t drive late at night

If you fit that profile, UBI is a no-brainer. If you drive a lot, often at night, or in heavy traffic, you might want to skip it.

The Edge Cases No One Tells You About

UBI sounds perfect - until it isn’t.

Here are the hidden edge cases most insurers won’t warn you about:

1. City Drivers Get Penalized for Traffic

Reddit user u/SafeDriver2022 drove 90% of their miles in the city. No speeding. No tickets. But they got an 8% rate increase. Why? Their app logged 12 hard stops a day - because of stop-and-go traffic. Even though they weren’t tailgating or driving recklessly, the system counted every brake as a risky behavior. That’s not fair, but it’s how the algorithm works.

2. The First Discount Isn’t Guaranteed

Many insurers offer an immediate discount just for signing up - like 10% off. But that’s just a teaser. Your final rate comes after the 4-6 month monitoring period. If your score drops during that time, your discount disappears. Some people think they’re locked in, but they’re not.

3. Phone Use Is Tracked - Even If You’re Not Using It

Some apps use your phone’s sensors to detect if it’s moving with you in the car. If your phone is in your pocket and vibrating (say, from a notification), the system might flag it as “phone use while driving.” You didn’t touch it. But the algorithm doesn’t know that. It just sees movement.

4. Rural Drivers Get Left Behind

UBI adoption is highest in cities - 23.7% of urban drivers use it. In rural areas? Only 8.2%. Why? Because rural drivers often have long, quiet roads. Their driving looks “safe” - but they cover more distance. So they don’t get the same discounts. Meanwhile, city drivers with short trips and frequent stops get penalized even if they’re careful.

5. Your Data Could Be Used Against You

Technically, insurers say they don’t use your data to cancel policies or deny claims. But they do use it to adjust pricing. And if you ever file a claim, your driving history could be reviewed. If your score was low, it might influence how they handle your case.

Who Should Skip Usage-Based Insurance

UBI isn’t for everyone. Avoid it if:

- You drive over 12,000 miles a year

- You commute during rush hour (7-9 a.m. and 4-7 p.m.)

- You live in a city with heavy traffic and frequent stops

- You drive mostly at night

- You’re uncomfortable with your driving being tracked

If you fall into any of these categories, traditional insurance might still be cheaper - and less stressful. You’re not a bad driver. You just don’t fit the UBI model.

How to Get Started - And What to Watch For

Ready to try it? Here’s how to do it right:

- Check if your insurer offers UBI. Progressive, State Farm, Allstate, and American Family all have programs.

- Ask: Is the initial discount locked in? Or does it disappear after the trial?

- Choose the method: app or plug-in? Apps are free. Plug-ins might cost $10-$20 upfront.

- Drive normally for 4-6 months. Don’t try to game the system. The algorithm catches that.

- After the trial, compare your new rate to your old one. If it’s higher, switch back.

Pro tip: Don’t sign up if you’re planning a big road trip. Long highway drives look good, but if you’re driving 1,000 extra miles in a month, your annual mileage estimate could jump - and your rate might rise.

The Future of UBI: What’s Coming by 2026

UBI isn’t slowing down. By 2025, experts predict 35% of U.S. auto insurance policies will use usage-based pricing - up from 18.5% in 2023.

Next up: more data. Insurers are testing:

- Drivetime fatigue detection (if you’ve been driving 3+ hours straight)

- Integration with weather apps (automatically adjusting for rain or ice)

- Real-time feedback via app notifications (“You braked hard 3x today - slow down on curves”)

Some companies are even experimenting with “driver scores” that follow you between insurers - like a credit score for driving. That could make it harder to shop around.

Privacy laws are catching up, too. California and New York are already looking at rules to limit how insurers use data. But for now, you’re giving them a lot of info - so know what you’re signing up for.

Final Thought: It’s Not About Being Perfect - It’s About Being Predictable

UBI doesn’t punish bad drivers. It rewards consistent, calm driving. You don’t have to drive like a monk. But if you’re always slamming brakes, speeding up fast, and driving late at night, you’re telling the algorithm you’re a higher risk. And they’ll price you accordingly.

If you drive safely and sparingly, UBI could save you hundreds. If you’re a busy commuter or night driver, it might cost you more. The key is knowing your habits - and whether they match the system’s expectations.

Test it for six months. If it works, keep it. If not, walk away. No penalty. No contract. Just data.

Does usage-based insurance track my location?

Yes, most UBI programs track where you drive - but not in real time for surveillance. The data is used to understand driving patterns, like whether you frequently drive in high-crash areas or on rural roads. Insurers say they don’t store exact addresses or use location data to penalize you for living in a certain neighborhood. But if you drive in areas with high accident rates often, your score may drop.

Can my insurance company cancel my policy if my UBI score is low?

No, insurers can’t cancel your policy just because your UBI score is low. But they can raise your premium at renewal time. Your policy terms won’t change mid-term unless you violate the contract (like lying on your application). The worst that happens is you pay more next year - not that you lose coverage.

Do I need to keep the device or app installed forever?

No. Most programs only require you to use the device or app for the initial 4-6 month evaluation period. After that, you can remove the plug-in or uninstall the app. Your new rate will stay locked in - unless you opt out of the program entirely. Some insurers let you keep the app active for ongoing feedback, but it’s optional.

Is UBI cheaper for older drivers?

Not necessarily. Traditional insurance charges older drivers more because of perceived risk. But UBI doesn’t care about age. A 70-year-old who drives 20,000 miles a year with aggressive habits might pay more than a 22-year-old who drives 4,000 miles calmly. UBI levels the playing field - your score matters more than your birth year.

What happens if my phone dies or the app stops working?

Most apps store data offline and sync when you reconnect to Wi-Fi or cellular. If your phone dies for a day, it won’t ruin your score. But if the app is off for weeks, your insurer might pause your discount or flag your account for review. Keep your phone charged and the app running during your trial period.

Can I switch insurers if I don’t like my UBI rate?

Yes. UBI programs don’t lock you in. You can cancel at any time and switch to another insurer. Your driving data stays with the original company - it doesn’t transfer. So you can start fresh with a new insurer’s UBI program. Just make sure your new policy starts before your old one ends to avoid a lapse.

Comments

Graeme C

November 16, 2025Let’s be real - this system is just a thinly veiled pay-to-play scheme disguised as fairness. I drive 4,000 miles a year, mostly during daylight, and still got a 5% rate hike because my phone vibrated in my pocket during a traffic jam. The algorithm doesn’t care that I wasn’t touching it - it just sees motion and assumes guilt. They’re not rewarding safe drivers. They’re punishing people who live in cities, have jobs, and don’t own Teslas. And don’t get me started on how rural drivers get shafted because their long, empty roads ‘don’t look risky’ - yeah, because they’re not doing anything wrong, unlike the guy in LA braking every 30 seconds because of gridlock.

It’s not data-driven insurance. It’s data-driven discrimination.

Also - why do I have to install an app that tracks my location, phone movement, and driving patterns just to get a discount I might not even qualify for? I’d rather pay the full premium and keep my privacy. This isn’t innovation. It’s surveillance with a discount sticker on it.

Astha Mishra

November 17, 2025It is fascinating, is it not, how we have come to measure human behavior through quantifiable metrics - as if the soul of driving can be distilled into brake force, mileage, and time-of-day indices? We have reduced the act of moving from point A to point B - an act that once carried with it the rhythm of life, the quiet solitude of dawn drives, the urgency of late-night errands - into a spreadsheet of risk factors.

And yet, I wonder: if a driver is calm, deliberate, and attentive - but lives in a city where stoplights are spaced like prison bars - should they be penalized for the design of the city, not their own conduct? Or if a retiree drives slowly, gently, and rarely - but their phone vibrates because of a notification from their granddaughter - should that be equated with texting while driving?

Perhaps the true question is not whether UBI is fair - but whether we have surrendered too much of our autonomy to algorithms that cannot understand context, nuance, or grace. The machine sees motion. The human sees meaning. Which one should decide our worth?

And yet… I still signed up. Because even flawed systems can offer relief. And perhaps, in this imperfect world, a 15% discount is better than no discount at all - even if it comes with the quiet shame of being watched.

Kenny McMiller

November 18, 2025UBI’s just the next phase in the monetization of behavioral data - and honestly, it’s genius from a biz dev standpoint. Insurers are turning every driver into a real-time telemetry stream. You’re not just paying for coverage anymore - you’re paying for the privilege of not being flagged as a ‘high-risk behavioral outlier.’

The real kicker? They’re not even using the data to underwrite risk anymore - they’re using it to *reshape* risk. If you drive like a robot, you get rewarded. If you’re human - you get priced out. And the worst part? The algorithm’s biased toward low-mileage, low-traffic, low-stress lifestyles - which means it’s basically a subsidy for the wealthy who can afford to work from home, avoid rush hour, and own a Prius.

Meanwhile, the working class? We’re the ones stuck in stop-and-go with vibrating phones and hard brakes we didn’t even cause. And the insurer? They just shrug and say, ‘The data doesn’t lie.’

But here’s the truth: the data lies. It just lies in a very precise, statistically significant way.

Dave McPherson

November 20, 2025Wow. Someone actually wrote a 2,000-word essay on how insurance companies are using your driving habits to charge you more, and you’re surprised? Bro. Welcome to 2024. We’ve been monetizing every breath since the iPhone. You think your Fitbit isn’t selling your sleep data? That your smart fridge isn’t reporting your midnight snack habits to advertisers? This is just the car version of that.

And you’re mad because your phone vibrated? Honey. Your toaster knows more about your emotional state than your therapist. If you can’t handle being tracked while driving, maybe don’t own a phone, a car, or a soul.

Also - ‘rural drivers get left behind’? Yeah, because they drive 100 miles to get milk and think it’s normal. Meanwhile, city folks are getting penalized for existing in civilization. Classic. The algorithm doesn’t care if you’re a 70-year-old grandma or a 22-year-old Uber driver - it only cares if you brake like you’re trying to avoid a ghost.

Just don’t sign up. Or better yet - get a horse. They don’t track galloping speed. And if you crash? At least the horse gets to live.

Write a comment