Visa Transaction Cost Calculator

How Visa Payment Processing Works

Visa charges merchants and fintechs for transaction processing. Costs vary by transaction type, volume, and location. This calculator estimates fees based on Visa's 2025 pricing structure.

Estimated Transaction Costs

When you tap your phone to pay for coffee, send money to a friend overseas, or let your business payroll system auto-deposit salaries, you’re not just using an app-you’re riding on Visa’s network. What started as a simple plastic card system in 1958 has become the invisible backbone of global payments, processing over 257.5 billion transactions in 2025 across 4 billion cards. But Visa isn’t just moving money anymore. It’s building the roads, traffic lights, and toll systems for the entire digital economy.

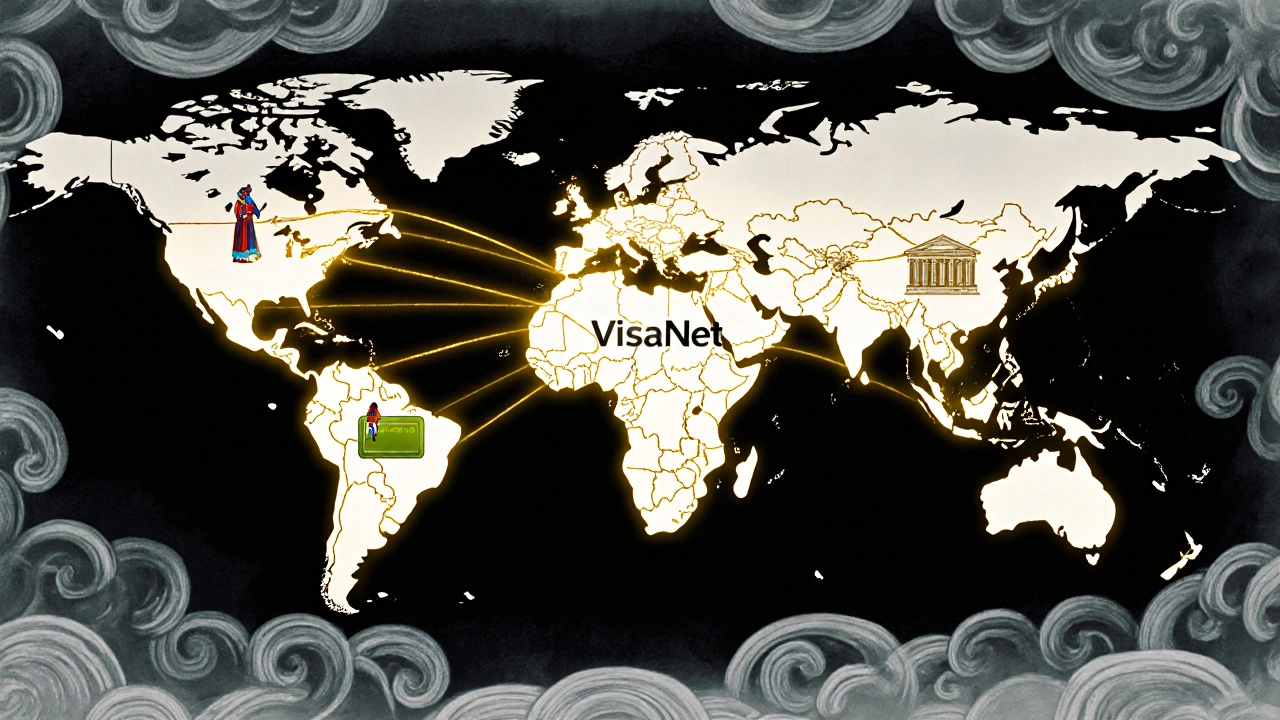

The Network of Networks

Visa’s big shift happened around 2020. Instead of being just one payment network, it became a platform that connects dozens. Today, Visa’s infrastructure links 15 card networks, 75 domestic payment schemes like India’s UPI and Brazil’s Pix, 15 real-time payment systems, and hundreds of fintech apps-all through a single, secure backbone called VisaNet. This isn’t just scale. It’s interoperability. A startup in Nairobi can now use Visa’s tools to let its users pay with a local mobile wallet, send money to a bank account in Mexico, and accept payments from a U.S. credit card-all without building their own payment rails.This is what Visa calls its ‘Network of Networks.’ It’s not about replacing other systems. It’s about making them work together. That’s why Visa can claim over 11 billion connected endpoints-more than any other payment company. Mastercard, its closest rival, connects about 9.5 billion. The difference isn’t just numbers. It’s reach. And reach means more opportunities for fintechs to grow.

How Fintechs Actually Use Visa

Most people think of Visa as the logo on their credit card. But for fintechs, Visa is a toolkit. The Commercial Integration Program, launched in early 2025, gives developers direct API access to Visa’s core services: payments, fraud detection, tokenization, and real-time settlement. Before this, integrating with Visa could take 6 to 8 months. Now, companies like Pleo, a Berlin-based expense management platform, cut that down to 72 days.Why does this matter? Because building payment infrastructure from scratch is expensive, slow, and risky. Visa handles the heavy lifting: compliance, security, global routing, and currency conversion. Fintechs focus on what they do best-user experience, niche features, or customer service. That’s why over 1,200 fintechs across 45 countries now use Visa’s commercial APIs. And 78 of the Fortune 100 companies rely on Visa for their corporate payments.

One standout product is Visa Direct. It’s Visa’s real-time money movement engine. It doesn’t just move card payments. It sends gig worker payouts, government stimulus checks, insurance claims, and even crypto-to-fiat conversions. In 2025, Visa Direct processed over $1.2 trillion in faster payments-up sixfold since 2020. That’s more than Zelle, the U.S. bank-to-bank transfer system, which handles $1.2 trillion annually. Visa Direct doesn’t compete with Zelle-it connects to it.

Tap to Everything: The Physical-Digital Blend

Visa didn’t ignore the real world. It doubled down on it. The Tap to Pay and Tap to Phone features let merchants accept contactless payments without expensive terminals. In Europe, 35% of all in-person transactions now happen with a tap. In the U.S., Apple Pay and Google Pay use Visa’s network to make these taps possible. Even online, Visa’s Tap to Confirm lets users approve purchases with a single tap on their phone instead of typing passwords or codes.Behind the scenes, Visa’s network handles 15,000 transactions per second with an average authorization time of just 1.2 seconds. That’s faster than most bank apps load. And it’s all built on VisaNet, which has 99.999% uptime-meaning it fails less than 5 minutes a year. For a business that processes billions of payments daily, that reliability isn’t optional. It’s the foundation.

AI Is the New Secret Weapon

Visa’s biggest innovation in 2025 wasn’t a new product. It was AI. The company launched its AI Commerce Network, linking 4.8 billion payment credentials to over 150 million merchant locations. This isn’t just for fraud detection-it’s for prediction. The system learns patterns: Is this purchase normal for this user? Is this merchant typically targeted by scams? Is this transaction coming from a new device in a different country?Results? A 27% drop in false declines (legit transactions blocked by mistake) and a 19% boost in fraud detection. That’s huge for merchants. Every false decline costs money and loses trust. Visa’s AI also helps developers. Its new tools can auto-generate code snippets for payment integrations, reducing setup time by up to 30%. In October 2025, Visa announced a $500 million investment to expand this AI engine across fraud, customer support, and transaction optimization.

Where Visa Struggles

Visa isn’t invincible. In markets like India, where UPI handles 11 billion transactions a month, Visa’s card-based model is barely a footnote. In Brazil, Pix dominates. In China, Alipay and WeChat Pay rule. Visa can’t force its way in. Instead, it partners. It connects to UPI through local banks. It lets fintechs use Visa’s network to offer UPI-like payments to global customers.Another weakness? Domestic real-time payments. In the U.S., Zelle and FedNow are growing fast. Visa doesn’t control them. It just connects to them. That’s smart-but it means Visa doesn’t own the customer relationship in those flows. It’s a service provider, not the brand.

And then there’s cost. Visa’s commercial API access starts at $15,000 a year plus per-transaction fees. For early-stage fintechs, that’s steep. A 2025 Gartner survey found 41% of startups saw Visa’s pricing as prohibitive. That’s why Visa launched the Fintech Fast Track Program, offering discounted access, mentorship, and faster onboarding. So far, 89% of participants have gone live within six months.

The Crypto and Stablecoin Bridge

Visa didn’t wait for crypto to cool down. It jumped in. In 2025, it partnered with Bridge (a Stripe company) to launch stablecoin-linked Visa cards. Now, fintechs can issue cards in 32 countries that automatically convert crypto to fiat at checkout. A user in Germany can hold USDC, spend it at a café in Tokyo, and never see a blockchain transaction. Visa handles the conversion, compliance, and settlement. No other major payment network has done this at scale.This isn’t about Bitcoin. It’s about utility. Stablecoins are fast, cheap, and borderless. Visa is making them usable in the real world. By the end of 2026, Visa plans to expand this to 50 countries.

What’s Next

Visa’s roadmap is clear: go deeper, not wider. In 2026, it will add support for 10 new programming languages in its developer tools. It’s expanding its AI network to handle more types of transactions-like subscription renewals, B2B invoices, and government benefits. It’s also lowering interchange fees for small merchants by 10 basis points starting January 2026 to encourage adoption.But the biggest question remains: Will central bank digital currencies (CBDCs) replace Visa? The Bank for International Settlements predicts CBDCs will make up 15% of global payment volume by 2030. Visa’s response? It’s building CBDC connectors. If a country launches a digital dollar or euro, Visa will let fintechs integrate it into their apps-just like they do with UPI or Pix.

Visa’s strategy isn’t about winning the future. It’s about being the platform the future runs on.

How does Visa make money in the fintech era?

Visa earns money through transaction fees-called interchange fees-charged to merchants and banks every time a payment moves through its network. In 2025, it processed $40 billion in net revenue, with a 67% operating margin. Its shift to APIs and commercial payments means it now charges fintechs for access to its infrastructure, fraud tools, and real-time settlement services, creating new revenue streams beyond traditional card transactions.

Can small fintechs afford to use Visa’s APIs?

Yes, but it’s not cheap. Standard commercial API access starts at $15,000 annually plus per-transaction fees, which can be tough for early-stage startups. However, Visa’s Fintech Fast Track Program offers discounted pricing, technical support, and faster integration for qualifying startups. Over 89% of participants in this program launch within six months, making it a viable path for well-funded or venture-backed fintechs.

What’s the difference between Visa and a payment processor like Stripe?

Stripe is a payment facilitator-it handles the entire customer experience: checkout, fraud, billing, and settlement. Visa is the underlying network-the pipes that move the money between banks and card schemes. Stripe often uses Visa (and Mastercard) to complete transactions. Think of Visa as the highway and Stripe as the toll booth operator. Fintechs use both: Stripe for ease of use, Visa for global reach and reliability.

Why is Visa winning in cross-border payments?

Visa processes 65% of all international card payments because its network is already in 200+ countries, with local currency support, compliance pre-built, and real-time settlement. Competitors often need to partner with local banks or build country-by-country infrastructure. Visa’s ‘Network of Networks’ lets fintechs tap into this global system with one integration, making cross-border payments faster and cheaper.

Does Visa compete with digital wallets like Apple Pay?

No. Apple Pay, Google Pay, and Samsung Pay are digital wallets that use Visa’s network to move money. Visa doesn’t own the wallet-it powers the transaction. When you tap your iPhone to pay, Visa’s system authorizes the payment, routes it to the right bank, and settles the funds. Visa benefits from every transaction, regardless of the interface.

How does Visa handle regulatory differences across countries?

Visa operates under 197 different regulatory frameworks, from GDPR in Europe to PSD3 and Singapore’s Payment Services Act. Its solution? A modular API design. Fintechs can choose which compliance layers to activate based on their target markets. Visa handles the heavy lifting-like KYC, AML, and data localization-but fintechs still need to adapt their apps to local rules. That’s why 63% of developers cite regional compliance as their biggest integration challenge.

Comments

RAHUL KUSHWAHA

November 16, 2025India’s UPI is just… insane. 11 billion transactions a month? Visa’s cool and all, but here? We don’t even think about cards. Tap, done. No card, no PIN, no hassle. Visa’s trying to connect to us? Good. But we’re already way ahead. 😅

Julia Czinna

November 17, 2025Really appreciate how Visa’s playing the long game-not trying to replace local systems, but weaving itself into them. That ‘Network of Networks’ approach is quietly brilliant. Especially love how they’re bridging stablecoins to real-world spending. It’s not crypto hype-it’s utility, wrapped in compliance. And the AI reducing false declines? Huge win for small merchants who lose trust every time a legit transaction gets blocked. 👏

Laura W

November 18, 2025Okay but let’s be real-Visa’s not the hero, it’s the infrastructure wizard. Stripe’s the front-facing UX guru, but Visa? They’re the silent OGs holding up the whole damn internet of payments. 💥 And now they’re doing AI-generated code snippets? That’s next-level developer love. Also, $15k/year for APIs is steep, but for any startup serious about global scale? Worth it. The Fintech Fast Track is basically a golden ticket. And the crypto-to-fiat cards? Genius. I just spent USDC on tacos in Tokyo last week. No blockchain. No stress. Just tap. Visa made that possible. 10/10 infrastructure flex.

Write a comment