KYC Verification Cost Calculator

Verification Details

Cost Analysis

Total Monthly Cost

$0.00

Industry Average Comparison

Cost-Saving Tip: 73% of users experience verification failures. Implement ambient light analysis to reduce rejections by 55%.

Optimization Insight

High-risk verification costs 30-50% more. Use risk-based approach: apply basic checks to low-risk users, EDD only for high-risk cases.

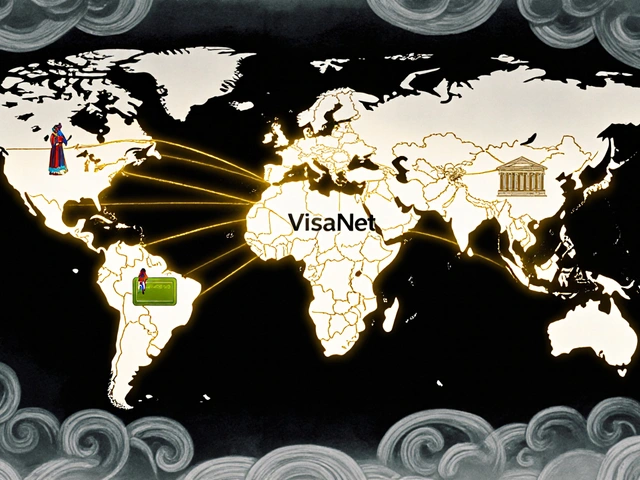

When you sign up for a new fintech app-whether it’s a neobank, crypto wallet, or peer-to-peer lender-you expect it to be fast, simple, and secure. What you don’t see is the complex web of rules, AI checks, and real-time monitoring happening behind the scenes. That’s KYC-Know Your Customer-and in 2025, it’s no longer just a box to check. It’s the backbone of trust, the shield against fraud, and the make-or-break factor for any fintech startup trying to scale legally.

What KYC Really Means Today

KYC isn’t new. It started in the 1970s with the Bank Secrecy Act, meant to stop drug money from flowing through banks. But today, it’s part of a much bigger system called Anti-Money Laundering (AML), which also fights terrorism financing, tax evasion, and cyber fraud. While AML is the whole machine, KYC is the first gear: verifying who you are before you can even open an account. In 2025, regulators don’t just want your name and ID. They want proof you’re who you say you are, that your money isn’t dirty, and that you’re not linked to sanctioned individuals or criminal networks. And they’re watching closer than ever. In 2024, TD Bank paid $3 billion in fines for failing to monitor suspicious activity. That’s not an outlier-it’s a warning.The Four Pillars of Modern KYC

If you’re building a fintech product, you need to nail these four components. Skip one, and you risk fines, user drop-offs, or even being shut down.- Customer Identification Program (CIP): This is the first step. You collect basic info-name, date of birth, address, government ID. But now, it’s not enough to just upload a photo. AI-powered systems verify documents in real time, cross-checking them against global databases. Some platforms now use biometric matching (like facial recognition with liveness detection) to ensure the person holding the ID is the same person using the app. Accuracy? Up to 99.8% with the right tech.

- Customer Due Diligence (CDD): Once you’ve verified identity, you assess risk. Is this a low-risk individual making small, regular deposits? Or a business owner from a high-risk country with sudden large transfers? CDD assigns risk levels and triggers different verification steps. Every customer gets screened against global watchlists (OFAC, UN, EU sanctions) and flagged if anything looks off.

- Enhanced Due Diligence (EDD): For high-risk customers-think crypto traders, foreign politicians, shell companies-you go deeper. You need source of funds documentation, proof of business ownership, third-party background checks, and sometimes even interviews. EDD can add 30-50% more steps to onboarding. It’s slow, but necessary. Missing this is how companies end up paying billions in fines.

- Continuous Monitoring: This is the biggest shift in 2025. No longer do you verify once and forget. Perpetual KYC means watching transactions in real time. If someone suddenly starts sending $10,000 to a high-risk country, the system flags it automatically. AI reduces false alarms by 30% and cuts Suspicious Activity Report (SAR) filing time by 40%. Companies like Revolut and N26 say this has slashed fraud by nearly half.

How Fintech KYC Differs from Banks

Traditional banks still rely on paper forms, manual reviews, and weeks-long onboarding. Fintechs? They do it in 90 seconds. Modern fintech KYC tools use APIs from providers like Onfido, Jumio, or AU10TIX. These platforms handle document scanning, facial matching, and watchlist checks in real time. The result? 70% faster signups and 99.5% compliance accuracy. But speed comes at a cost: $0.10 to $0.50 per verification. For a startup doing 50,000 verifications a month, that’s $5,000-$25,000 just in fees. Banks spend $2 million and six months to build their own systems. Fintechs spend $50,000-$200,000 and get up and running in 4-8 weeks. But here’s the catch: banks still win on complex cases. When verifying a corporate entity with layered ownership, their human reviewers are 15% more accurate than even the best AI. That’s why many fintechs use hybrid models-automated for individuals, human review for businesses.

The Real Pain Points Users Experience

You can have the most advanced KYC system, but if users hate it, you’ll lose them. Reddit threads and Trustpilot reviews from early 2025 show a clear pattern:- Document rejections: Non-U.S. passports, IDs in Cyrillic or Arabic scripts, or blurry photos still get flagged-even if the provider claims 200+ country support.

- Mobile camera issues: 73% of users report problems verifying in low light or with older phones. Newer systems now use ambient light analysis to adjust exposure automatically, cutting failures by 55%.

- Too many steps: Users bail if you ask for everything upfront. Companies like Chime and Current use “just-in-time” KYC: only ask for what’s needed at each stage. Result? 87% completion rate versus the industry average of 63%.

- Cost frustration: One developer on Reddit said their KYC provider cost $0.35 per verification-eating 18% of their early revenue. That’s not sustainable for bootstrapped startups.

Regulatory Chaos: U.S. vs. EU vs. Global

If you’re targeting more than one country, buckle up. The European Union just rolled out AMLR (Anti-Money Laundering Regulation), replacing AMLD6. It’s a single, direct rule across all member states. No more waiting for countries to translate laws into their own systems. That’s good news for compliance. The U.S.? Still a mess. You’ve got FinCEN, SEC, state regulators, and now the Digital Asset Reporting Rule (DARR), which kicks in on January 1, 2025. If you’re handling crypto transactions over $250, you need KYC-even if you’re just a small exchange or wallet provider. A 2025 survey of 250 fintech compliance officers found 78% say cross-border regulation is their top headache. One company operating in 12 countries spends 35% of its compliance budget just mapping which rules apply where.

What You Need to Do Right Now

If you’re launching or scaling a fintech in 2025, here’s your checklist:- Choose a KYC provider with global document coverage and AI-powered biometrics. Look at Onfido, Jumio, or Trulioo-they’re in the top 5 by market share.

- Implement risk-based KYC. Don’t treat every user the same. Low-risk? Basic ID. High-risk? Full EDD.

- Use perpetual monitoring. Set up real-time transaction alerts. Don’t wait for annual reviews.

- Hire a compliance officer early. Most compliant startups bring one on board within the first 15 employees.

- Test your flow with real users. Watch where people drop off. Fix document rejection issues before launch.

- Stay updated. Sanctions lists change every 72 hours. Your system must auto-update or you’ll fall out of compliance.

Comments

Graeme C

October 30, 2025KYC in 2025 isn't just compliance-it's a psychological game. You think users care about AMLR or DARR? Nah. They care if their damn selfie gets rejected because their Indian passport photo was taken under a fluorescent light. I’ve seen users abandon apps after three failed attempts. The tech is flawless on paper, but real-world lighting, old phones, and non-Latin scripts? Still a nightmare. And don’t get me started on the $0.50/verification fee eating into margins. Fintechs are selling trust, but they’re charging users in frustration. Fix the UX before you fix the algorithm.

Also-why is everyone still using Jumio? Onfido’s biometric liveness detection cuts false rejections by 40% in emerging markets. Stop using the same vendor everyone else does. Be better.

And yes, decentralized identity is the future. But until users can verify themselves without uploading a blurry scan of their birth certificate, we’re all just rearranging deck chairs on the Titanic.

Astha Mishra

November 1, 2025It is fascinating, really, how we have come to accept this invisible machinery that governs our financial existence without ever questioning its origins or its ethics. KYC began as a tool to stop drug cartels, yes-but now it is used to screen students in rural Bihar trying to open a digital savings account, or a grandmother in Lagos sending remittances to her grandchildren. The systems are designed for Western norms: clear IDs, stable addresses, high-resolution selfies under perfect lighting. What does this say about our definition of ‘trust’? Is trust only valid when it conforms to Western bureaucratic aesthetics?

And yet, we praise fintechs for speed and efficiency, while ignoring the silent exclusion happening at the edges. The 27% who fail verification? They aren’t criminals. They are simply not represented in the training data. AI doesn’t see humanity-it sees patterns. And if your face doesn’t match the pattern, you are flagged. Not because you are dangerous. But because you are different.

Perhaps the real innovation isn’t in AI accuracy or blockchain credentials-but in designing systems that don’t require you to prove your humanity to be allowed to exist in the financial world. Maybe the future isn’t faster KYC… but less KYC. Less surveillance. More dignity.

RAHUL KUSHWAHA

November 1, 2025just wanted to say i got my account approved on the 3rd try after 3 days of crying over my blurry nrc card… finally worked when i used my laptop camera instead of phone. also the $0.35/verif is brutal but i get it. thx for the post :)

Julia Czinna

November 1, 2025RAHUL’s comment made me smile. That’s the real story behind all these stats-people struggling with blurry scans and bad lighting while trying to build a better life. I’ve worked with fintechs in Nigeria and Indonesia, and the most successful ones weren’t the ones with the fanciest AI. They were the ones who added a simple option: ‘Need help? Call us.’ A real human on the line, speaking local dialects, guiding users through the process. No chatbot. No form. Just a voice.

And Julia, you’re right-trust isn’t built by flawless algorithms. It’s built by patience. By letting someone feel seen, even when their ID doesn’t match the template. Maybe the next frontier isn’t decentralized identity… but decentralized empathy.

Also-$2 million for a bank to build KYC? That’s a scandal. A startup can do it for $50k. The real cost isn’t tech. It’s legacy.

Write a comment