Why Hidden Fees Hurt Real People

Imagine you sign up for an investment account because the ad says "zero fees." Then, six months later, you notice $987 disappeared from your balance. No warning. No email. Just a line item buried in a 47-page document you never read. This isn’t a scam-it’s legal. And it happens every day.

Financial institutions have spent decades designing products with fees hidden in plain sight. Small print. Cross-references. Jargon-heavy prospectuses. These aren’t accidents. They’re tactics that exploit a simple truth: most people don’t understand how fees work, and they trust the company they’re dealing with. That trust gets broken when fees show up out of nowhere. And the people hit hardest? Seniors, low-income families, and first-time investors.

What Transparent Fees Actually Look Like

Transparent fees aren’t just about listing numbers. They’re about making those numbers mean something. The CFPB’s "Know Before You Owe" rule changed how mortgages are explained. Instead of a 50-page booklet full of legalese, borrowers now get a two-page summary that says: "If you make only the minimum payment, your loan balance will grow. Here’s how much more you’ll pay over time." That’s transparency.

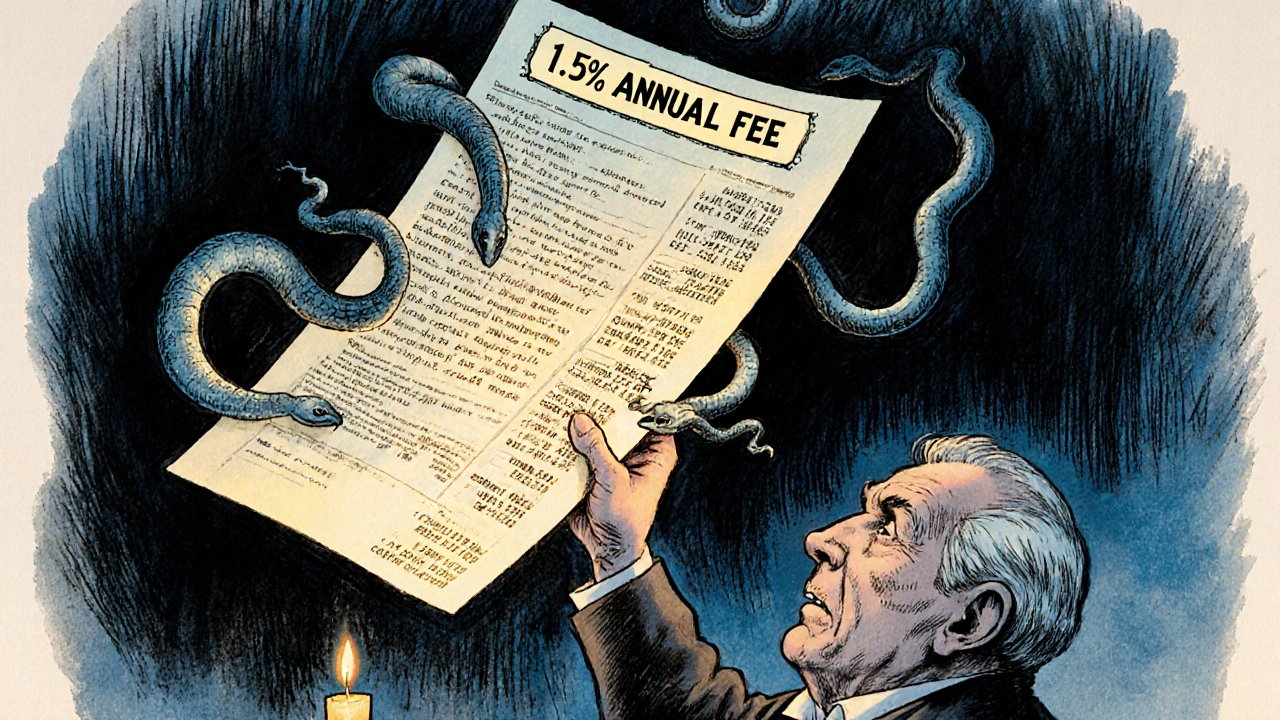

For investment advisers, the SEC and NASAA require fees to be shown as a percentage of your assets-and they’re not allowed to bury them. If a firm charges 1.5% annually, that number must appear clearly in three places: the client brochure (Form ADV Part 2), the contract, and the website. No hiding it in the appendix. No calling it a "management service fee" to confuse you. It’s called what it is: an advisory fee.

Even remittance services-used by millions of immigrants sending money home-must now tell you upfront: "We charge $5.50. The agent in Mexico charges $2.10. There’s a state tax of $0.45." No surprises. No "additional charges may apply."

Where the System Still Fails

Not all fees are created equal. Mutual funds are still a mess. Even though the expense ratio is listed, it doesn’t include trading costs, brokerage commissions, or the hidden fees inside the funds the mutual fund invests in. That’s like telling you the price of a car but not including the cost of gas, insurance, or maintenance.

Professor Haslem’s research from 2006 still holds true today: "Readily disclosed fees do not necessarily reflect the true costs." The SEC admitted in 2014 that mutual fund prospectuses are "complex, technical, and duplicative." Many run over 300 pages. Who reads that? No one. And that’s the problem.

Even when fees are disclosed, they’re often presented in ways that make comparison impossible. One fund says "0.85% expense ratio." Another says "$12.50 per $1,000 invested." Which is cheaper? Most people can’t tell. That’s not transparency. That’s obfuscation with a compliance stamp.

How Transparency Reduces Harm

The data doesn’t lie. When disclosures are clear, people make better choices-and fewer complaints follow.

- The CFPB found that after implementing clearer mortgage disclosures, consumer complaints dropped by 37%.

- Credit card complaints fell by 29% when APRs were presented in plain language with real-world examples.

- Consumers who saw visual charts showing how minimum payments grow debt were 100% more likely to understand the long-term cost, compared to 72% with text-only.

It’s not magic. It’s design. When you show people the real impact of a fee-like how a 1% annual fee eats $1,000 out of a $100,000 portfolio over 10 years-they stop accepting it as normal.

One Reddit user discovered $1,842 in hidden advisory fees over 18 months. He didn’t file a complaint. He switched firms. And he told others. That’s the power of transparency: it doesn’t just protect people. It changes markets.

Who’s Being Left Behind

Not everyone has the time, language skills, or financial literacy to dig through fee disclosures. That’s why predatory practices thrive.

According to the CFPB, 37% of "hidden fee" complaints in 2021 came from people aged 65 and older. Many were targeted with complex annuities or reverse mortgages that looked like "safe" options but came with 6%+ annual fees hidden in fine print.

Younger users aren’t immune. A 2023 Morningstar survey found that people under 35 care about fee transparency 2.3 times more than those over 65. Why? Because they’ve grown up with apps that show costs upfront-Spotify, Netflix, Uber. When a financial app hides fees, they feel tricked. And they leave.

Meanwhile, low-income households pay more in fees per dollar saved. Check-cashing services, payday lenders, and prepaid debit cards all charge high fees that compound over time. A $15 fee to cash a $200 check isn’t just expensive-it’s a tax on poverty.

What’s Changing in 2025

Regulators aren’t sitting still. In Q2 2025, all mutual funds will be required to show an "all-in" expense ratio that includes every cost-trading, custody, even the fees of the underlying funds. No more hiding the true cost.

The CFPB is testing AI-powered disclosure tools that personalize fee explanations. Instead of one generic form, you get: "Based on your $50,000 balance, this fund will cost you $625 this year. That’s the same as skipping two vacations." Early tests showed a 58% jump in comprehension.

NASAA is pushing for digital-first disclosures. If you sign up for a robo-advisor, you can’t be buried in PDFs anymore. You must get a plain-language summary before you click "Agree." And if you don’t understand it? You can’t proceed until you’ve watched a 90-second video explaining it.

And it’s working. The global market for financial disclosures is growing at 11.9% per year. Why? Because companies that disclose clearly are worth more. The CFA Institute found that firms with transparent reporting had 14.2% higher price-to-earnings ratios. Investors trust them more. Customers stay longer. Regulators leave them alone.

What You Can Do Today

You don’t have to wait for regulations to protect you. Here’s how to fight back:

- Ask for the fee schedule in writing. Not a link. Not a PDF. A printed or emailed list.

- Calculate the annual cost. Multiply your balance by the fee percentage. If it’s 1%, that’s $100 per $10,000. Does that feel fair?

- Compare apples to apples. If one fund says 0.75% and another says $8.50 per $1,000, convert them. $8.50 per $1,000 = 0.85%. The first is cheaper.

- Check Form ADV Part 2. It’s public. Search "EDGAR Form ADV" on the SEC website. Look for Part 2A-the client brochure. That’s where the real fees are listed.

- If something feels off, walk away. No reputable firm will pressure you to sign without time to review.

Remember: if a fee isn’t clear, it’s not transparent. And if it’s not transparent, it’s not trustworthy.

Why This Matters Beyond Your Wallet

Financial transparency isn’t just about money. It’s about dignity. It’s about being treated like an adult who deserves to know the truth.

When fees are hidden, people feel powerless. When they’re clear, people feel in control. And when people feel in control, they invest more, save more, and build more wealth.

The companies that win in the long run aren’t the ones that hide fees. They’re the ones that say: "Here’s exactly what you’ll pay. Here’s what you get. Here’s why it’s worth it." That’s not just good compliance. That’s good business. And it’s the only way to build real financial inclusion.

What’s the difference between a fee and a cost in financial products?

A fee is a direct charge you pay to a provider-like a $10 monthly account fee or a 1% advisory fee. A cost is broader and includes indirect expenses, like trading commissions inside a mutual fund or the opportunity cost of underperforming investments. Fees are visible. Costs are often hidden. Transparency means showing both.

Can I trust a financial advisor who doesn’t list their fees upfront?

No. Any advisor who doesn’t clearly state their fees before you sign anything is not acting in your best interest. Under SEC and NASAA rules, they must provide Form ADV Part 2, which details their fees, conflicts of interest, and disciplinary history. If they refuse to give it to you, walk away. That’s not just a red flag-it’s a violation.

Are all hidden fees illegal?

Not always. Some fees are legal but unethical-like burying a 1.5% fee in a 50-page document. Others, like charging for services you never received, are outright illegal. The difference is intent. Regulators focus on whether the disclosure was clear, conspicuous, and consistent. If the fee exists in the contract but was hidden in tiny font or buried in footnotes, that’s a violation-even if it’s technically "disclosed."

How do I know if a mutual fund’s expense ratio is fair?

Compare it to similar funds. The average index fund charges 0.05% to 0.20%. Actively managed funds average 0.5% to 1.0%. If a fund charges more than 1.5% and doesn’t consistently outperform its benchmark, you’re paying too much. Use tools like Morningstar or the SEC’s EDGAR database to compare. And always check the "all-in" ratio starting in 2025-it’ll include every hidden cost.

Why do some companies still hide fees if it’s against the law?

Because many people don’t look. Studies show over 68% of consumers feel overwhelmed by fee disclosures. Companies count on that. They know most customers won’t read the fine print. They also know enforcement is slow. But with the CFPB’s 2023 enforcement actions totaling $84.6 million in penalties, and AI tools making hidden fees easier to detect, the risk is rising. The smart companies are moving toward transparency-not because they have to, but because customers now demand it.

Comments

Laura W

November 15, 2025Okay but let’s be real - I signed up for a robo-advisor last year thinking it was "free." Turned out they were charging me 0.75% on my IRA and burying it under "portfolio management services." I didn’t catch it until my tax guy asked why my gains were so low. I switched to Vanguard that same week. No more games. If you’re gonna take my money, show me the receipt before I hand it over.

Also - why do financial apps still use "annualized fee" instead of just saying "you’ll lose $120 a year on $16k"? That’s not transparency. That’s psychological warfare.

And yes, I’m still mad.

Graeme C

November 17, 2025Let me be unequivocally clear: this is not merely a regulatory failure - it is a systemic moral collapse. The financial services industry has weaponised obscurity as a business model, and regulators have been complicit through inertia, not intent. The CFPB’s 37% drop in complaints post-disclosure reform? That’s not progress - it’s the bare minimum. We are talking about people’s retirement savings, their children’s education funds, their last hope of escaping poverty - and we’re letting firms hide behind 300-page prospectuses written in Latin-tinged legalese.

And yet, the market rewards opacity. Firms that obscure fees still outperform those that don’t - because consumers are lazy, distracted, and systematically manipulated. This isn’t about compliance. It’s about culture. Until we criminalise willful obfuscation as fraud - not just a violation - we’re just rearranging deck chairs on the Titanic.

Astha Mishra

November 18, 2025It is a profound tragedy, is it not, that in an age where we can track the flight of a sparrow across continents with satellite precision, we still permit human beings to be financially disarmed by the deliberate concealment of numbers? We live in a world of algorithmic transparency - Spotify tells you exactly how much time you’ve spent listening to each song, Netflix shows you the cost per hour of content - yet when it comes to our livelihoods, our futures, our dignity - we are handed a 50-page document written by lawyers who graduated top of their class in obfuscation.

Perhaps the true cost of hidden fees is not the dollar amount, but the erosion of trust - the quiet, daily whisper that says, "You are not smart enough to understand this, so we will decide for you." And isn’t that the oldest form of control? The one dressed in compliance, stamped with SEC approval, and buried in the appendix?

I wonder - if we redesigned financial disclosures as poetry, would people finally read them? Would they feel the weight of a 1.5% fee if it were written as: "Every year, you lose a weekend’s wages to silence."

Kenny McMiller

November 19, 2025Bro, the whole "all-in expense ratio" thing in 2025? Long overdue. I’ve been screaming this since 2018. Mutual funds are the ultimate bait-and-switch - they show you 0.8% on the homepage, then you find out there’s a 0.4% trading fee, another 0.2% custody fee, and the underlying ETFs? Those have their own fees too. It’s like buying a pizza and getting charged for the oven, the delivery guy, and the cheese wrapper.

And don’t even get me started on Form ADV. Most people don’t know it exists. Even my CPA didn’t know where to find it until I showed him. Just slap the real cost on the sign-up screen. Like, "You’re paying $780 this year. Here’s what you get. Take it or leave it." No fluff. No jargon. Just numbers.

Also - if your advisor says "we don’t charge fees," they’re lying. They just get paid in commissions. Same thing, different packaging.

Dave McPherson

November 19, 2025One sentence: If you’re still using a financial advisor who doesn’t lead with their fee like it’s a tattoo on their forehead, you’re not investing - you’re donating to their yacht fund.

Write a comment