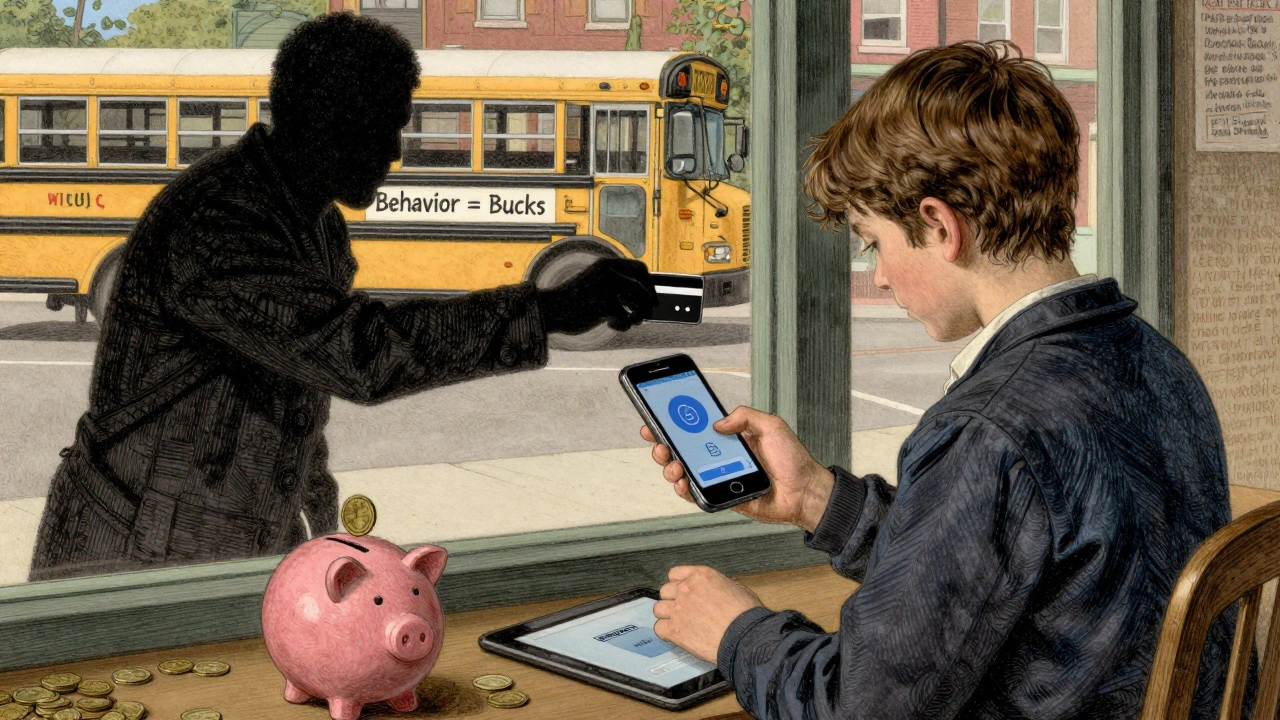

Most teens don’t understand how money works until they actually have to manage it. That’s why teen debit cards have become one of the most practical tools parents use to teach real-world financial skills. These aren’t just prepaid cards with spending limits-they’re interactive learning platforms that tie money to effort, responsibility, and consequences.

How Teen Debit Cards Actually Work

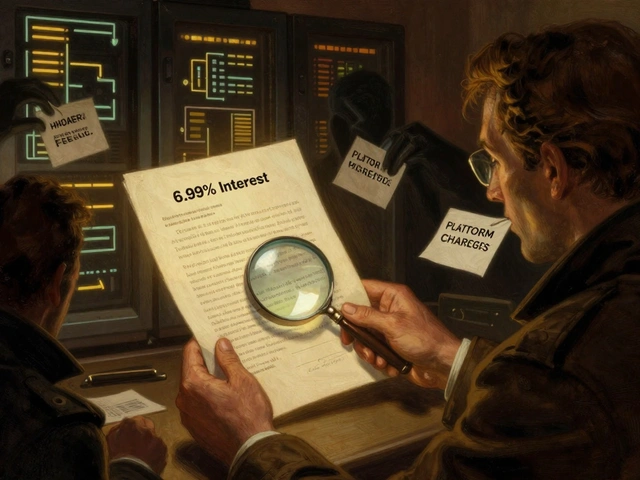

Teen debit cards operate in two main ways: prepaid accounts through fintech apps like Greenlight, or joint checking accounts through traditional banks like Capital One or Bank of America. Both give teens a physical or digital card they can use at stores, online, or at ATMs. But the real difference is in the control and education features. Fintech apps focus on hands-on learning. Parents load money onto the account, set spending limits, block certain stores (like vape shops or gaming sites), and approve or deny transactions in real time. Some even let teens see their balance and transaction history through a kid-friendly app. Traditional banks offer similar controls but often with less flexibility-like no way to assign specific chores to payments or set weekly allowances tied to tasks. The most common age to start is between 10 and 13. Midstates Bank allows kids as young as 8, while Bank of America’s SafeBalance requires teens to be at least 13. Most services don’t require a minimum deposit. Capital One’s MONEY Teen Checking account, for example, has no opening balance needed. Others, like My Homebank’s Teen Wallet, ask for $50 to start.Parental Controls: More Than Just Spending Limits

Parental controls are the backbone of these cards. But they’re not just about saying “no” to spending. They’re about guiding decisions. Every major provider lets you set daily spending caps. Midstates Bank limits ATM withdrawals to $310 and point-of-sale purchases to $510. My Homebank caps daily spending at $50. Greenlight lets you create category-specific limits-say, $20 per week for entertainment, $10 for snacks. You can also block entire merchant categories. Over 64% of Greenlight users use this feature weekly to keep teens from spending on things like in-app purchases or subscription services. You can lock the card instantly if something goes wrong. If your teen overspends or you notice suspicious activity, one tap in the app freezes the card. No calls to customer service. No waiting. Some apps even let you set a 24-hour “cool-off” period after an overspending incident, forcing a pause and a conversation. Fraud protection is built in. All services offer zero liability for unauthorized transactions under FDIC Regulation E. And nearly all support Apple Pay and Google Pay, so teens can pay with their phone instead of carrying a physical card.Chore Payments: Turning Chores Into Cash

The most powerful feature? Linking chores to payments. This isn’t just about getting allowance-it’s about teaching that money is earned, not given. Greenlight leads here. Parents create custom chore lists: “Take out trash,” “Clean bathroom,” “Walk the dog.” Each chore has a dollar value. You can set payment schedules: immediate (after approval), weekly, or only when you verify completion. Teens get a notification when a chore is done and approved. The money hits their account automatically. Parents report big changes. On Reddit, one user wrote that using Greenlight’s chore system cut allowance arguments by 90%. Their 14-year-old started doing chores without being asked-just to earn money for a new video game. That’s the goal: turning responsibility into motivation. But it’s not perfect. About 57% of Greenlight parents say they spend 8 to 12 minutes a day verifying chores. That’s a lot of time. Bank of America’s newer ChorePay feature tries to fix this by letting teens upload photos of completed tasks for approval. Still, manual verification is the norm. Some services don’t even offer chore integration. Bank of America’s SafeBalance lets you set allowances, but you have to manually transfer money. No automation. No tracking. No connection between effort and reward. That’s why many parents stick with fintech apps-even if they cost more.

Which Provider Is Best for Your Family?

Not all teen debit cards are created equal. Here’s how the top players compare:| Provider | Monthly Fee | Min Age | Chore Payments | Zelle Access | Spending Limits |

|---|---|---|---|---|---|

| Greenlight | $3.99-$4.99 | 8+ | Yes, AI verification | No | Custom categories |

| Capital One MONEY | $0 | 13+ | No | Yes | Basic daily limits |

| Bank of America SafeBalance | $0 | 13+ | Yes (new ChorePay) | No | Fixed daily limits |

| Midstates Bank | $0 | 8+ | No | No | $310 ATM, $510 POS |

| My Homebank Teen Wallet | $2.99 | 10+ | Yes | No | $50 daily cap |

Greenlight is the clear winner for chore-based learning. It’s the only one with AI-powered photo verification for chores, reducing parental workload by over 60% in beta tests. But it costs $4.99 a month. If you want no monthly fee and Zelle access (so your teen can send money to friends or siblings), Capital One is the pick. Bank of America’s new ChorePay is promising but still clunky. Midstates Bank is great for younger kids who need strict controls.

What Parents Wish They Knew Earlier

Most parents start with good intentions but hit snags. Here’s what actually works based on real user experiences:- Start with low limits-$10 to $20 a day. Too high, and teens waste money. Too low, and they feel restricted.

- Use the “lock card” feature after overspending. It forces a pause and a teachable moment.

- Review transactions together every Sunday. Not to punish, but to ask: “What did you buy? Was it worth it?”

- Don’t use the card for everything. Let them carry cash sometimes. It helps them understand physical money.

- Set rules for peer-to-peer payments. Many teens use Venmo or Cash App to send money to friends. Make sure they know not to pay for things like drugs, alcohol, or gambling.

One parent on Trustpilot said her 15-year-old used his card to buy a $70 pair of sneakers he didn’t need. Instead of taking the card away, they sat down and made a savings plan: he’d save $10 a week for four weeks to replace the money. He learned more from that than any lecture ever could.

What These Cards Can’t Do

It’s important to know the limits. Teen debit cards don’t build credit. They’re debit-only. That means no credit score impact, good or bad. That’s actually a good thing-teens can’t go into debt. But it also means they won’t start building a credit history until they’re older. Also, most services don’t support co-parenting. If you and your ex share custody, only one parent can control the account. That’s a problem for 68% of families, according to NerdWallet’s 2025 review. And while apps are fast and easy to use, they’re not foolproof. Consumer Reports found that 83% of fraud cases involving teen cards happen under the daily spending limit. Setting a $5 cap doesn’t stop someone from making 10 small purchases. The real protection? Talking to your teen about what’s okay to buy-and what’s not.What’s Next for Teen Debit Cards?

The market is growing fast. In 2025, over 14.7 million U.S. teens are using these cards. Revenue hit $1.2 billion in the first quarter alone. New features are coming. Greenlight is testing biometric authentication-fingerprint or Face ID-to approve purchases. That means even if a teen loses their phone, someone else can’t just swipe and spend. Some schools are starting to link classroom behavior to digital allowances. In a pilot program with 200 Texas schools, students earn points for attendance, homework, or helping others-and those points turn into money on their card. Early results show improved behavior and higher engagement. And parents? 87% plan to keep using these cards even after their teen turns 18. Not because they need them-but because the habits stick.Can a 10-year-old have a debit card?

Yes. Many services like Greenlight and Midstates Bank allow kids as young as 8 to have a debit card with parental controls. The card is linked to a parent’s account, and spending is limited and monitored. This is a great way to start teaching money skills early.

Do teen debit cards help build credit?

No. Teen debit cards are not credit cards. They draw from money already loaded by parents, so they don’t report to credit bureaus. That means they won’t help build a credit score. But they do teach financial responsibility, which sets teens up to handle credit cards responsibly later.

How much should I give my teen as an allowance?

There’s no universal amount. A common rule is $1 per year of age per week-so a 14-year-old gets $14 a week. But tying it to chores is better. For example, $5 for taking out the trash, $10 for cleaning the bathroom. This teaches that money comes from effort, not just age.

Are teen debit cards safe from fraud?

Yes. All major providers offer zero liability for unauthorized transactions under federal law. If your teen’s card is used without permission, you won’t be charged. Still, monitor transactions weekly and use app features like card locking and spending alerts to stay ahead of problems.

What’s the best way to teach teens about saving?

Use the card’s savings feature. Greenlight and My Homebank let teens split their allowance into spending and saving buckets. Encourage them to save 20-30% for something they want-like a phone, concert ticket, or car fund. Watching their savings grow in the app makes it real.

Comments

Royce Demolition

December 13, 2025OMG this is LIFE CHANGING 😍 I gave my 11-year-old Greenlight last month and now she’s saving for a drone WITHOUT me nagging her. She did 3 chores a week, watched her balance grow, and BOOM - bought it herself. No more ‘I need money’ texts. Just pure financial dopamine 🚀💸

Robert Shurte

December 15, 2025It’s fascinating how these tools externalize abstract economic principles into tangible, daily rituals - the chore-to-cash pipeline essentially operationalizes the labor theory of value for pre-teens. Yet, one must wonder: in automating responsibility, do we inadvertently sterilize the moral ambiguity inherent in earning? Is it still virtue if the reward is algorithmically guaranteed? The card doesn’t teach patience - it teaches transactional efficiency. And efficiency, as history shows, is not wisdom.

Perhaps the real lesson isn’t in the spending - but in the silence between the notification and the purchase. That pause - where impulse meets intention - that’s where character forms. Not in the app’s AI verification, but in the quiet, unmonitored choices made after the phone is put down.

Still… I’ll admit: I cried when my 12-year-old used his savings to buy his little sister a book. No one asked him to. He just did. Maybe the system works - not because it’s perfect - but because it creates space for grace to slip through the cracks.

Mark Vale

December 16, 2025you know what they dont tell u tho… these ‘teen debit cards’ are just the tip of the iceberg. the real agenda? tracking spending habits from age 8 so they can sell ur kid’s data to advertisers. greenlight? owned by a data broker. chore pay? they log every ‘walk the dog’ as behavioral data. next thing u know, ur 16yo gets targeted ads for vapes because they bought 3 candy bars in a week. its not parenting… its surveillance capitalism with a smiley face 😊

and dont get me started on the schools linking attendance to cash. that’s not education. thats conditioning. they’re turning children into programmable economic units. i’ve seen the patents. its all there. they want us to think its ‘financial literacy’… but its just the first step to a universal credit score… starting at 8.

Sabrina de Freitas Rosa

December 16, 2025Wow. So you’re telling me a 10-year-old needs a $50/month app to learn not to spend all their money on Skittles? My mom gave me $5 a week and said ‘don’t be a dumbass’ - I learned faster than any AI verification ever could. Now kids think money grows on trees… because their phone tells them when it does. You’re raising a generation of entitled digital serfs. And you call this ‘teaching responsibility’? Please. Just take away the phone. Let them feel the sting of regret. That’s how you raise adults.

Write a comment