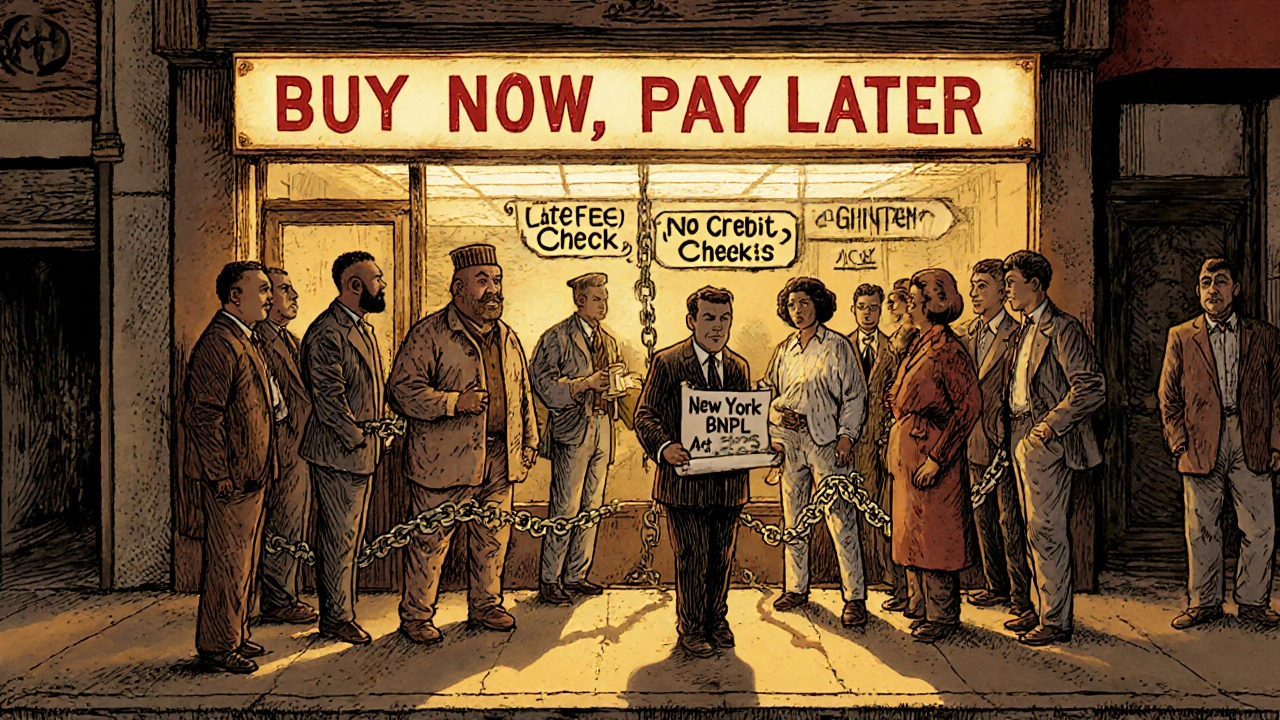

By 2025, BNPL isn't just a trendy payment option anymore-it's a financial tool used by 76% of Americans, according to a November 2025 consumer report. But behind the convenience of splitting your Amazon order into four payments lies a legal minefield. Until recently, BNPL services slipped through the cracks of consumer finance laws. No credit checks. No interest. No formal oversight. That’s all changed. Now, governments are stepping in-with real rules, real penalties, and real protections for you.

What Changed in 2025?

For years, BNPL companies operated under a loophole. Because they didn’t charge interest and structured payments as short-term, closed-end credit, they were exempt from the Truth in Lending Act (TILA) and most state lending laws. That meant no requirement to check if you could afford the payments, no clear warnings about late fees, and no obligation to report your payment history to credit bureaus-even if you missed payments.

That changed in 2025. Two major jurisdictions led the charge: the United Kingdom and New York State. The UK passed new legislation in July 2025, setting a clear path for regulation starting July 15, 2026. New York didn’t wait. On May 9, 2025, Governor Kathy Hochul signed Senate Bill 3008-C into law, making it the first U.S. state to create a dedicated BNPL regulatory framework.

These aren’t minor tweaks. They’re full-scale overhauls. BNPL providers now must prove you can afford the purchase before approving it. They must tell you exactly what happens if you miss a payment. And in New York, they need a state license to operate at all.

New York’s BNPL Act: The First U.S. Law

New York’s Buy-Now-Pay-Later Act (BNPL Act) is the most aggressive consumer protection law for BNPL in the U.S. It doesn’t just tweak old rules-it rebuilds them.

First, every BNPL provider serving New York residents must get a license from the Department of Financial Services (DFS). That means companies like Klarna, Affirm, and Afterpay can’t just show up and start offering installments. They have to apply, pay fees, and prove they’re following the law.

Second, the law defines a BNPL loan as any closed-end credit tied to a specific purchase of goods or services. That’s broader than you might think. It could cover everything from a $20 pair of sneakers to a $500 laptop, as long as it’s paid in installments. Only motor vehicles and certain credit sales are excluded.

Third, the law forces providers to do real affordability checks. They can’t just rely on a quick algorithm. They must assess your income, existing debts, and current BNPL obligations across all providers. And here’s the kicker: national banks like Chase or Wells Fargo are exempt. But state-chartered banks and fintechs? They’re fully covered. That’s creating a big competitive gap-something industry analysts say could distort the market.

Finally, the law requires clear disclosures. You must be told upfront: how many payments you’ll make, when they’re due, what fees you’ll pay if you’re late, and whether your payment history will be reported to credit bureaus. And if you dispute a charge, you have a right to a fair, independent review process.

Implementation is delayed until 180 days after DFS issues final rules. But those rules are expected by December 2025. So if you’re using BNPL in New York, you’ll start seeing changes in mid-2026.

The UK’s Approach: Proportionate and Phased

The UK didn’t go for a heavy-handed ban or license requirement. Instead, the Financial Conduct Authority (FCA) took a smarter route: proportionate regulation.

Under the UK’s new rules, which take full effect July 15, 2026, BNPL providers must:

- Perform affordability checks that match the size of the purchase. A $10 coffee doesn’t need the same scrutiny as a $500 TV.

- Stop users from stacking multiple BNPL loans across different providers-something that led many consumers into debt traps.

- Report data to the FCA so regulators can spot risky behavior early.

- Provide standardized, easy-to-read information before you agree to any payment plan.

- Offer access to an independent dispute resolution service, similar to what credit card users get.

The FCA’s goal isn’t to kill BNPL. It’s to make it safer. Their consultation paper, CP25/23, says they want to support innovation while protecting people from financial harm. That’s why they’re giving companies 12 months to adapt after the law kicks in.

Unlike New York, the UK isn’t requiring licenses. Instead, it’s applying existing consumer credit rules in a way that fits BNPL’s unique structure. It’s less about control and more about balance.

What About the Rest of the U.S.?

New York isn’t alone. California, Illinois, and Texas all introduced BNPL-specific bills in Q3 2025. Each is different. California’s draft law focuses on credit reporting transparency. Texas wants to cap late fees. Illinois is pushing for mandatory debt tracking across providers.

This patchwork is exactly what experts warned about. The Consumer Financial Protection Bureau (CFPB) tried to step in back in 2024 by arguing some BNPL products should count as open-end credit under TILA. But in May 2025, they withdrew that guidance-leaving a vacuum. Now, states are filling it. That means if you live in New York, you get strong protections. If you live in Ohio? You might still be using BNPL with no rules at all.

Industry analysts predict this will lead to consolidation. Smaller BNPL players can’t afford the $1.2-1.8 million in tech and compliance costs needed to meet New York’s rules. By 2027, the top five providers could control 68% of the market-up from 52% in 2024.

What This Means for You

If you use BNPL, here’s what you need to know right now:

- You’re not protected like you are with a credit card. If someone steals your BNPL login and runs up $500 in purchases, you could be on the hook. Unlike credit cards, where liability is capped at $50, BNPL has no federal limit.

- Missed payments might not hurt your credit-yet. Only 35% of BNPL providers report to credit bureaus. But that’s changing. New York’s law requires reporting if you’re late. The UK’s rules will too. Your payment history may soon affect your credit score.

- You might be paying more than you think. A 2025 Denver7 survey found 62% of users didn’t understand late fee rules when they first signed up. Some providers charge $10-$25 per missed payment. Others charge interest after 30 days. Always read the fine print.

- You’re not alone in juggling multiple accounts. A National Association of Consumer Advocates report found 78% of BNPL providers can’t see your other BNPL loans. That means you could be paying 10 different providers, each thinking you’re fine-while you’re drowning in debt.

Use BNPL wisely. Track every payment in a spreadsheet or app. Don’t use it for things you can’t afford today. And if you’re in New York or planning to move there, expect to see more transparency-before you click “Buy Now.”

What’s Next?

The European Union is rolling out its own BNPL rules in Q2 2026, modeled after the UK’s approach but with stricter cross-border rules. Globally, 92% of BNPL transactions will occur under specific regulations by 2027-up from just 18% in 2024.

That means BNPL isn’t going away. But it’s changing. The days of “no credit check, no problem” are over. The future of BNPL will be transparent, accountable, and regulated. And if you’re using it, you should know exactly what you’re signing up for.

Don’t wait for a surprise fee or a credit score drop. Understand the rules. Ask questions. And if your provider won’t answer them clearly, find one that will.

Are BNPL services now regulated in the U.S.?

Yes-but only in some states. New York passed the first comprehensive BNPL law in May 2025, requiring providers to get a license and follow strict consumer protection rules. Other states like California, Illinois, and Texas are drafting similar laws. Most of the U.S. still has no BNPL-specific rules, but that’s changing fast.

Do BNPL payments affect my credit score?

Most don’t-yet. Only about 35% of BNPL providers report payment history to credit bureaus. But under New York’s new law and the UK’s upcoming rules, providers will be required to report late or missed payments. On-time payments may also be reported in the future. This means your BNPL behavior could soon impact your credit score, just like credit cards.

Can I dispute a BNPL charge like I can with a credit card?

It depends. Before 2025, most BNPL providers had no formal dispute process. Now, both New York and the UK require providers to offer independent dispute resolution. That means you can challenge a charge, get a refund if it was wrong, and escalate to an external ombudsman if needed. If your provider doesn’t offer this, they’re not compliant with the new laws.

What happens if I miss a BNPL payment?

You’ll likely face a late fee-usually $10 to $25-and your provider may send you reminders. If you keep missing payments, they may stop you from using their service again. Under new laws, they may also report the missed payment to credit bureaus. And if you’re using multiple BNPL services, you could be stuck in a cycle where you take out another loan just to cover the last one.

Is BNPL safer now than it was in 2024?

Yes, in regulated areas. The new rules force providers to check if you can afford a purchase, stop you from stacking too many loans, and tell you exactly what fees you’ll pay. Before, many users didn’t realize they were borrowing money. Now, they’re getting clear disclosures. But in states without laws, BNPL is still risky. Always read the terms and track your spending.

What Should You Do Next?

If you use BNPL regularly:

- Check your state’s laws. Are you in New York, California, or another state with new rules?

- Use a free app or spreadsheet to track all your BNPL payments. Don’t rely on your phone’s reminders.

- Ask each provider: “Do you report to credit bureaus?” and “What happens if I miss a payment?”

- Never use BNPL to cover other debts. It’s not a solution-it’s a trap.

- If you’re in New York, expect to see clearer terms by mid-2026. If you’re elsewhere, keep watching for new laws.

The goal isn’t to stop using BNPL. It’s to use it wisely. The rules are catching up. Now it’s your turn to catch up too.

Comments

Laura W

November 7, 2025Okay but let’s be real - if I can buy a $300 pair of Jordans in 4 payments and not get hit with interest, why should I care if some bureaucrat in Albany wants me to fill out a 12-page affordability form? I’m not taking out a mortgage, I’m buying sneakers. The fact that they’re forcing providers to report to credit bureaus is wild though - that’s gonna change how people use this stuff. I’ve got 6 BNPL apps open right now and none of them talk to each other. If they start syncing debt across platforms, I’m gonna need a spreadsheet with a flowchart and a therapist.

Also, why are national banks exempt? That’s like letting Ferrari drive through a speed bump while the rest of us have to stop at red lights. Total hypocrisy.

Graeme C

November 8, 2025Oh, for heaven’s sake. The UK’s approach is the only one that makes sense. New York’s licensing regime is a regulatory overreach dressed up as consumer protection - it’s not a bank, it’s a buy-now-pay-later service. The FCA didn’t invent a new regulatory category; they applied existing consumer credit principles proportionally. A £10 coffee doesn’t need the same scrutiny as a £500 TV. That’s common sense, not bureaucracy.

And the fact that the US is letting states go rogue? Pathetic. We’re creating a patchwork of compliance nightmares. One state requires credit reporting, another caps late fees, another ignores it entirely. This isn’t innovation - it’s regulatory chaos. And don’t get me started on the $1.8 million compliance cost for fintechs. That’s not protecting consumers - that’s entrenching oligopoly. Klarna and Affirm will dominate because smaller players can’t afford to play. The market will shrink, not improve. And we call this progress?

Astha Mishra

November 9, 2025It is interesting to observe how financial systems evolve when they are not governed by the wisdom of foresight but by the urgency of crisis. BNPL, in its early days, was a gift - a gentle bridge between impulse and income, allowing young people, gig workers, and those without credit histories to participate in the economy without the shadow of traditional lending. But now, as regulation rushes in like a tide after a dam breaks, we risk drowning the very flexibility that made it useful.

I wonder - is it possible to protect people without punishing their autonomy? Must every transaction be scrutinized, logged, reported, licensed, and monitored? Or can we trust individuals to make choices, even flawed ones, if they are given clear information? The UK’s proportionality is a breath of fresh air - it does not assume that all users are reckless, nor does it treat every small purchase as a potential default. But New York’s law, while well-intentioned, feels like applying a nuclear solution to a paper cut.

And yet… I also understand the desperation. Seven out of ten users are juggling multiple BNPL accounts, unaware of the cumulative burden. The system was designed for convenience, not accountability. So perhaps regulation is not the enemy - but the absence of education is. If we taught financial literacy in schools alongside algebra, maybe we wouldn’t need laws to stop people from borrowing themselves into oblivion.

Still, I worry. When the state begins to define what you can afford, who decides what ‘afford’ means? Is it your income? Your rent? Your emotional need for new shoes? We must be careful not to replace one kind of control with another. The goal should not be to prevent mistakes, but to help people recover from them - with dignity, not debt traps.

Kenny McMiller

November 11, 2025Bro, the real issue isn’t the laws - it’s that BNPL companies made it *too* easy. No credit check? No interest? Sounds like free money until you realize you’ve got 12 pending payments across 5 apps and your bank account’s at $3.27. The UK’s model is smart - tiered checks based on purchase size. No need to over-regulate a $15 hoodie. But New York’s license thing? That’s just corporate consolidation in a suit. Fintech startups can’t afford $1.5M in compliance - so yeah, Klarna and Affirm win by default. That’s not consumer protection, that’s monopoly-by-regulation.

And the credit reporting thing? Game-changer. I’ve been using BNPL for 2 years and never thought about my credit score. Now I’m terrified I’ll get hit with a late fee and suddenly my FICO drops because some algorithm decided my AirPods weren’t ‘affordable.’

Bottom line: BNPL’s not going away. But if you’re using it, track every payment. Use a damn spreadsheet. And if your provider won’t tell you what fees you’re paying? Walk away. This ain’t magic money. It’s debt with glitter.

Write a comment