What a POS System Actually Does for Your Small Business

A POS system isn’t just a cash register with a screen. It’s the central nervous system of your business. It handles payments, tracks inventory in real time, manages employee schedules, generates sales reports, and even helps you run promotions. For small and medium businesses, getting this right means less time spent on paperwork and more time serving customers.

Back in 2020, most SMBs still used basic cash registers. Today, 83% of businesses with two or more employees use a modern POS system, up from just 54% five years ago. Why? Because the difference isn’t just convenience-it’s survival. Businesses using a good POS system report 32% faster checkouts and 27% better inventory accuracy, according to the National Retail Federation. That’s not a small edge. That’s profit.

Hardware: What You Actually Need (and What You Don’t)

Don’t get tricked into buying a fancy setup you don’t need. The core hardware for any SMB POS is simple: a touchscreen terminal, a card reader, a receipt printer, and a cash drawer. That’s it. Everything else is optional.

For most shops, cafes, or boutiques, an iPad or Android tablet works perfectly. You don’t need a $1,500 all-in-one terminal unless you’re running a high-volume restaurant. Square’s starter kit costs $499 and includes everything you need to start accepting cards, printing receipts, and tracking sales. It’s durable, easy to clean, and fits on any counter.

Restaurants need tougher gear. Toast’s terminals are spill-proof and built to handle grease, steam, and busy servers dropping them on the floor. If you’re in a kitchen environment, that’s worth the extra cost. But if you’re selling books or t-shirts? Stick with a standard tablet. You’ll save hundreds and get the same software performance.

Thermal receipt printers are non-negotiable. Avoid dot-matrix or inkjet-they’re slow, noisy, and expensive to maintain. Look for models that connect via Bluetooth or Wi-Fi so you’re not stuck with tangled cables. Cash drawers should be sturdy but not massive. A 2-drawer unit is enough for most small businesses. Save the 5-drawer monster for big retail chains.

Software: Cloud-Based Is the Only Real Choice

Forget on-premise software. If your POS runs on a local server in the back room, you’re already behind. Cloud-based systems update automatically, work from any device, and back up your data every minute. As of 2025, 78% of new SMB POS deployments are cloud-based, according to Retail TouchPoints.

Here’s what good POS software must do:

- Process payments fast-Square averages 1.2 seconds per transaction, Lightspeed takes 1.8. That’s the difference between a happy customer and someone walking out.

- Track inventory accurately-If you sell 10,000+ SKUs (like a specialty retailer), Lightspeed Retail is the only system that handles matrix inventory well. For under 500 items, Square’s system is fine.

- Sync with your bank and accounting software-If you use QuickBooks or Xero, make sure your POS connects directly. Manual entry is a recipe for errors.

- Update tax rates automatically-44% of new users mess up tax settings. Systems like Toast and Square auto-update based on your location, which is critical if you operate in multiple cities or states.

Don’t fall for free software that charges you in hidden ways. Some systems offer free POS software but charge 3.5% per transaction. That adds up fast. Square’s free software charges 2.6% + 10¢ per swipe, which is still the most competitive rate for low-volume businesses.

Choosing Based on Your Business Type

Not all POS systems are built the same. Your choice should match your business model.

For Retail (boutiques, bookstores, hardware shops): Lightspeed Retail leads. It handles complex inventory, barcodes, and multi-location stock transfers. But it’s not beginner-friendly. If you’re not tech-savvy, expect to spend 8-12 hours setting it up. The $99/month base fee plus $79 per register adds up quickly. Only choose this if you have over 10,000 SKUs or multiple stores.

For Restaurants (cafes, diners, full-service): Toast is the clear winner. Its kitchen display system (KDS) sends orders directly to the grill. Servers use handheld devices to split checks, add modifiers (like "no onions"), and send payments to the table. But if you’re a bakery or food truck? Toast’s features are overkill. Square’s simpler interface works better here.

For Service-Based Businesses (salons, repair shops, consultants): Square and SpotOn are your best bets. They handle appointments, service packages, and customer notes. SpotOn’s customer service is unmatched-95% of calls are answered within two minutes, according to NerdWallet. That matters when your system goes down during a busy Saturday.

For Multi-Location Businesses: Revel POS has enterprise features like centralized reporting and staff permissions across stores. But at $149/month per terminal, it’s only worth it if you have 5+ locations. For 2-4 locations, Lightspeed or Square with multi-store add-ons are cheaper and easier.

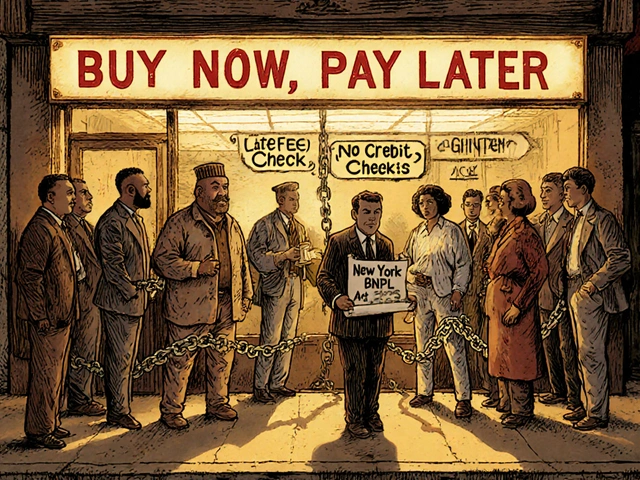

Hidden Costs and Pricing Traps

Most SMB owners get burned by pricing. The advertised monthly fee is just the start.

- Transaction fees: Square charges 2.6% + 10¢. Toast charges 2.49%-3.49% depending on your plan. That’s fine if you process $5,000 a month. But if you’re doing $15,000, you’re paying $390-$520 just in fees. Some providers offer flat-rate pricing-check if SumUp’s 1.5% revenue-based model fits your volume.

- Hardware upgrades: Your tablet might die in 3 years. Thermal printers wear out. Budget $100-$200/year for replacements.

- Third-party add-ons: Loyalty programs, online ordering, payroll-these often cost extra. Lightspeed charges $50/month for its loyalty module. Square includes it free. Read the fine print.

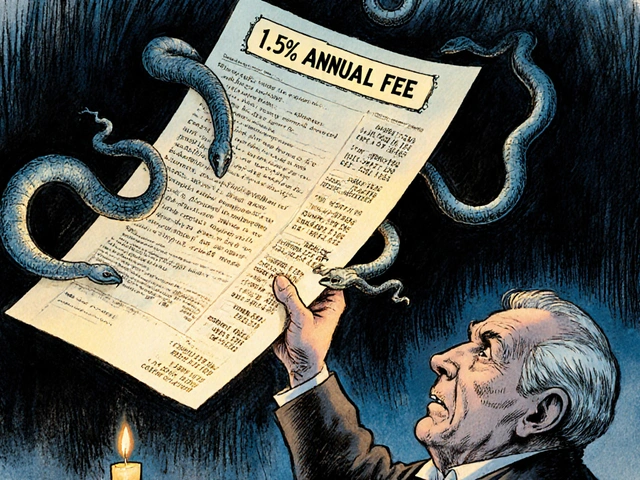

- Hidden fees: 68% of negative reviews on Trustpilot mention unexpected charges. One Lightspeed user paid $1,200 extra because their payment processor added a 1.5% markup they didn’t disclose.

Rule of thumb: Calculate your total cost of ownership. Add monthly fees + transaction fees + hardware + add-ons. Then compare that to your monthly sales. If your POS costs more than 5% of your revenue, you’re overpaying.

Implementation: How to Avoid the Common Mistakes

Most businesses fail at rollout-not because the software is bad, but because they rush it.

Follow this simple 4-week plan:

- Week 1: Set up payment processing only. Get your card reader working, test a few sales, and train staff on basic checkouts.

- Week 2: Add inventory tracking. Input your top 100 products. Don’t try to load everything at once.

- Week 3: Connect to your accounting software. Sync your bank feed. Make sure sales data flows into QuickBooks or Xero without errors.

- Week 4: Turn on loyalty, reporting, or online ordering. Only after the basics work smoothly.

Common mistakes:

- Trying to migrate all data at once-leads to duplicate entries and lost sales.

- Not testing offline mode-most systems let you take 50-100 transactions offline. Test it. If your internet goes down during lunch rush, you need to keep selling.

- Ignoring staff training-57% of SMB owners say resistance to new systems kills adoption. Run a 30-minute demo. Let employees ask questions. Reward them for using it right.

What’s New in 2025 (And What Matters to You)

POS tech is moving fast. Here’s what’s actually useful right now:

- AI inventory forecasting: Lightspeed’s new AI predicts what will sell next week based on weather, holidays, and past trends. One retailer in Denver cut stockouts by 37%.

- Google Shopping sync: Square’s Local Inventory Ads now push your in-stock items to Google Search and Maps. Participating businesses saw 22% more sales from local customers.

- Labor prediction: Toast’s Labor Optimizer tells you how many staff you need each shift. One restaurant saved 15% on payroll by trimming overstaffed hours.

Ignore the hype. Biometric login and AR inventory scanners? They’re coming-but not for your shop in 2025. Focus on features that save you time, reduce waste, or bring in more customers. Everything else is noise.

Final Checklist: Are You Ready to Buy?

Before you sign anything, run through this:

- Does the system work offline? Test it.

- Can you import your current inventory? Most systems let you upload CSV files.

- Are tax rates auto-updated for your state and city?

- Is the card reader EMV and NFC compliant? (It must be to avoid fraud liability.)

- What’s the real monthly cost? Add hardware, fees, and add-ons.

- Can your staff use it without training? Try the demo version.

- Is customer support available when you need it? Call their help line at 7 p.m. on a Tuesday.

If you answered yes to all of these, you’re ready. If not, keep looking. A bad POS system costs more than money-it costs your time, your customers’ trust, and your peace of mind.

What’s the cheapest POS system for a small business?

Square offers free software with no monthly fee. You only pay 2.6% + 10¢ per transaction. Their starter hardware kit costs $499 and includes a tablet stand, card reader, and receipt printer. For businesses processing under $5,000 per month, this is the lowest total cost of ownership. Avoid "free" systems that charge high transaction fees or lock you into expensive payment processors.

Do I need a dedicated cash drawer?

If you handle cash regularly, yes. A cash drawer keeps bills and coins secure and speeds up transactions. Most POS systems trigger the drawer automatically when you close a cash sale. You don’t need a big one-just a sturdy 2-drawer model that connects via USB or Ethernet. Skip it only if you’re 100% card-only, like a coffee kiosk with no cash sales.

Can I use my existing iPad or Android tablet?

Yes, if it’s running iOS 16+ or Android 11+. Most modern POS apps work on tablets you already own. Just make sure it has Bluetooth or Wi-Fi for the card reader and printer. Avoid older devices-they’ll slow down the system and may not support the latest security updates. A 2020 iPad Air or newer is ideal.

Which POS system works best for restaurants?

Toast is the top choice for full-service restaurants. Its kitchen display system (KDS) sends orders directly to the cook line, and its handheld devices let servers split checks and add custom notes. It’s built for high-volume, messy environments. For fast-casual or food trucks, Square’s simpler interface and lower cost may be better. Avoid retail-focused systems like Lightspeed-they lack kitchen-specific tools.

How long does it take to set up a POS system?

Square can be up and running in under 15 minutes for basic setups. Lightspeed takes 8-12 hours because of complex inventory and tax settings. Most SMBs should plan for a full day of setup, even with the easiest system. Don’t try to go live on a busy weekend. Start on a slow day, test everything, and train your team before opening to customers.

What happens if my internet goes down?

All major cloud-based POS systems have offline mode. You can still process sales, accept cash and cards, and print receipts. The system stores transactions locally and syncs when the internet returns. Most allow 50-100 transactions before locking up. Test this feature before launch. If your location has unreliable internet, consider a backup hotspot or a system with stronger offline capabilities like Revel or Toast.

Is my customer data safe with a cloud POS?

Yes-if you choose a PCI-DSS Level 1 compliant system. All major providers (Square, Toast, Lightspeed) use point-to-point encryption and tokenization to protect card data. They’re audited yearly. Your customer names and emails are stored securely, and you’re not responsible for breaches. Avoid systems that don’t mention PCI compliance. It’s non-negotiable.

Can I switch POS systems later?

Yes, but it’s messy. Data migration is possible, but you’ll lose historical reports unless you export them manually. Staff will need retraining. The best time to switch is during a slow season. Make sure your new system can import your inventory, customer list, and sales history. Most providers offer free migration help if you sign a contract.

Comments

Laura W

October 31, 2025Bro, Square’s free software is a game-changer for small shops. I run a vintage record store and the 2.6% + 10¢ fee? Barely a blip. We’ve got three registers, a Bluetooth printer, and an old iPad Air 2 that still runs like a champ. No monthly fees, auto tax updates, and it talks to QuickBooks like it’s family. Stop overcomplicating it-your time is worth more than that $1,500 all-in-one terminal you’re drooling over.

Kenny McMiller

November 1, 2025Let’s be real-the real ROI isn’t in transaction speed or inventory accuracy. It’s in cognitive load reduction. When your staff isn’t wrestling with clunky interfaces or manual reconciliation, their mental bandwidth frees up for customer intimacy. That’s the invisible metric. POS isn’t software-it’s an extension of your operational philosophy. If your system demands more effort than it saves, you’re not optimizing-you’re just automating frustration.

Dave McPherson

November 2, 2025Oh wow, another ‘Square is perfect for everyone’ LinkedIn post masquerading as a blog. Let me guess-you also think ‘cloud-based’ is a personality trait and ‘EMV compliant’ is a vibe. Toast’s KDS is the only thing that doesn’t make you want to scream into a cash drawer. And don’t even get me started on those ‘free’ systems that nickel-and-dime you into bankruptcy. I’ve seen mom-and-pop shops get wrecked by ‘no monthly fee’ traps. If your POS feels like a cult, it probably is. Stick with the real pros-or go back to paper receipts and pray.

Graeme C

November 2, 2025It’s not just about the hardware or the software-it’s about the ecosystem. I’ve seen too many businesses invest in flashy terminals while neglecting the human layer: training, buy-in, and support. A $500 tablet with a $0 software fee is meaningless if your barista can’t process a $12 latte without calling you over. The real failure point? Implementation. And yes, calling support at 7 p.m. on a Tuesday is non-negotiable. If they don’t answer, you’re not buying a POS-you’re buying a liability.

Astha Mishra

November 4, 2025Actually, I think this is very insightful, and I am glad someone finally wrote about this with clarity. In India, many small shop owners still use handwritten ledgers and manual calculators, and they are losing so much because of it. Even a simple system like Square, which is easy to learn and does not require expensive hardware, can change everything for them. I have a cousin who sells spices in Jaipur, and after using a basic Android tablet with Square, her sales increased by 40% because she could track what was selling fast and reorder before running out. Also, the fact that it auto-updates tax rates is a blessing, because tax rules here change every six months. I hope more people in developing countries get access to these tools-technology should not be a luxury for the rich.

Write a comment