EWA Savings Impact Calculator

Based on Harvard Kennedy School data: Employees using EWA without coaching are 3x more likely to end up in a cycle of repeated withdrawals.

Enter your EWA usage details above to see your potential savings.

Most people don’t realize that getting paid early isn’t just about avoiding payday loans anymore. It’s about changing how you think about money. Earned Wage Access (EWA) used to be a quick fix - let employees pull out cash before Friday. Now, the best EWA platforms do something smarter: they teach you how to use that money wisely. And they don’t just give you advice. They nudge you toward better habits - automatically, quietly, and without judgment.

Why EWA Without Coaching Is a Trap

Imagine you’re stuck between rent and groceries. Your paycheck is three days away. You open your company’s EWA app, pull out $100, and breathe easier. Sounds good, right? But what if you do that every week? Suddenly, you’re paying $1.99 per withdrawal. That’s $8 per month. $96 a year. Not a lot - until you realize you’re also not saving anything. You’re just moving the same money around, paying small fees to keep the cycle going. That’s the trap. EWA without financial coaching turns into a band-aid. It doesn’t fix the problem - it just makes the pain less sharp. A 2023 Harvard Kennedy School study found that employees using EWA without education were 3 times more likely to end up in a cycle of repeated withdrawals. One Reddit user, u/MoneyMindful, shared how their EWA app showed them they were spending $200 a month on coffee and takeout. They didn’t know. The app didn’t just give them access to cash - it showed them where it was going. That’s the difference.What Financial Coaching Actually Looks Like in EWA Apps

Real financial coaching in EWA platforms doesn’t mean reading a PDF titled “10 Tips to Budget Better.” It’s built into the experience. Here’s what it looks like in practice:- When you withdraw $150, the app asks: “Would you like to save $10 from this withdrawal?” - and it’s pre-checked. You can uncheck it, but most people leave it. That’s a savings nudge.

- Your spending is automatically categorized. Rent, groceries, gas, entertainment. You get a pie chart every pay period. No math needed.

- Every Friday, you get a short tip: “You’ve saved $42 this month. That’s enough for a new pair of shoes. Keep going.”

- If you’re using EWA more than twice a week, you get a message: “You’ve accessed your pay 6 times this month. Would you like to talk to a coach about your cash flow?”

Savings Nudges: How Small Triggers Change Big Behaviors

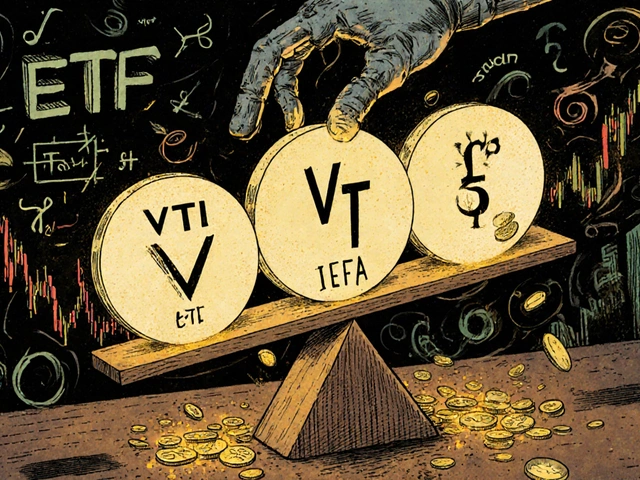

You’ve probably heard of “round-up” savings apps. You buy coffee for $4.75, and $0.25 goes to savings. It’s the same idea - but smarter. EWA platforms now use behavioral science to predict when you’re most likely to save. Qsalary’s “Savings Nudge Analytics,” launched in August 2023, looks at your pay schedule, your spending patterns, and even your weather-based spending habits (yes, people spend more on takeout when it rains). Then it sends a nudge at the perfect moment - not when you’re stressed, but when you’ve just gotten paid and feel a little more in control. A 2022 Credolab study found that users exposed to these nudges were 32% less likely to overdraft their bank accounts. Why? Because they didn’t have to make a big decision. The system made the smart choice for them - and let them keep it.

Why This Works Better Than Traditional Financial Advice

Most financial wellness programs are optional. You get an email. You click a link. You watch a 20-minute video about 401(k)s. Then you forget about it. HR Dive’s 2022 analysis found that only 21% of employees used standalone financial programs. But EWA with coaching? It’s in your pocket. It’s there when you’re broke. It’s there when you’re tempted. It’s not a lecture. It’s a conversation that happens when you need it most. Companies using EWA with coaching saw 3.2 times more engagement than those using traditional programs. One retail chain saw a 22% drop in employee turnover after adding coaching. Another healthcare provider cut payroll advance requests by 17% in six months. People weren’t just saving money - they were staying at their jobs longer.Who Benefits Most - and Who Doesn’t

The Financial Health Network’s 2023 report found EWA with coaching works best for people earning under $50,000 a year. Why? Because their biggest problem isn’t investing. It’s cash flow. They’re choosing between medicine and groceries. They’re paying $150 in overdraft fees every year. EWA coaching helps them avoid those traps. For people earning over $80,000, the impact is smaller. They already have retirement accounts, investment apps, and financial advisors. EWA coaching doesn’t add much value - unless they’re also struggling with debt or overspending. It’s not about income. It’s about financial stress. If you’re constantly worried about money between paychecks, this system works. If you’re not, you probably don’t need it.The Dark Side: When Coaching Is Just a Marketing Trick

Not all EWA platforms are created equal. Some slap on a few educational pop-ups and call it “financial wellness.” A 2022 Harvard Business Review article warned that this is dangerous. It makes people think they’re being helped - when they’re just being sold. The Consumer Financial Protection Bureau (CFPB) says EWA providers must offer “meaningful financial education” - not just a link to a blog. But there’s no standard for what “meaningful” means. That’s why some users on Trustpilot say the coaching feels like an afterthought. Here’s how to tell the difference:- Does the app personalize advice based on your actual spending? Yes → good. Generic tips → skip it.

- Is there a live coach you can talk to? DailyPay offers 24/7 chat. Others only email. Live help matters.

- Are you required to complete a 15-minute module before using EWA? Companies that do this see 87% adoption of coaching features.

What’s Next for EWA and Financial Coaching

The next wave is integration. By 2025, most EWA platforms will connect to your bank accounts, credit cards, and even utility bills. Imagine this: you log into your EWA app and see one screen showing all your money - earned, spent, saved, and owed. No more juggling apps. Emerald Finance just partnered with Money Coaching to offer live video sessions inside the app. DailyPay’s new “Financial Wellness Pathways” uses AI to build a custom learning plan - like a personal trainer for your money. The goal isn’t to make you rich. It’s to make you less stressed. To help you sleep better. To stop you from paying $100 a year in fees just to get your own paycheck.Real Results: Stories That Matter

Mentor Education, a nonprofit, had a 45% employee turnover rate. After adding EWA with financial coaching, it dropped to 28% in one year. Why? Employees didn’t quit because they were broke. They stayed because they felt supported. One warehouse worker in Ohio used to withdraw $50 every Tuesday and Thursday. After the app showed him his spending, he started saving $15 each time. In six months, he bought a used car - cash. No loan. No interest. Another user in Texas stopped using payday loans after her EWA app showed her she was spending $300 a month on late fees and overdrafts. She started saving $20 a week. In a year, she had $1,000 in emergency savings. This isn’t magic. It’s design. It’s data. It’s a system that meets people where they are - not where they should be.How to Get Started - If Your Employer Doesn’t Offer It

If your company doesn’t offer EWA with coaching, you can still take action:- Ask HR if they’ve looked into EWA platforms with financial coaching. Mention DailyPay, Qsalary, or Emerald Finance.

- Share the data: Companies see a $3.20 return for every $1 spent on EWA coaching.

- Point to turnover reduction. Replacing an employee costs 50-200% of their salary. Coaching is cheaper.

- Offer to pilot it with a small team. Start with 10 people. Measure the results.

Is Earned Wage Access the same as a payday loan?

No. Payday loans charge 300-400% APR and trap people in debt cycles. EWA lets you access money you’ve already earned, usually for a flat fee of $1.99-$4.99 per withdrawal. The CFPB requires EWA providers to clearly state it’s not credit. With coaching, it’s designed to help you avoid payday loans altogether.

Can I use EWA if I have bad credit?

Yes. EWA doesn’t check your credit score. It only looks at how much you’ve earned so far in the pay period. That’s why it’s so popular with people who’ve been turned down by banks or lenders. But remember - without financial coaching, you could still end up paying fees every week. Coaching helps you break that habit.

Does EWA affect my taxes or paycheck?

No. EWA doesn’t change your paycheck or tax withholding. You’re just getting a portion of your wages earlier. The full amount is still deducted from your next payday. The fee is separate and clearly disclosed. Your employer still pays you the same total amount - just in two parts instead of one.

Are savings nudges really effective?

Yes - if they’re well-designed. Studies show people save 3-5% more when nudges are built into their daily financial habits. The key is timing and personalization. A nudge that says “Save $5” when you’ve just earned $300 feels different than one that says “Save $50” when you’re already low. The best EWA platforms adjust based on your behavior.

What if I use EWA every day? Is that okay?

Using EWA daily isn’t a problem - if you’re also using the coaching tools. But if you’re using it daily without saving or budgeting, you’re likely paying $100+ in fees a year. That’s money you could have kept. The best platforms will flag frequent use and offer help - not judgment. If yours doesn’t, it’s not designed for your long-term health.

Comments

Graeme C

November 16, 2025This isn't financial coaching-it's behavioral manipulation dressed up as empowerment. You're not helping people build financial literacy; you're engineering their decisions with pre-checked boxes and guilt-laced pie charts. The CFPB should be auditing these platforms for coercive design patterns, not patting them on the back. I've seen this in fintech before-'nudges' become traps, and the user thinks they're in control while the algorithm pulls the strings. This isn't innovation. It's exploitation with a smiley face.

And don't get me started on the 'live coach' gimmick. If your 'coach' is a chatbot that replies with canned responses about 'cash flow alignment,' you're not helping-you're gaslighting.

RAHUL KUSHWAHA

November 17, 2025From India, I’ve seen how small nudges can change lives. My cousin used to spend half his salary on phone recharges and snacks just to feel something. Then his company added EWA with savings prompts-he started saving ₹50 daily. Now he’s got ₹15,000 saved. No lectures. Just a quiet ‘Would you like to save today?’

It’s not magic. It’s kindness with code. 🙏

Julia Czinna

November 17, 2025I appreciate the nuance here. Too many people treat EWA as either a villain or a savior, but the truth is in the implementation. The real differentiator isn’t the tech-it’s whether the system assumes the user is capable of change or just needs to be managed.

I’ve worked with low-income clients who’ve been burned by predatory lending. When an app says, ‘You’ve saved $42 this month. That’s enough for a new pair of shoes,’ it doesn’t just change behavior-it rebuilds identity. That’s powerful. Not because it’s clever, but because it’s human.

And yes, the dark side exists. I’ve seen platforms slap on a ‘financial wellness’ badge after adding one pop-up. But that’s not the fault of the model-it’s the failure of corporate ethics. The tools are there. We just need to demand better.

Also, the weather-based spending triggers? Genius. I didn’t know people spent more on takeout during rainstorms until my app told me. Now I bring an umbrella and a packed lunch. Small wins.

And to Graeme: yes, it’s manipulation-but not the kind that harms. It’s the kind that rescues. There’s a difference.

Dave McPherson

November 18, 2025Oh please. Let me guess-this is the same ‘behavioral economics’ nonsense that got us ‘free’ credit scores and ‘gamified’ budgeting apps that turned personal finance into a Candy Crush clone.

You think people need to be coddled into saving $10 because they’re too stupid to manage their own money? That’s not coaching-it’s infantilization wrapped in a UI theme that looks like a Pinterest board.

And the ‘live coach’? More like a bot that says ‘I’m here for you!’ while charging $2.99/month for the privilege. Meanwhile, real financial advisors charge $150/hour and don’t need to nudge you into saving because they’re actually qualified.

Also, ‘EWA helps people avoid payday loans’? Cool. So now we’re celebrating not drowning instead of teaching people to swim? Pathetic.

And don’t quote me Harvard or Credolab. I’ve read those papers. The sample sizes are tiny, the control groups are garbage, and the metrics are cherry-picked to make fintech look like a miracle cure. Wake up.

This isn’t financial health. It’s financial placebo with a subscription fee.

Laura W

November 19, 2025Okay but HAVE YOU SEEN THE EMERALD FINANCE INTERFACE?!?!

It’s like a financial therapist who also runs a TikTok account. You get your pay, it says ‘Hey, you earned $1,200 this week-want to lock in $20 for that trip to Mexico?’ and BOOM-your savings just grew without you even thinking about it. No guilt. No shame. Just a little spark.

My roommate was using payday loans. Now she’s got $800 saved and a new pair of Jordans. She didn’t even realize she’d done it. That’s the power of frictionless design.

And Graeme? You’re mad because you don’t get to be the hero? Chill. Not everyone needs a 401(k) advisor. Some people just need someone to say ‘You got this’ before they hit ‘withdraw.’

Also-weather nudges? YES. I spent $60 on pizza last Tuesday because it was raining. My app flagged it. I laughed. Then I saved $20 the next week. That’s not manipulation. That’s accountability with a personality.

Stop hating on the tools. The problem isn’t EWA. It’s the companies that turn it into a gimmick. The good ones? They’re quietly changing lives. And honestly? We need more of that.

Also-ask your HR. It’s cheaper than replacing you. 💸✨

Write a comment