Compliance Deadline Calculator

Calculate Your Compliance Timeline

Enter your state and business type to see key AI regulation deadlines and calculate remaining time.

Key Deadlines for Colorado

ColoradoColorado expanded AI governance rules in August 2025 to cover all major insurance types. You have 10.5 months to prove your algorithms don't discriminate before July 1, 2026.

Required Action

- Document data sources and model training process

- Implement quarterly bias audits using tools like Aequitas

- Prepare algorithmic bias reports for regulator review

Compliance Timeline

| Phase | Deadline | Required Actions |

|---|---|---|

| Rule Implementation | August 2025 | Understand new Colorado AI governance rules |

| Effective Date | October 2025 | Begin preparing compliance systems |

| Compliance Deadline | July 1, 2026 | Submit proof of compliance to regulator |

Why InsurTech Regulation Isn’t Just Another Box to Check

If you’re building or investing in an InsurTech company, you’re not just writing code or designing a user interface-you’re navigating a minefield of state-by-state rules, federal expectations, and global standards that are changing faster than your product roadmap. In 2025, InsurTech regulation isn’t a back-office concern. It’s the difference between scaling fast and getting shut down before your Series A closes.

Take Colorado, for example. In August 2025, the state expanded its AI governance rules to cover not just life insurance, but also private auto and health plans. That’s 83% of the U.S. insurance market. If your algorithm adjusts premiums based on driving behavior or health data, you now have to prove it doesn’t discriminate. And you have to show that proof by July 1, 2026. No extensions. No grace period. Just compliance-or risk fines, license suspension, or worse.

How U.S. State Regulation Is Reshaping InsurTech

The U.S. doesn’t have one federal insurance regulator. It has 50. And each one moves at its own pace. As of mid-2025, 25 states (49%) have adopted the National Association of Insurance Commissioners (NAIC) guidance on AI use in insurance. That sounds like progress. But it’s not uniform.

Some states, like Colorado, are ahead of the curve. Others are still debating whether to even define what an algorithm is. This patchwork forces InsurTech firms to build compliance into their product from day one-not as an afterthought. A startup in California might be fine under its own state’s rules, but if it wants to sell policies in Texas or Florida, it needs to retrain its models, rewrite its disclosures, and re-certify its data pipelines.

The NAIC’s ‘Securing Tomorrow’ agenda, launched in 2024, made it clear: they’re not handing over control to Washington. Insurance regulation stays state-based. That means you can’t rely on a single federal standard. You need to track 50 different rulebooks. And they’re all updating. The NAIC’s amended Model Simplifying Framework (MSA), now managed by the Health Actuarial (B) Task Force, requires insurers to recalculate cost-sharing factors by Q1 2026 to protect policyholders who’ve faced repeated rate hikes. That’s 12.7% of older policyholders. Your system must identify them automatically-and adjust pricing fairly.

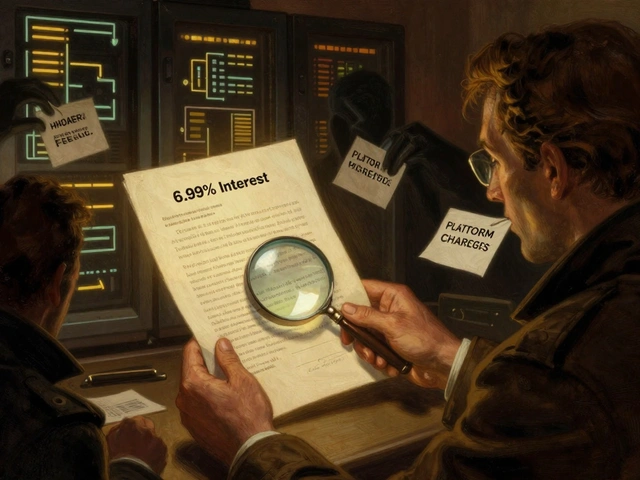

What Europe’s AI Act and DORA Mean for Global InsurTech

If your company plans to operate outside the U.S., Europe’s rules hit harder and faster. The EU’s AI Act, which came into full force in 2025, classifies insurance algorithms as “high-risk.” That means you can’t just train a model on historical claims data and call it good. You need to document every step: where the data came from, how it was cleaned, what biases were tested, and how often the model is audited.

Then there’s DORA-the Digital Operational Resilience Act. It forces insurers to prove they can withstand cyberattacks, system failures, and third-party outages. If your InsurTech platform relies on a cloud provider or a third-party API for underwriting, you need contracts that guarantee uptime, data sovereignty, and audit rights. Most startups don’t realize this applies to them too. If you’re handling customer data or making coverage decisions, you’re in scope.

And it’s not just about tech. CRR3, the new Capital Requirements Regulation, affects bank-owned insurers and their InsurTech partners. It changes how much capital they must hold against digital risks. That means your funding round could stall if your compliance posture doesn’t match their risk appetite.

The Real Cost of Non-Compliance (It’s Not What You Think)

Most people think fines are the biggest risk. They’re not. The real cost is lost opportunity.

Deloitte found that companies engaging proactively with regulators see 27% fewer enforcement actions. Why? Because regulators aren’t just enforcers-they’re partners in innovation. When you share your tech specs, testing results, and risk controls early, you build trust. You get feedback. You avoid costly redesigns later.

On the flip side, companies that wait until they’re audited face delays, public scrutiny, and investor pullback. In 2024, M&A deals involving InsurTech firms with weak AI governance saw 32% more friction. Buyers walked away because they couldn’t verify compliance. That’s not a bug. It’s a feature of today’s market.

And it’s getting worse. EY reports that 78% of insurers faced more regulatory data requests in 2024 than in 2023. State departments are now asking for algorithmic bias reports, data lineage maps, and real-time monitoring logs. If you don’t have those, you’re not just non-compliant-you’re invisible to regulators.

What You Need to Build Right Now

Here’s what successful InsurTech firms are doing in 2025:

- Map your AI use cases-Not just “we use AI for pricing.” List every model. What does it do? What data does it use? Who does it impact? A life insurance model that predicts longevity is different from a claims fraud detector.

- Implement quarterly bias audits-Use tools like Aequitas or IBM’s AI Fairness 360. Test for disparities by age, zip code, gender, or health history. Document everything. Regulators will ask.

- Build data lineage tracking-You must show where every input came from, how it was transformed, and who approved it. No spreadsheets. Use a dedicated system like Collibra or Alation.

- Allocate 15-18% of your tech budget to compliance-That’s not a cost center. It’s your license to operate. Leading firms treat it like cybersecurity: non-negotiable.

- Engage regulators early-Don’t wait for a letter. Reach out to your state’s insurance department. Attend NAIC meetings. Ask: “What are you looking for?”

Colorado’s timeline gives you a blueprint: August 2025-rule issued. October 2025-effective date. July 2026-compliance proof due. That’s 10.5 months. If you’re launching in 2026, you don’t have that luxury. Start now.

Global Fragmentation Is the New Normal

There’s no global standard for InsurTech regulation. The International Association of Insurance Supervisors (IAIS) is trying to create one. Their Roadmap 2025-2026 includes a final Application Paper on AI governance, due in Q2 2025. But only 38% of member countries have fully adopted the Insurance Capital Standard. That means even if the IAIS says “do this,” your local regulator might say “do that.”

That’s why 67% of global insurers say compliance costs are rising. And 63% expect even more divergence through 2027. If you’re a U.S.-based startup planning to expand into Germany or Singapore, you’re not just scaling your app-you’re building five different compliance engines.

Some companies solve this by localizing their tech stack: one model for the U.S., another for Europe, another for Asia. It’s expensive. But cheaper than getting banned from a market.

Climate, ESG, and the Next Wave of Regulation

It’s not just AI. Climate risk is now a regulatory priority. As of Q2 2025, 41 U.S. state insurance departments require insurers to assess climate-related losses in their underwriting models. That means if you’re offering home insurance in Florida or California, your algorithm must factor in wildfire risk, sea-level rise, and storm frequency.

And ESG isn’t optional anymore. Regulators are asking: “Do your algorithms reflect fair labor practices in your supply chain? Do your investment portfolios align with climate goals?” If you’re pitching to investors, they’re asking the same thing. Your compliance stack must now cover data privacy, algorithmic fairness, climate modeling, and ESG reporting-all in one system.

Final Thought: Compliance Is Your Competitive Edge

Most InsurTech founders think regulation slows them down. The best ones know it’s their fastest path to scale.

Companies that bake compliance into their product design win trust. They get faster approvals. They attract better partners. They close deals faster. In a market where 83% of insurance premiums are now touched by AI, being the one that can prove it’s fair, transparent, and secure isn’t just safe-it’s profitable.

Don’t wait for a subpoena. Don’t wait for a competitor to get fined. Start today. Document everything. Test constantly. Talk to regulators. Build a system that doesn’t just meet rules-it anticipates them.

Do I need a license to operate an InsurTech company?

Yes-if your company is making underwriting decisions, setting prices, or handling customer data as part of insurance sales or claims, you likely need a license from the state insurance department where you operate. Some InsurTechs partner with licensed carriers to avoid this, but even then, regulators may require you to register as a third-party vendor. Check your state’s rules on “producer licensing” and “technology service provider” requirements.

What happens if my AI model is found to be biased?

If regulators find your algorithm discriminates based on race, gender, zip code, or health status, you could face fines, forced model shutdowns, or license revocation. Colorado and New York have already issued penalties for biased pricing models. Beyond legal consequences, reputational damage can cost you customers and investors. The fix isn’t just retraining your model-it’s implementing ongoing bias monitoring and transparent reporting.

How often do regulators audit InsurTech systems?

Market conduct exams focused on AI usage are expected to begin imminently in 2025. Seventeen states are already developing specific AI audit protocols. While routine audits may happen every 2-3 years, targeted investigations can occur anytime-especially after a complaint, data breach, or public incident. Proactive companies with documented governance processes report fewer audits and smoother reviews.

Can I use open-source AI tools in my InsurTech product?

Yes-but you’re still responsible for what they do. Regulators don’t care if you used TensorFlow or PyTorch. They care if the output is fair, explainable, and traceable. Open-source models often lack documentation on training data or bias testing. You must add your own governance layer: document inputs, test for fairness, and track outputs. Otherwise, you’re not using an open-source tool-you’re using a liability.

What’s the biggest mistake InsurTech startups make on compliance?

Waiting until they’re funded or ready to launch. Many startups build their product first, then try to “add compliance” later. That almost always fails. Regulators expect governance from day one. The best founders hire a compliance lead before their first engineer. They build audit trails, data lineage, and bias checks into their architecture-not as a feature, but as the foundation.

Next Steps for InsurTech Founders

Start here:

- Download the NAIC’s 2025 AI Guidance Document and compare it to your state’s rules.

- Map every AI model in your system and list its inputs, outputs, and decision impact.

- Set up a quarterly bias testing schedule using free tools like Aequitas.

- Reach out to your state’s insurance department and ask: “What are your top three compliance concerns for AI-driven insurers?”

- Allocate budget for compliance tech-not just people. Tools for data lineage and audit trails are non-negotiable.

InsurTech isn’t just about innovation anymore. It’s about responsibility. The companies that thrive won’t be the ones with the flashiest app. They’ll be the ones that regulators trust.

Comments

Dave McPherson

November 14, 2025Let’s be real - most InsurTech founders think they’re building the next Uber, but they’re just a poorly documented API away from getting smacked by a state regulator with a 300-page compliance binder. Colorado’s AI rules? That’s not regulation - that’s a wake-up call wrapped in legalese. And don’t even get me started on ‘open-source tools.’ You think PyTorch gives you a free pass? Nah. You’re just outsourcing your liability to GitHub. The real winners? The ones who treat compliance like their product roadmap - not an afterthought, but the damn foundation. I’ve seen startups die because they hired engineers before a compliance officer. Don’t be that guy.

RAHUL KUSHWAHA

November 16, 2025Thank you for this. 😊

As someone from India trying to build an InsurTech solution for global markets, this is gold. We’re already juggling 5 different regulatory frameworks here - now adding US states and EU rules feels like learning 10 languages at once. But you’re right: if we don’t build data lineage and bias checks from day one, we’re just building sandcastles before the tide. Will start mapping our models this week. Small steps. 🙏

Laura W

November 16, 2025OMG YES. I’ve been screaming this from the rooftops since last year. Compliance isn’t the enemy - it’s your moat. 💥

When you bake audit trails into your stack like you’re coding for NASA, you don’t just avoid fines - you become the vendor that enterprise insurers actually want to partner with. I watched one startup in Austin get acquired for 3x because their compliance docs were cleaner than a Fortune 500’s quarterly report. Meanwhile, their competitor? Still using Excel to track model versions. LOL. Stop treating regulation like a tax. Treat it like your secret weapon. The market’s shifting - and the players who move first? They’re the ones writing the rules now. #InsurTechGang

Graeme C

November 17, 2025You’re all missing the elephant in the room: DORA isn’t optional. It’s existential. If your third-party cloud provider doesn’t guarantee data sovereignty and audit rights - you’re not ‘using the cloud,’ you’re gambling with your license. And let’s be brutally honest: most InsurTechs are running on AWS or Azure with a handshake agreement and zero contractual teeth. That’s not innovation - it’s negligence dressed in startup lingo. The NAIC guidance? Helpful. But without enforceable vendor contracts under DORA, you’re building on quicksand. I’ve audited three firms this year who thought ‘we’re just a tech vendor’ meant ‘we’re exempt.’ They’re all dead now. Don’t be one of them.

Write a comment