Ex-Dividend Date Calculator

Enter the record date to calculate the ex-dividend date under T+1 settlement rules. The ex-dividend date is always one business day before the record date.

Ex-Dividend Date

Result will appear here

Important: Calculations account for business days (weekends and U.S. holidays excluded). If your record date falls on a holiday, the ex-dividend date may be adjusted.

To get a dividend, you don’t need to own a stock for weeks or even days. You just need to own it before the ex-dividend date. That’s it. But if you miss that one-day window-by even a few hours-you won’t get a cent. And if you’re still using old rules from 2023, you’re already behind.

What the Ex-Dividend Date Actually Means

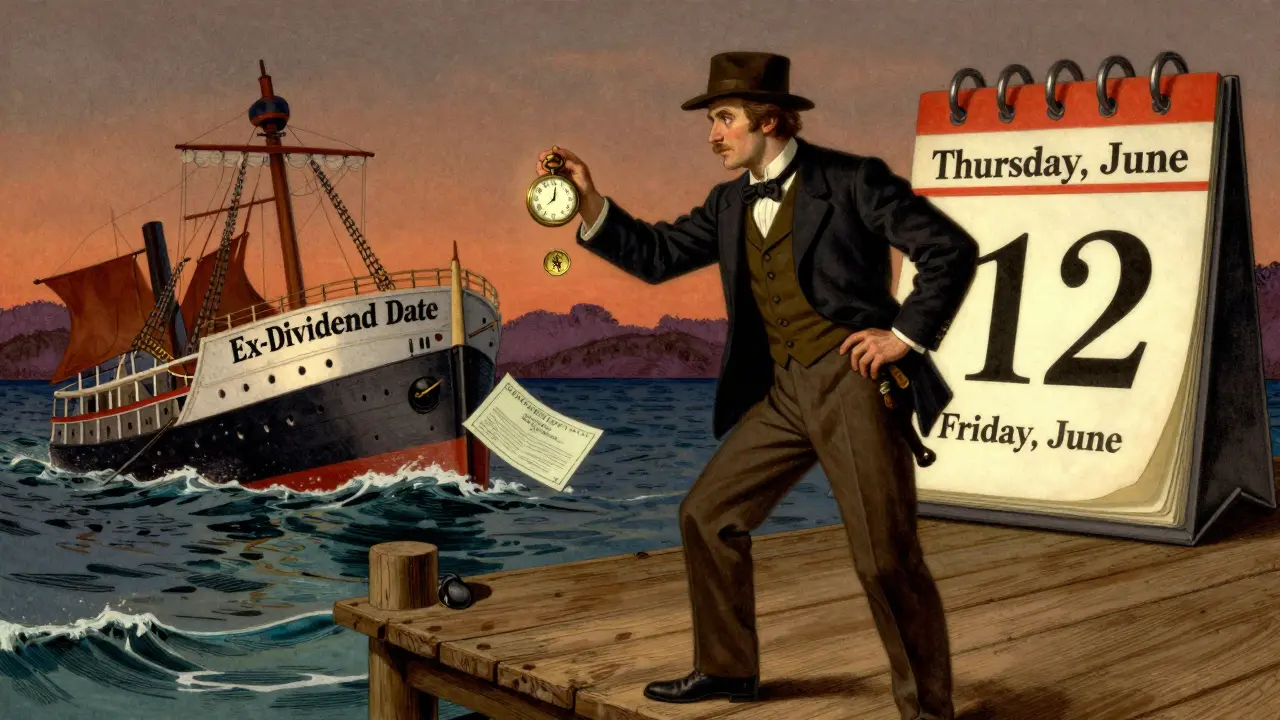

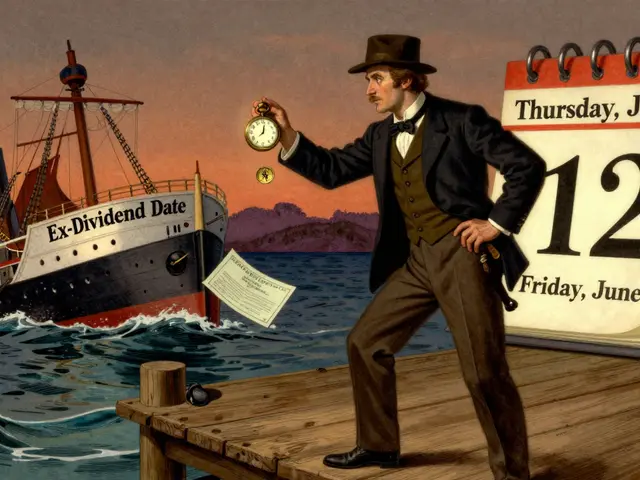

The ex-dividend date is the cutoff. It’s the day the stock starts trading without the upcoming dividend attached. If you buy on or after that date, you’re buying the stock without the dividend. The person who owned it the day before gets paid, not you.

Here’s the real-world consequence: Say Apple announces a $0.96 dividend. The ex-dividend date is Friday, June 13. If you buy Apple shares on Friday, June 13, or later, you won’t get the $0.96. If you bought on Thursday, June 12, you will-even if you sell the stock on Friday morning.

This isn’t about holding the stock for a long time. It’s about being the registered owner at the exact moment the company locks in its list of shareholders. That moment is determined by the record date, but you can’t buy shares on the record date and expect to get paid. Why? Because of settlement.

Why T+1 Settlement Changed Everything

Before May 28, 2024, stock trades took two business days to settle. That meant if you bought shares on Monday, you wouldn’t officially own them until Wednesday. So, the ex-dividend date was set two business days before the record date. If you wanted to get the dividend, you had to buy at least two days before the record date.

That’s no longer true.

On May 28, 2024, the U.S. Securities and Exchange Commission switched to T+1 settlement. Now, trades settle in one business day. That means if you buy shares on Monday, you’re the official owner by Tuesday. So the ex-dividend date moved from two days before the record date to one business day before.

This change wasn’t just a tweak. It affected millions of investors. A Reddit thread from June 2024 had over 1,200 upvotes from people who missed dividends because they bought the day before the record date-thinking they had two days to settle. They didn’t. They had one.

Now, if the record date is Wednesday, the ex-dividend date is Tuesday. Buy on Tuesday or earlier? You get the dividend. Buy on Wednesday? You don’t.

Record Date vs. Ex-Dividend Date vs. Payable Date

It’s easy to mix these up. Here’s how they actually work together:

- Declaration Date: The company announces the dividend, including the ex-dividend date, record date, and payable date. This is when the company commits to paying.

- Ex-Dividend Date: The cutoff. You must own the stock before this date to qualify. This is the date you need to pay attention to.

- Record Date: The day the company checks its books to see who owns the stock. But you don’t buy on this day-you buy before it.

- Payable Date: The day the money hits your brokerage account. This is usually a few weeks after the ex-dividend date.

For example: Coca-Cola declares a dividend on April 1. The record date is April 15. The payable date is May 15. Under T+1, the ex-dividend date is April 14. Buy on April 13 or earlier? You get paid on May 15. Buy on April 14? You don’t.

What Happens to the Stock Price?

On the ex-dividend date, the stock price typically drops by roughly the amount of the dividend. Why? Because the company is handing out cash. The value of the company goes down by that amount.

So if Tesla is trading at $250 and pays a $5 dividend, you’ll likely see it open at $245 on the ex-dividend date. This isn’t a loss-it’s a transfer. You get $5 in cash, but your shares are worth $5 less. The total value of your position stays the same.

Some traders try to exploit this drop, buying before the ex-date and selling after. But this rarely works for small investors. The price drop is usually immediate and exact. Plus, you’re paying commissions, taxes, and slippage. It’s not free money.

Exceptions to the Rule

There are two big exceptions that trip people up.

First: Large Dividends-If a company pays a dividend that’s 25% or more of the stock’s value, the ex-dividend date flips. Instead of being one day before the record date, it’s the first business day after the payable date. This is rare, but it happens with special dividends or spin-offs.

Example: Company X announces a $10 dividend on a stock trading at $35. That’s 28.5% of the price. The record date is June 10. The payable date is June 30. The ex-dividend date? July 1. So you’d need to buy on or before June 30 to get the dividend.

Second: Cash Settlement Trades-Some trades settle immediately. If you’re using a cash account and your broker allows same-day settlement (rare for retail investors), you could theoretically buy on the record date and still get the dividend. But this is the exception to the exception. For 99% of people using standard brokerage accounts, T+1 applies.

Business Days Matter More Than You Think

Not every day counts as a business day for dividend calculations.

Weekends? Not business days. Federal holidays? Not business days. But here’s the twist: Columbus Day and Veterans Day are trading days in the U.S. But they’re not business days for dividend calculations because banks in New York are closed.

So if the record date falls on a Sunday, you don’t count backward from Sunday. You count backward from the last business day before that-which could be Thursday if Friday and Saturday are weekend, and Monday is a holiday.

Example: Record date is Sunday, July 6. Monday is Independence Day (holiday). Tuesday is a regular trading day. The ex-dividend date? Friday, July 4. You’d need to buy on or before Thursday, July 3.

Most brokers automatically adjust for this, but if you’re tracking dividends manually, you need to check the NYSE and bank holiday calendar.

How to Find the Ex-Dividend Date

You don’t need to calculate this yourself. Your broker will show it. But here’s how to find it fast:

- Check your brokerage app (Charles Schwab, Fidelity, TD Ameritrade). Search for the stock, then look under "Dividends" or "Corporate Actions."

- Use financial websites like Yahoo Finance or Morningstar. Type in the ticker, go to the "Dividends" tab.

- Look at the company’s investor relations page. Public companies are required to disclose these dates.

Don’t rely on Google searches or old blog posts. Many sites still say "two days before" because they haven’t updated since 2024.

Why This Matters for Long-Term Investors

If you’re buying dividend stocks for income, you don’t need to time the market. You just need to know the ex-dividend dates and make sure you’re not buying on or after them.

Dr. Robert Johnson of The American College of Financial Services said it best: "The T+1 shift has simplified the process for long-term income investors. You don’t have to guess. You just need to buy before the ex-date, and you’re in."

For those who hold dividend stocks in retirement accounts or long-term portfolios, this rule is a gift. It reduces confusion. It removes the risk of missing a payment because you waited too long.

And here’s the kicker: 84% of S&P 500 companies pay dividends. If you’re building a portfolio for income, you’re dealing with this date every few weeks.

Common Mistakes to Avoid

- Buying on the record date. You think you’re safe. You’re not. Settlement takes a day.

- Assuming T+2 still applies. If your broker, blog, or YouTube video says "two days before," it’s outdated. Verify with your broker’s official site.

- Ignoring holidays. If the ex-dividend date falls on a holiday, it moves. Your broker will adjust, but you should know why.

- Thinking you need to hold past the payable date. You only need to own it before the ex-dividend date. Sell the next day if you want. You still get paid.

What If You Miss the Ex-Dividend Date?

You don’t get the dividend. That’s it.

There’s no appeal. No exception. No "I didn’t know" clause.

But here’s the upside: Missing one dividend doesn’t ruin your strategy. Dividend stocks pay quarterly. You’ll have another chance in three months. The key is consistency-not perfection.

Set up alerts in your brokerage app. Use a calendar. Write down the next ex-dividend date for each stock you own. It takes five minutes a month.

And remember: The goal isn’t to catch every single dividend. It’s to build a reliable income stream over time. One missed payment won’t break that.

Final Rule: Own Before the Ex-Dividend Date

It’s simple. It’s clear. It’s been true since the 1920s.

Today, with T+1 settlement, it’s even simpler. You don’t need to buy two days before. You don’t need to plan weeks ahead.

You just need to own the stock before the ex-dividend date.

If you do that, you get paid. If you don’t, you don’t.

That’s the whole game.

Comments

Geoffrey Trent

December 24, 2025Bro, I bought Apple on June 12th last year and sold it the next day after the dividend hit. Got my $0.96 and didn’t even feel guilty. Dividends aren’t about holding, they’re about free money you didn’t earn. T+1 just made it easier to game the system. Who cares if you own it for 12 hours? The system’s rigged anyway.

Also, why are people still confused about record dates? It’s been 2 years since T+1. Google it. It’s not that hard.

John Weninger

December 25, 2025I love how this post breaks it down so clearly - seriously, thank you. I used to stress over buying a day too late and missing out, especially with holiday weekends messing with settlement dates. Now I just set a calendar alert for ex-div dates and chill. It’s wild how such a small change (T+1) made dividend investing so much less stressful for regular folks.

And yeah, the price drop on ex-date? Totally normal. Don’t try to ‘profit’ off it - you’re just paying taxes and fees to break even. Better to just hold, collect, and let compounding do its thing. Keep it simple, folks.

Omar Lopez

December 25, 2025It’s mildly concerning that so many investors still conflate the record date with the ex-dividend date - a fundamental misunderstanding that predates T+1 but has been exacerbated by outdated financial blogs and YouTube influencers who haven’t updated their content since 2023.

Furthermore, the assertion that Columbus Day and Veterans Day are ‘trading days’ but not ‘business days’ for dividend purposes requires precise adherence to NYSE and bank holiday calendars, which are not synonymous. This distinction is non-negotiable under SEC Rule 10b-18 and should be explicitly referenced in any educational material. Most retail platforms auto-calculate correctly, but the onus remains on the investor to understand the underlying mechanics - not to blindly trust their broker’s UI.

Also, ‘free money’ is a misnomer. Dividends are a redistribution of equity value, not a windfall. The market adjusts. The math is elegant. The behavioral bias is not.

Jonathan Turner

December 25, 2025So you’re telling me some dumbass bought Tesla on the record date in 2024 and cried because they didn’t get the dividend? Bro, you’re not an investor, you’re a spectator with a brokerage account.

And now you want a trophy for reading a 10-minute blog? T+1 has been live for over a year. If you didn’t know, you were lazy. If you still think it’s T+2, you’re not just behind - you’re a liability to your own portfolio.

84% of the S&P pays dividends? Cool. So does your neighbor’s lawn mower. Doesn’t make you rich. Stop acting like you cracked the code because you didn’t buy on a Friday and miss a check. Grow up.

Also, ‘set up alerts’? Yeah, genius. That’s the entire strategy now? Congrats, you’ve graduated from ‘buy and hope’ to ‘buy and check your phone.’

Write a comment