Micro-Investing Growth Calculator

How Your Small Investments Grow

Calculate how your weekly micro-investments compound over time. Enter your investment amount, time horizon, and expected return to see your potential growth.

Your Investment Summary

Total Invested:

Total Fees Paid:

Expected Value:

Net Growth:

Fee Impact Analysis

Note: This calculator shows typical results based on historical S&P 500 returns. Actual results may vary. Fees can significantly impact long-term growth.

For investments under $50/month, fees above 10% of your contributions can slow growth substantially.

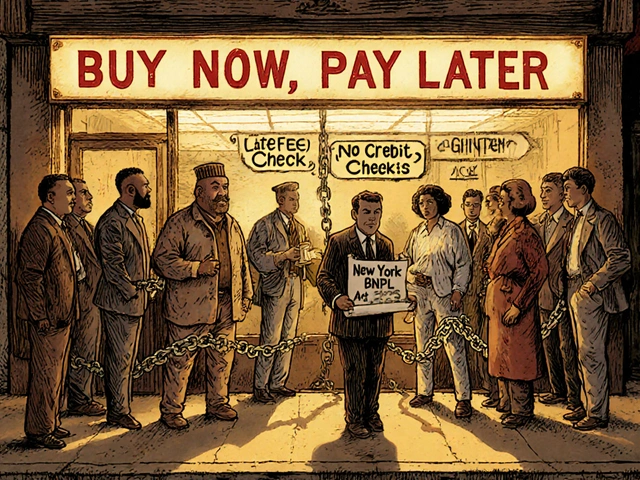

What if you could start investing without saving up hundreds of dollars first? What if you could turn your coffee purchases into tiny investments that grow over time? That’s the real promise of micro-investing apps - and it’s not a gimmick. It’s how millions of people, especially those just starting out, are building their first real investment portfolios with as little as $1.

How Micro-Investing Actually Works

Micro-investing isn’t about getting rich quick. It’s about getting started. The idea is simple: instead of waiting to save $500 or $1,000 to buy a single stock, you invest small amounts regularly - often automatically. Most apps use two main methods to do this.The first is round-up investing. You link your debit card or bank account to the app. Every time you spend $4.75 on lunch, the app rounds it up to $5 and invests the 25-cent difference. Do that 20 times a month? That’s $5 extra going into your portfolio. Over a year, that’s $60. Do it for five years? That’s $300 - and that’s just from spare change.

The second method is fractional shares. You don’t need to buy a whole share of Amazon or Apple, which might cost $150 or more. Instead, you buy a fraction - say, $5 worth. That $5 buys you 0.03 shares. It sounds tiny, but when you do it every week, those fractions add up. And because these apps invest in ETFs - bundles of hundreds of stocks - you’re diversified from day one. No need to pick winners. The app does it for you.

Why This Works Better Than Waiting

People often delay investing because they think they need a big chunk of cash. But time is the real advantage. The earlier you start, the more compounding works for you.Let’s say you invest $10 a week. That’s $520 a year. If you earn an average of 7% annually - which is close to the historical return of the S&P 500 - after 10 years, you’d have about $7,200. After 20 years? Over $21,000. And you didn’t have to save up a dime upfront. You just let your spending habits fund your future.

Financial planner Jody D’Agostini puts it plainly: “Starting that compounding effect before you have much income can be an incentive to continue investing as your income starts to grow.” That’s the hidden power here. Micro-investing doesn’t just grow your money. It grows your habits.

How to Get Started in Under 5 Minutes

You don’t need a finance degree. You don’t even need to know what an ETF is. Here’s how to begin:- Download one of the top micro-investing apps - Acorns, Stash, or SoFi are popular in the U.S.

- Create an account. You’ll need your name, Social Security number, and a photo ID - standard for any investment account.

- Link your checking account or debit card. Most apps use bank-level encryption, so your data is safe.

- Choose your risk level. Most apps ask if you’re conservative, moderate, or aggressive. Pick moderate if you’re unsure. They’ll build a portfolio of ETFs based on your answer.

- Turn on round-ups or set a weekly auto-invest amount. $5, $10, $25 - whatever feels painless.

That’s it. You’re invested. No paperwork. No broker calls. No confusing charts. The app does the rest.

What You’re Actually Buying

Most micro-investing apps don’t let you pick individual stocks. Instead, they invest in ETFs - exchange-traded funds. These are baskets of hundreds of stocks or bonds, managed by professionals. For example, an S&P 500 ETF holds shares of Apple, Microsoft, Amazon, and 497 other big U.S. companies. A global ETF might include companies from Japan, Germany, Brazil, and beyond.This diversification is the biggest advantage. If one company crashes, your whole portfolio doesn’t collapse. You’re spread thin across dozens, even hundreds, of assets. That’s the opposite of buying one stock hoping it doubles - which is how most beginners lose money.

Some apps, like Mintos, go further and let you invest in micro-loans - tiny amounts lent to small businesses or individuals overseas. These offer higher potential returns but come with more risk. Stick to ETFs when you’re starting out. Learn the basics before branching out.

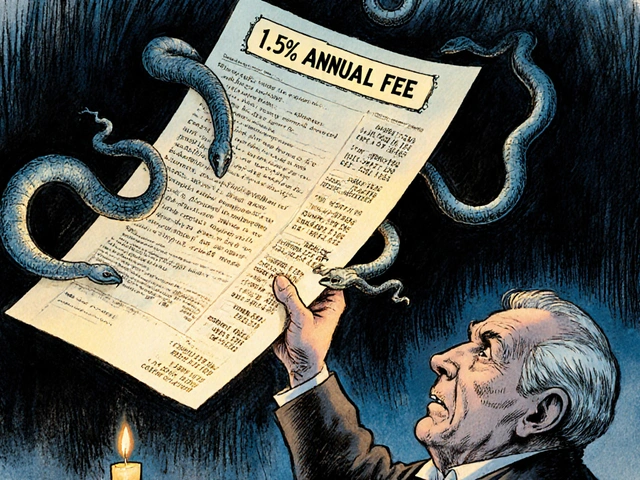

Fees: The Hidden Catch

Here’s the thing: micro-investing apps aren’t free. They charge monthly fees - usually $1 to $5. Sounds small, right? But if you’re only investing $5 a week, a $3 monthly fee eats up 25% of your contribution. That’s not sustainable.Compare that to a traditional brokerage like Fidelity or Charles Schwab, where you can buy ETFs for $0 commission. But they require $1,000 minimums to open a portfolio. So the trade-off is: pay a small fee to start now, or wait until you can afford the big platforms.

Here’s the rule: if you’re investing less than $50 a month, a $1 or $2 fee is fine. If you’re investing $100 or more, look for apps with lower fees or consider switching to a low-cost brokerage. Don’t let fees kill your growth.

What These Apps Can’t Do

Micro-investing apps are great for starting out. But they’re not magic. They won’t:- Protect you from market crashes. If the stock market drops 20%, your portfolio drops too. That’s just how investing works.

- Guarantee returns. No one can promise you’ll make money. Past performance doesn’t predict the future.

- Replace budgeting. If you’re overspending on takeout and streaming services, no app will fix that. Micro-investing works best when you’re already managing your cash flow.

- Help you retire rich alone. It’s a starter tool. Once you’re earning more, you’ll want to add IRAs, 401(k)s, and maybe real estate.

Think of these apps as training wheels. They help you learn how investing feels - the ups, the downs, the patience it takes. Once you’re comfortable, you can ride without them.

Real Users, Real Results

One user on Reddit started with $5 a week in Acorns. She didn’t touch it for four years. When she needed money for a car repair, she checked her balance. She had $2,800 - all from rounding up coffee, groceries, and gas. She didn’t feel the money leave. She didn’t have to think about it. It just grew.Another user, a college student, used Stash to invest $10 a week. He didn’t know what an ETF was. He just clicked “invest” every Monday. After two years, he had $1,200. He used it to pay off part of his student loan. He didn’t win the lottery. He just stayed consistent.

These aren’t outliers. They’re the norm. The apps are designed to make investing feel effortless. And that’s why they work.

What to Avoid

Don’t fall for these traps:- Don’t expect quick gains. Micro-investing is a 10-year game, not a 10-day one.

- Don’t withdraw money every time the market dips. Selling low locks in losses. Let it ride.

- Don’t use this as your only savings tool. Keep an emergency fund in cash first - at least $500 to $1,000.

- Don’t ignore fees. If your fee is eating more than 10% of your monthly investment, it’s time to reconsider.

Also, don’t compare yourself to people who bought Bitcoin in 2017 or Tesla in 2020. Those were lucky bets. Micro-investing is about building wealth slowly, safely, and steadily.

Where This Is Headed

The future of micro-investing is getting smarter. Apps now use AI to suggest investments based on your spending habits, income changes, and even your calendar. Some are testing automatic contributions when your paycheck hits. Others are integrating with budgeting tools so you can see your savings and investments in one place.More banks are adding round-up features directly to their apps. Chase, Capital One, and others now offer “spare change” investing without requiring a separate app. That means the line between banking and investing is fading - and that’s good for users.

The trend is clear: investing is becoming less about expertise and more about consistency. You don’t need to be a genius. You just need to show up.

Can you really make money with micro-investing apps?

Yes - but not fast, and not guaranteed. If you invest $10 a week for 20 years at a 7% average return, you’ll have over $21,000. The power comes from consistency and compounding, not from picking hot stocks. Most users who stick with it for five years or more see real growth, even if they started with just spare change.

Are micro-investing apps safe?

Yes, if you use regulated platforms. Apps like Acorns, Stash, and SoFi are registered with the SEC and FINRA. Your investments are protected up to $500,000 by SIPC insurance - the same protection you get from traditional brokers. Your bank login is encrypted, and most apps use two-factor authentication. But remember: your money is still exposed to market risk. The app won’t protect you from a stock market crash.

What’s the best micro-investing app for beginners?

For most beginners, Acorns is the easiest. It has the most intuitive round-up feature and simple portfolio options. Stash is great if you want to learn more about what you’re investing in - it includes educational content. SoFi offers free investing with no fees if you use their banking services. Try one for three months. See which interface feels natural. You can always switch later.

Do I need to be good with money to use these apps?

No. These apps are built for people who aren’t financial experts. You don’t need to track the market or understand balance sheets. But you should have a basic handle on your budget. If you’re spending more than you earn, no app will fix that. Start by tracking your spending for a month. Then let the app do the investing.

Can I withdraw my money anytime?

Yes. Most apps let you withdraw your money anytime - but it takes 1 to 5 business days to process. You can’t cash out instantly like you would from a checking account. That’s by design: it prevents impulsive withdrawals. Treat your micro-investing account like a long-term savings account, not a piggy bank.

Micro-investing apps won’t make you rich overnight. But they can make you a better investor - one coffee purchase at a time.

Comments

Laura W

November 8, 2025Okay but like-round-ups are genius if you’re already spending dumb money anyway. I used to buy $4.50 lattes every day and never thought twice. Now? That 50 cents goes into an ETF that owns half of Silicon Valley. I didn’t even notice the money was gone until I checked my balance and had $1,800. No discipline. No willpower. Just bad spending habits turned into wealth. Micro-investing isn’t investing-it’s financial alchemy.

Graeme C

November 8, 2025While I appreciate the sentiment, this piece is fundamentally misleading. The notion that $5 weekly investments yield $21,000 over two decades assumes a 7% real return-ignoring inflation, fees, and sequence-of-returns risk. Moreover, SIPC insurance protects against broker failure, not market decline. And let’s not pretend $3/month fees are trivial when they consume 60% of a $5 weekly contribution. This is financial placebo therapy for those who fear arithmetic. Real investing requires capital, knowledge, and patience-not rounding up your Starbucks.

Astha Mishra

November 10, 2025It is truly fascinating how the modern world has transformed the very concept of wealth-building into something so seamless, almost invisible-like water seeping into soil without anyone noticing. I, as someone from a country where saving even a dollar feels like a victory, find this approach deeply moving. To think that the small change from a chai tea or a bus ride can, over time, blossom into a portfolio that outlives our doubts-it speaks to the quiet power of consistency. Perhaps the real miracle isn’t the compounding interest, but the fact that we, as humans, are finally learning to trust time more than urgency. I have started using a similar app, though I invest only ₹20 a day-about 25 cents. I don’t check it often. I don’t need to. It is my silent promise to my future self.

Kenny McMiller

November 12, 2025Bro, the real flex isn’t even the money-it’s the behavioral conditioning. You’re not just investing $5 a week, you’re rewiring your brain to treat money like a flow, not a static thing. ETFs are the ultimate lazy man’s hedge. You don’t need to pick stocks, you don’t need to time the market, you just let the machine do the heavy lifting. And yeah, fees suck, but if you’re under 30 and making $40k, who’s gonna wait until they have $1K to open a Fidelity account? This is the on-ramp. The app is your financial therapist. It doesn’t judge you for buying avocado toast-it turns it into equity. That’s next-level.

Dave McPherson

November 12, 2025Wow. What a masterpiece of financial con artistry. You’re selling financial ADHD as a lifestyle. People think they’re building wealth, but they’re just feeding the app’s subscription model with their Starbucks receipts. And don’t get me started on ‘round-ups’-it’s like giving your kid a piggy bank and calling it a retirement plan. If you need an app to remind you to invest, you shouldn’t be investing. You should be learning how to budget. And don’t even get me started on SIPC-your ‘protection’ means nothing if the market tanks and you’re stuck with 0.03 shares of Tesla. This isn’t finance. It’s gamified financial self-delusion dressed up in minimalist UIs and influencer TikToks.

Write a comment