Portfolio Rebalancing Calculator

Restore Your Target Allocation

Calculate how much to sell or buy to get back to your desired stock/bond mix.

Your Current Allocation

Target Allocation

Recommended Action

Most people think investing is about picking the right stocks or timing the market. But here’s the truth: if you’re not rebalancing your portfolio, you’re not really investing-you’re just riding a rollercoaster blindfolded.

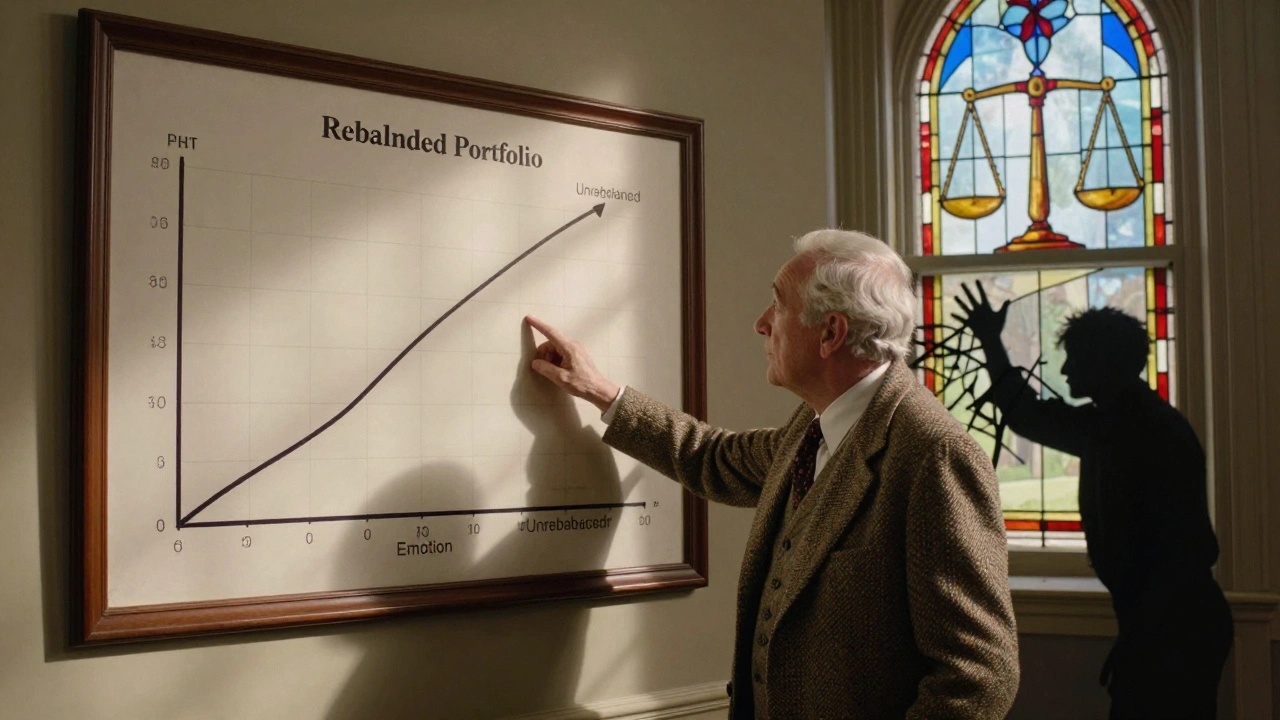

What Portfolio Rebalancing Actually Does

Portfolio rebalancing is the simple act of bringing your investments back to their original target mix. Let’s say you set up a portfolio with 60% stocks and 40% bonds because that matches your risk level. Over time, stocks surge and now make up 70% of your portfolio. Bonds drop, and now they’re only 30%. That’s not your plan anymore. That’s luck-or worse, a gamble. Rebalancing means selling some of those overgrown stocks and buying more bonds to get back to 60/40. It sounds boring. But it’s the only way to make sure your risk stays where you want it. Without it, your portfolio slowly turns into a high-risk bet you never signed up for.Why It’s Not Just About Risk

People assume rebalancing is only about avoiding big losses. It’s more than that. It’s about capturing discipline in a market that rewards emotion. Think about what happens when the market goes up. Your winning stocks balloon. You feel smart. You want to hold more. But that’s exactly when you should be selling. And when stocks crash? You panic. You want to sell everything. But rebalancing forces you to buy more when prices are low. Charles Schwab’s research shows that over 30 years, portfolios that were rebalanced annually had 12-15% less volatility than those left alone. Same returns. Less stress. That’s the real win.The Numbers Don’t Lie

Vanguard studied portfolios from 1990 to 2020. A 60/40 stock/bond portfolio that was never rebalanced returned 6.3% annually. The one rebalanced annually returned 6.5%. Sounds tiny, right? But look at the risk: the non-rebalanced portfolio had a standard deviation of 14.1%. The rebalanced one? 11.8%. That’s a huge difference in how much your account swings. During the 2008 crash, portfolios that hadn’t been rebalanced were carrying 25-30% more stocks than intended. When the market collapsed, those investors lost way more than they should have. Rebalanced portfolios? They lost less. And they recovered faster. Morningstar found that over 90 years, rebalancing added about 7-10 basis points per year in extra return. That’s not much-but it’s free money. No trading skill needed. Just consistency.

How Often Should You Rebalance?

There’s no magic number. But most experts agree: once a year is enough. Quarterly rebalancing sounds safe, but it adds cost without benefit. Vanguard’s data shows quarterly rebalancing only improves returns by 0.1% more than annual-and you pay more in fees and taxes. Annual rebalancing in December is ideal. You can use tax-loss harvesting if you’ve lost money elsewhere. Some prefer threshold-based rebalancing. If any asset moves more than 5 percentage points from target, you act. For a 60/40 portfolio, that means rebalancing when stocks hit 65% or drop below 55%. This approach cuts down on unnecessary trades by 40% while keeping 98% of the risk reduction.When Rebalancing Doesn’t Help (And When It Hurts)

Rebalancing isn’t a silver bullet. During strong bull markets-like 2019 to 2021-non-rebalanced portfolios outperformed by 2.3% annually. Why? Because you’re selling your winners to buy losers. In a raging uptrend, that feels like a mistake. But here’s the catch: those same markets are followed by crashes. The 2022 bear market wiped out 20% of stock portfolios. Rebalanced portfolios bounced back 18% faster because they still had bonds to cushion the fall. Rebalancing between stocks and bonds works best. Rebalancing between U.S. and international stocks? Not so much. They move together too much. You get almost no benefit. Stick to uncorrelated assets.What Happens If You Don’t Do It?

A 2022 Vanguard survey of 1.2 million retail investors found only 37% rebalanced annually. The top reason? Fear of selling something that’s doing well. That’s the trap. You think you’re being smart by holding winners. But you’re not. You’re letting your portfolio drift into something riskier than you planned. In 2000, investors who didn’t rebalance had 70% of their portfolio in tech stocks. When the dot-com bubble burst, their losses were 55% worse than those who stuck to their plan. Fidelity found that disciplined rebalancing reduced the chance of permanent capital loss by 18% over 10-year periods since 1970. That’s not theoretical. That’s real money saved.

How to Start Rebalancing

Step 1: Know your target. What’s your ideal mix? 60/40? 70/30? 50/50? Write it down. Step 2: Check your portfolio. Do it once a year. Use your brokerage’s asset allocation tool. Most platforms show this automatically. Step 3: Act only if you’re off by 5% or more. Don’t chase small moves. Let the market breathe. Step 4: Use tax-advantaged accounts first. Rebalance inside your IRA or 401(k). Avoid taxes and capital gains. Step 5: Automate if you can. Robo-advisors like Betterment and Wealthfront rebalance automatically when allocations drift beyond 5%. Over 78% of users report high confidence in this system.What Experts Say

John Bogle, founder of Vanguard, called rebalancing “the one free lunch in finance.” He wasn’t exaggerating. You’re not predicting the market. You’re just enforcing discipline. Liz Ann Sonders from Charles Schwab says the real value isn’t in the numbers-it’s in the behavior. Rebalancing stops you from becoming an accidental speculator. It keeps your emotions in check. And Dr. Yan Reynolds at Vanguard found that rebalancing improved risk-adjusted returns (Sharpe ratio) by 0.08-0.12 points annually from 1926 to 2019. That’s not a fluke. That’s math.The Bottom Line

You don’t need to be a genius to win in investing. You just need to be consistent. Rebalancing is the quiet, boring habit that separates people who grow wealth from those who watch it vanish. It’s not about timing. It’s about staying on track. It’s not about chasing returns. It’s about protecting them. If you’ve got a portfolio, you owe it to yourself to rebalance. Once a year. No more. No less. And if you’re unsure? Set up an automated rebalance in your retirement account. Let the system do the work. Your future self will thank you.Is portfolio rebalancing necessary for small investors?

Yes. Rebalancing isn’t just for millionaires. Whether you have $5,000 or $500,000, your risk level matters. If you’re invested in stocks and bonds, your allocation drifts over time. Rebalancing keeps your risk in line with your goals. Many robo-advisors offer free automatic rebalancing-even for small accounts.

Does rebalancing cost money?

There can be costs, but they’re usually small. Brokerage trades might cost $0-$10 per transaction. Tax implications in taxable accounts are the bigger concern. But the benefits far outweigh the costs. Morningstar found rebalancing added 8 basis points annually even after fees. And using tax-advantaged accounts like IRAs eliminates most of the tax burden.

Can I rebalance too often?

Absolutely. Rebalancing monthly or quarterly increases transaction fees and tax liability without meaningful benefit. Vanguard’s research shows that rebalancing more than once a year reduces net returns by about 0.15% annually. Stick to annual or threshold-based rebalancing. Less is more.

Should I rebalance during a market crash?

Yes-and it’s often the best time. During crashes, stocks drop, bonds often hold steady or rise. That means your portfolio may have drifted to, say, 45% stocks and 55% bonds. Rebalancing means buying more stocks while they’re cheap. That’s exactly how you turn fear into opportunity. Fidelity found rebalanced portfolios recovered 18% faster after the 2020 crash.

What’s the difference between rebalancing and market timing?

Market timing is trying to predict when to buy or sell based on forecasts. Rebalancing is mechanical. You don’t guess what the market will do. You just restore your original plan. It’s not about predicting. It’s about preserving. Rebalancing removes emotion. Timing adds it.

Do target-date funds rebalance automatically?

Yes. Target-date funds are designed to rebalance automatically as you get closer to retirement. They gradually shift from stocks to bonds. Vanguard, Fidelity, and T. Rowe Price all do this. If you’re using one, you’re already rebalancing-no action needed. Just make sure you’re in the right fund for your retirement year.

Can I rebalance with new contributions instead of selling?

Yes, and it’s a smart way to avoid taxes. If your bond allocation is low, direct new deposits into bonds instead of selling stocks. This is called contribution-based rebalancing. It’s ideal for taxable accounts. Over time, your allocation will naturally return to target without triggering capital gains.

Is rebalancing still useful in low-volatility markets?

Yes, but the benefits shrink. During low-volatility periods like 2012-2019, rebalancing added only 3 basis points annually. But volatility always returns. Rebalancing isn’t about maximizing returns in calm markets-it’s about protecting you when chaos hits. The math still works. The discipline still matters.

Comments

Erika French Jade Ross

December 15, 2025lol i just let my portfolio do its thing and somehow still not homeless? 🤷♀️ but like... i guess if i had a panic attack every time apple went up 10%, maybe rebalancing would help me not scream into my pillow at 3am. also, ty for not making me feel dumb for not knowing what a sharpe ratio is.

John Weninger

December 16, 2025really appreciate this breakdown - especially the part about using new contributions to rebalance instead of selling. i’ve been doing that with my Roth IRA and it’s been a game changer. no taxes, no stress, just quietly nudging things back into place. also, the 5% threshold tip? genius. i used to freak out over 1% swings. now i just sip my coffee and wait. peace of mind > perfect timing.

Omar Lopez

December 17, 2025It’s worth noting that the 6.5% vs. 6.3% return differential is statistically insignificant in the context of long-term equity market returns - the real value proposition of rebalancing lies in its reduction of tail risk and behavioral drift, not alpha generation. The 11.8% vs. 14.1% standard deviation differential, however, is both statistically and economically meaningful. Further, the claim that rebalancing adds ‘free money’ is misleading; it reallocates risk exposure, not creates value ex nihilo. One must also account for transaction costs, bid-ask spreads, and tax drag - particularly in non-qualified accounts. The literature, particularly from Dimson, Marsh, and Staunton, supports annual rebalancing only for highly uncorrelated asset classes. Rebalancing correlated equities (e.g., US vs. international) is essentially noise trading. This post conflates discipline with mechanical reversion - which is not always optimal in persistent trending regimes.

Write a comment