QARP Screening Calculator

This tool helps you determine if a company meets Quality at a Reasonable Price (QARP) criteria by applying key financial metrics. Enter your thresholds for quality and value metrics to see if a hypothetical company qualifies.

Enter your quality and value metrics to see if a company meets QARP criteria.

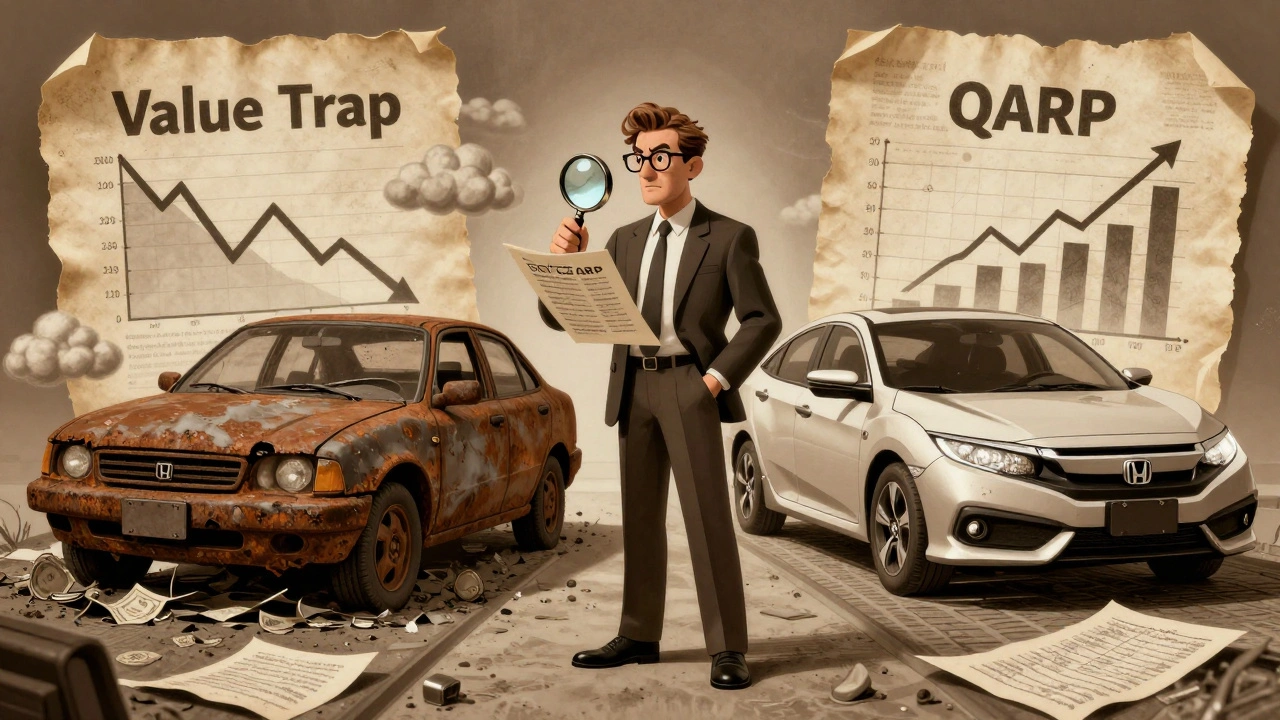

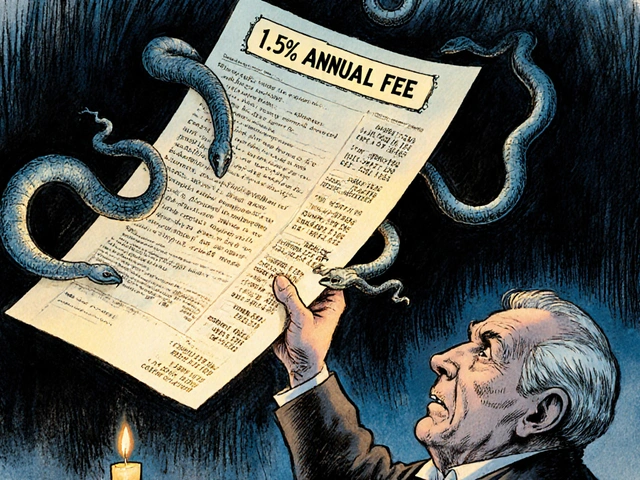

Most investors know the trap: a stock looks cheap, so you buy it. Then it keeps falling. You tell yourself it’s just a temporary dip, but the company’s profits keep shrinking, debt climbs, and management keeps making bad calls. You didn’t buy a bargain-you bought a value trap.

On the other side, you see a company with strong earnings, clean balance sheets, and loyal customers. It’s growing steadily. But the price? So high you feel like you’re paying for a luxury watch when you just need a reliable clock. You miss out-again.

What if you could avoid both mistakes? What if you could find companies that are not just cheap, but actually good-and still reasonably priced? That’s the idea behind Quality at a Reasonable Price, or QARP.

What Is QARP, Really?

QARP isn’t a new word. It’s a simple idea dressed up in finance jargon. It means buying businesses with strong fundamentals-solid profits, low debt, consistent cash flow-at prices that aren’t crazy. Not the cheapest stock on the block. Not the most glamorous growth stock either. Somewhere in the middle. The sweet spot.

This approach was formalized in the early 2010s by researchers like Cliff Asness at AQR Capital Management. Their landmark 2013 paper, "Quality Minus Junk," showed that high-quality companies-those with high returns on assets, low accruals, and strong cash flow-tended to outperform over time. But here’s the twist: they didn’t just buy the most expensive quality stocks. They filtered out the overpriced ones. That’s QARP.

Think of it like shopping for a used car. You don’t want the rusted-out beater just because it’s $2,000. And you don’t want the mint-condition BMW at $50,000 if you only commute 10 miles a day. You want the well-maintained Honda Civic with low mileage and a clean history-priced fairly. That’s QARP.

How QARP Works: The Two Filters

QARP uses two clear filters: quality and value. Neither alone works well. Together, they create a powerful filter.

Quality metrics look at how well a company runs. They measure:

- Return on Assets (ROA): How efficiently it turns its resources into profit. A company with 12% ROA is doing better than one with 3%.

- Cash flow coverage: Can it pay its bills without borrowing more? High cash flow means less risk.

- Accruals: Are profits real, or just accounting tricks? Low accruals = more trustworthy earnings.

- Debt levels: Is the company over-leveraged? High debt can sink even a good business in a downturn.

Value metrics look at price. They ask: Is this company cheap relative to what it earns or owns?

- Price-to-Cash Flow: Compares stock price to actual cash the company generates.

- Price-to-Earnings (P/E): Stock price divided by earnings per share.

- Price-to-Sales: How much you pay for every dollar of revenue.

Good QARP strategies use all three value ratios equally-not just P/E, which can be distorted by accounting changes. They also weight quality higher than value. The Russell 1000 2Qual/Val Index, for example, uses a 2:1 quality-to-value ratio. That means if a company scores high on quality, it can still be included even if its price isn’t rock-bottom. That’s the key: you’re not chasing the absolute cheapest. You’re chasing the cheapest among the best.

Why QARP Beats Pure Value Investing

Traditional value investing-buying stocks with low P/E or P/B ratios-has struggled for over a decade. Why? Because many cheap stocks are cheap for a reason. They’re losing market share. Their products are outdated. Their management is incompetent. They’re not bargains. They’re disasters waiting to happen.

QARP solves this by filtering out the junk. A 2014 study by Kalesnik and Kose found that high-quality value stocks outperformed low-quality value stocks by a wide margin. The difference? Quality. Companies with strong balance sheets and consistent profitability didn’t just survive downturns-they thrived afterward.

During the 2020 market crash, QARP-focused portfolios held up far better than pure value portfolios. Why? Because companies with strong cash flow and low debt could keep paying employees, investing in R&D, and even buying back shares. The weak ones? They cut dividends, laid off workers, and begged for loans.

QARP doesn’t promise the biggest gains in a bull market. But it doesn’t get wrecked in a bear market either. That’s the trade-off-and it’s worth it.

Where QARP Falls Short

QARP isn’t magic. It has limits.

In the late 1990s, during the dot-com bubble, QARP would have missed out on companies like Amazon and Google. Why? Because they weren’t profitable yet. Their balance sheets were weak. Their P/E ratios were sky-high. To a QARP investor, they looked risky-not a buy.

And that’s the trade-off. You give up some upside potential in hot growth markets to avoid catastrophic losses. That’s fine if you’re investing for the long term, not trying to time the next tech frenzy.

Another problem? Defining "reasonable price." During the 2021 market peak, some investors thought 25x P/E was "reasonable" for a quality company. By 2023, those same companies were trading at 15x. What looked cheap turned out to be expensive. That’s why QARP requires constant review. You can’t set it and forget it.

How to Get Started with QARP

You don’t need to build a financial model from scratch to start using QARP.

Option 1: Use an ETF

The DWS QARP ETF (ticker: QARP) is one of the few retail-friendly funds built entirely around this strategy. It tracks a methodology that combines quality and value factors with equal weighting. Its expense ratio is 0.35%. Minimum investment? $1,000. That’s it.

Another option: the Russell 1000 2Qual/Val Index. You can’t buy it directly, but several ETFs and mutual funds track it. These are more common in institutional portfolios, but some brokerages offer access to them.

Option 2: Build Your Own Screen

If you’re comfortable with financial data, use free tools like Finviz, Yahoo Finance, or Morningstar to screen for:

- ROA above 10%

- Debt-to-Equity under 0.5

- Price-to-Cash Flow under 12

- Price-to-Sales under 2

- Positive earnings growth over the last 5 years

Then dig into the 10-K filings. Look for consistent management, low litigation risk, and steady customer retention. If the company has been profitable through multiple recessions, that’s a strong signal.

Who Uses QARP-and Why

QARP isn’t just for Wall Street. It’s gaining traction with everyday investors too.

Institutional investors-pension funds, endowments, hedge funds-have been using QARP since 2015. By 2023, assets in QARP-focused strategies had grown from $2 billion to over $15 billion. Why? Because it reduces volatility. One survey found QARP strategies captured only 77% of market downside during corrections, compared to 100% for traditional value funds.

Advisors managing over $50 million in assets now use QARP principles at a 63% adoption rate, according to Morningstar. Why? Client retention. When markets crash, clients who stay calm are the ones who didn’t lose half their portfolio. QARP helps advisors keep clients from panic-selling.

On Reddit and Seeking Alpha, retail investors are sharing stories. One user, "QualitySeeker2023," said he lost money on three energy stocks between 2019 and 2021 because they looked cheap but had crumbling balance sheets. After switching to QARP, he avoided the next wave of similar traps-and still found solid returns.

The Future of QARP

QARP is evolving. In 2023, Russell launched a global version of its QARP index. Now you can apply the same logic to international markets.

In 2025, AQR plans to launch "QARP 2.0," which will add ESG metrics as part of the quality filter. Why? Because research shows companies with strong environmental and governance practices tend to have more durable competitive advantages. ESG isn’t about politics-it’s about risk and resilience.

By 2030, Morningstar predicts that less than 15% of "value" funds will still use the old, pure valuation approach without quality filters. The market is learning: cheap isn’t always good. Good is worth paying for-if you don’t overpay.

Final Thought: QARP Is the New Value

Value investing isn’t dead. It’s just upgraded.

The old way-buying the cheapest stocks-worked when markets were less efficient. Today, every cheap stock has a reason. The market is smarter. The data is everywhere. You need more than a low P/E to win.

QARP gives you a framework to separate real value from illusion. It’s not about finding the next 10x stock. It’s about building a portfolio that survives recessions, outperforms over time, and lets you sleep at night.

If you’re tired of chasing bargains that turn into losses, or missing out on great companies because they’re too expensive-QARP might be the strategy you’ve been looking for.

What’s the difference between QARP and traditional value investing?

Traditional value investing looks for stocks with low prices relative to earnings or book value, regardless of business quality. QARP adds a quality filter-only buying cheap stocks that also have strong profitability, low debt, and solid cash flow. This avoids "value traps"-companies that look cheap but are actually failing.

Is QARP better than growth investing?

It depends on the market. Growth investing wins when investors are chasing momentum and future potential-like in the late 1990s or 2021. QARP wins in uncertain or volatile times when business stability matters more than hype. QARP doesn’t chase high P/E stocks. It finds proven companies at fair prices, which often leads to better long-term risk-adjusted returns.

Can I invest in QARP as a retail investor?

Yes. The DWS QARP ETF (ticker: QARP) is designed for retail investors with a $1,000 minimum. It tracks a quality-and-value strategy with transparent rules. You can also invest in ETFs that track the Russell 1000 2Qual/Val Index through brokers like Fidelity or Schwab.

How do I know if a company is "high quality"?

Look at three things: Return on Assets (ROA) above 10%, low debt (Debt-to-Equity under 0.5), and consistent cash flow over 5+ years. Check the 10-K for declining margins, rising receivables, or frequent accounting changes-these are red flags. Companies that survive recessions without cutting dividends or laying off workers are usually high quality.

Does QARP work outside the U.S.?

Yes. In 2023, Russell launched the Russell Global 2Qual/Val Index, applying the same quality-and-value screen to international markets. Studies show the QARP effect works across 25 countries, including Europe, Japan, and emerging markets. The strategy isn’t tied to one economy-it’s tied to how businesses operate.

Is QARP just a trend, or is it here to stay?

It’s here to stay. Traditional value investing has underperformed growth for over a decade. As markets get more efficient, simple valuation metrics alone aren’t enough. QARP combines proven financial discipline with modern risk management. Institutional assets in QARP strategies have grown from $2 billion in 2015 to over $15 billion in 2023. This isn’t a fad-it’s the evolution of value investing.

Comments

Geoffrey Trent

December 10, 2025Ugh, another ‘QARP’ guru telling us how to invest like we’re all dumbass retail monkeys. I’ve been buying cheap stocks for 15 years and I’ve made more in 2020 alone than your fancy ETF ever will. If you’re not buying distressed assets when everyone’s panicking, you’re just playing it safe and letting the hedge funds eat your lunch.

John Weninger

December 11, 2025I really appreciate how you laid this out - it’s easy to get swept up in the hype of ‘cheap stocks’ without asking why they’re cheap. I used to chase dividend yields like they were free money, then got burned when the company cut it and sold off half the business. QARP feels like the grown-up version of value investing. Not sexy, but it lets me sleep at night. Thanks for the clarity.

Omar Lopez

December 12, 2025While your exposition is generally coherent, the conflation of ‘reasonable price’ with ‘not overpriced’ is semantically imprecise. QARP, as formalized by Asness, explicitly employs a multi-factor scoring algorithm - not a heuristic of ‘well-maintained Honda Civics.’ Furthermore, the Russell 2Qual/Val Index uses a proprietary Z-score normalization, not arbitrary thresholds like ‘ROA above 10%.’ Your simplification, while accessible, risks misrepresenting the underlying quant framework. Please cite your sources before generalizing.

Jonathan Turner

December 13, 2025Wow. A whole essay about not buying junk stocks. Did you get this from a Bloomberg terminal or your dad’s 1998 mutual fund brochure? Everyone knows the market’s rigged. If you’re not buying crypto or meme stocks, you’re just donating your money to the rich so they can buy yachts. QARP? More like QARP-ly losing out on the real action. #BuyTheDip #CryptoIsFuture

Write a comment