Cash Flow Forecast Calculator

Your Cash Flow Forecast

Most small business owners don’t go broke because they aren’t making money. They go broke because they run out of cash. That’s not the same thing. You could be selling like crazy, but if your customers haven’t paid yet and your bills are due tomorrow, you’re in trouble. That’s where a cash flow dashboard changes everything.

What a Cash Flow Dashboard Actually Does

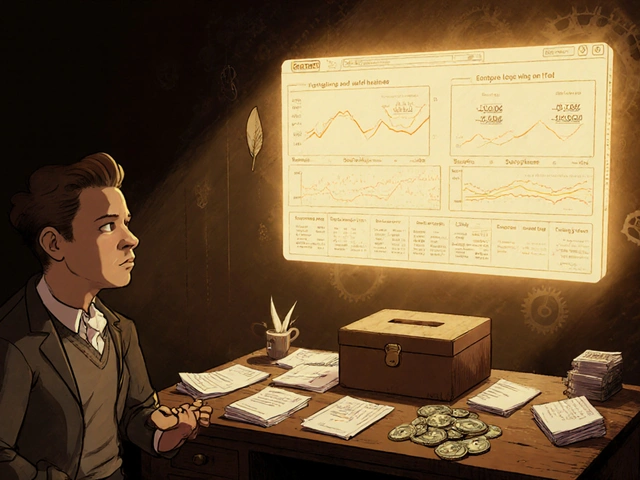

A cash flow dashboard isn’t just a fancy spreadsheet. It’s a live feed of your business’s financial heartbeat. It pulls data from your bank accounts, invoices, payroll systems, and accounting software - all in one place. Instead of waiting days or weeks to close your books, you see exactly how much cash you have right now, what’s coming in next week, and what’s about to go out.Think of it like a car’s dashboard. You don’t wait until the engine stops to check your fuel level. You watch the gauge. A cash flow dashboard does the same for your business. It shows you your current balance, upcoming payments, unpaid invoices, and even forecasts what your balance will be 30, 60, or 90 days from now.

According to Lucid.Now’s 2024 report, SMBs using these tools save about 10 hours a week on bookkeeping. That’s more time to run your business instead of chasing receipts. One restaurant owner in Boise told me he avoided a $15,000 cash shortfall just because his dashboard flagged a payment delay from a big client two weeks before it hit. He called the client, got an advance, and paid his supplier on time.

Why Real-Time Matters More Than Ever

Old-school accounting means you look back. You wait for the bank statement. You reconcile entries. You run reports at month-end. By then, it’s too late to fix problems.Real-time dashboards change that. Platforms like Xero and QuickBooks sync with your bank accounts every few hours. When a customer pays, it shows up immediately. When a bill clears, it’s deducted right away. No more guessing. No more surprises.

That’s not just convenient - it’s critical. In 2024, 58% of SMBs use some form of cash flow tracking, but only 32% use tools that forecast future balances. That gap is where most businesses fail. You can’t manage what you can’t see. And if you’re only seeing what already happened, you’re flying blind.

Take a seasonal business like a landscaping company. Without a dashboard, they might think they’re doing fine in March because they made $20,000 in sales. But if they don’t see that their biggest vendor invoice ($12,000) is due in April and their clients won’t pay until May, they’ll be out of cash by the end of the month. A good dashboard shows that pattern months in advance.

How the Big Tools Compare

Not all cash flow dashboards are built the same. Here’s how the top players stack up:| Tool | Real-Time Sync | Forecasting Range | Bank Reconciliation | Starting Price | Best For |

|---|---|---|---|---|---|

| Xero | Yes, every 2 hours | Up to 90 days, with scenario modeling | Automated, 78% fewer errors | $12/month | Growing businesses needing depth |

| QuickBooks Online | Yes, daily | Up to 90 days (extra $20/month) | Good, requires setup | $30/month | Most SMBs, especially with inventory |

| FreshBooks | Yes, but limited | Only 30 days | Basic, manual-heavy | $17/month | Freelancers and service providers |

| Wave | Yes, but delayed | No forecasting | Manual | Free | Very small businesses on a budget |

| U.S. Bank Cash Flow Tool | Yes, but only for U.S. Bank accounts | Up to 90 days | Only for U.S. Bank | Free | Businesses banking exclusively with U.S. Bank |

Xero leads in automation and forecasting depth. Its bank reconciliation is nearly flawless - it matches transactions automatically and flags mismatches. That’s why 63% of Reddit users switching from Wave to Xero said it cut their bookkeeping time by 10+ hours a month.

QuickBooks is the most popular, but its advanced cash flow tools cost extra. If you’re using it just for invoicing and payroll, you’re missing half the value. Paying $20 more per month for forecasting is often worth it - one manufacturing owner saved $8,200 in interest by timing equipment purchases based on the dashboard’s seasonal cash pattern.

FreshBooks is clean and easy, but it’s not built for complex cash flow. If you’re a freelancer with one client paying every two weeks, it’s fine. If you’re hiring staff, managing vendors, and juggling multiple payment terms? You’ll hit a wall.

Wave is free, and that’s great - if you only need to track what’s already happened. But 68% of users say they can’t predict next month’s cash position. That’s like driving with your eyes closed and only checking the rearview mirror.

What You Can’t Ignore: The Hidden Risks

These tools are powerful, but they’re not magic. And over-trusting them can be dangerous.One CPA in Colorado told me about a client who relied on a dashboard’s forecast to take out a loan. The forecast assumed all invoices would be paid on time. But two big clients delayed payment - because they were going bankrupt. The dashboard didn’t know that. The business ended up drowning in debt.

That’s why experts like Robert Davis from FVCbank warn: “Automated forecasts are only as good as the assumptions behind them.”

Here’s what you need to do:

- Always review the assumptions. Is the forecast assuming 100% invoice collection? That’s unrealistic. Adjust it to 85% or 90%.

- Check for outliers. A $10,000 invoice from a new client? Don’t let the dashboard count it as guaranteed cash until you’ve received the payment.

- Use the dashboard to spot trends, not make final decisions. If your cash balance drops every third month, plan for it. Don’t just wait for the alert.

Also, data entry matters. If you mislabel a $5,000 payment as “income” instead of “loan repayment,” your dashboard will think you’re richer than you are. That’s how people get in trouble.

Getting Started - No Tech Expert Needed

You don’t need an accounting degree to use a cash flow dashboard. Here’s how to start:- Choose your tool. If you’re under $100K/year in revenue and want free, try Wave. If you’re growing and need forecasts, go with Xero or QuickBooks.

- Connect your bank accounts. Most platforms let you link accounts with just your login credentials (no passwords stored - they use secure banking APIs).

- Set up your categories. Label your income and expenses correctly. “Gas” shouldn’t be under “Office Supplies.” This takes an hour but saves hours later.

- Enable automated bank reconciliation. This is the biggest time-saver. Let the system match transactions automatically.

- Run your first forecast. Look at the next 60 days. Do you see a dip? Plan ahead. Talk to your vendor about stretching a payment. Ask a client for a deposit.

Most paid platforms offer free onboarding calls. Use them. Xero’s support team walks you through setting up cash flow rules. QuickBooks has video tutorials for every step. Don’t skip this.

It takes 2-5 days to get set up. After that, you’ll spend 10-15 minutes a week checking it. That’s less time than scrolling through social media.

What’s Coming Next

The best dashboards are getting smarter. Monit’s new AI feature improved forecast accuracy by 37% in tests. Xero’s “Cash Flow Copilot” now suggests actions: “You have $8,000 in unpaid invoices. Send reminders to these 3 clients.”By 2026, Deloitte predicts 75% of SMBs will use dashboards that forecast 180 days out - not just 90. AI will start warning you about risks before they happen: “Your cash runway is shrinking. Consider delaying the new equipment purchase.”

That’s not science fiction. It’s already happening.

What’s not changing? The rule that cash is king. Tools just make it easier to see the crown.

Frequently Asked Questions

Do I need a cash flow dashboard if I use QuickBooks or Xero already?

Yes - if you’re only using the basic accounting features. QuickBooks and Xero have cash flow dashboards built in, but you have to turn them on. Check under “Reports” or “Cash Flow” in your dashboard. If you’re not seeing a live graph of your cash position, you’re missing the most valuable part.

Can I use a free tool like Wave and still avoid cash problems?

You can track what’s happened - but not what’s coming. Wave shows you past income and expenses. It doesn’t predict when your next big payment is due or if your customers are late. If you’re a freelancer with steady clients, maybe. If you’re hiring employees, paying vendors monthly, or dealing with seasonal sales - you’ll get blindsided. Paying $12-$30/month for forecasting is cheaper than a missed payroll.

How secure are these dashboards?

Top platforms like Xero, QuickBooks, and Monit meet SOC 2 Type II security standards - the same level banks use. They don’t store your bank passwords. They use encrypted connections and multi-factor authentication. In 2024, 92% of major tools passed independent security audits. Your data is safer in the cloud than on a laptop that could get stolen.

What if I’m not good with numbers?

You don’t need to be. The dashboard shows you colors and graphs - red means cash is low, green means you’re safe. You don’t need to know what “accrual accounting” means. Just look at the forecast. If it says you’ll have $2,000 on May 15 and your rent is $5,000, you know you need to act. That’s all you need to know.

How long does it take to see results?

Within 24 hours of connecting your accounts, you’ll see your current balance. Within a week, you’ll start noticing patterns - like every third Friday, your cash dips. That’s when you start making smarter decisions. Most owners say they feel less stressed and more in control after just two weeks.

Next Steps

- If you’re not using a cash flow dashboard: pick one today. Start with Xero’s free trial or Wave if you’re on a tight budget.

- If you’re already using one: check your forecast for the next 60 days. Do you see a red flag? If yes, call your banker or accountant - don’t wait.

- If you’re unsure: ask your bookkeeper to show you the dashboard. If they don’t use one, it’s time to find someone who does.

Cash flow isn’t about being rich. It’s about being ready. The right dashboard doesn’t make you rich - it keeps you alive long enough to get there.

Comments

RAHUL KUSHWAHA

October 30, 2025Been using Wave for my freelance gigs - free and simple, but man, I just got blindsided last month when two clients paid late. Wish I had forecasting. Now I'm switching to Xero. $12/month is cheaper than panic attacks. 😅

Julia Czinna

October 31, 2025This is one of the clearest breakdowns of cash flow tools I’ve read in years. The part about adjusting forecast assumptions to 85-90% instead of 100%? Gold. So many small business owners treat these dashboards like crystal balls, and it’s dangerous. Also, love the note about data entry - mislabeling a loan as income is such a quiet killer. Thanks for the practical, no-fluff advice.

Laura W

October 31, 2025Y’all need to stop treating cash flow dashboards like some magic wand. They’re not AI gods - they’re data mirrors. If you feed them garbage (like mislabeled transactions or unrealistic collections), you get garbage forecasts. I’ve seen three businesses crash because they trusted the green line without asking ‘why?’ The real power isn’t in the graph - it’s in the discipline to check assumptions, call clients early, and never let automation replace your brain. Also - Xero’s Copilot is legit. It texted me to remind a client last week. I was like… who sent that? Then I remembered I paid for this.

Write a comment