Embedded Lending Cost Calculator

Calculate Your Embedded Lending Cost

Your Loan Breakdown

Imagine you're running an online store. You just got a big order, but you don't have enough cash to buy the inventory. Instead of filling out loan applications, waiting weeks for approval, or calling your bank, you click a button inside your Shopify dashboard-and $10,000 is deposited into your account the same day. No paperwork. No bank visit. Just money, right when you need it. That’s embedded lending in action.

This isn’t science fiction. It’s happening right now on platforms like Shopify, Amazon, and even SaaS tools like QuickBooks and Square. Embedded lending means financial services, especially loans and credit, are built directly into the apps and websites you already use. You never leave the platform. You don’t need to switch to a bank website. The money appears as naturally as a checkout button.

How Embedded Lending Actually Works

At its core, embedded lending is about integration. A non-financial company-say, an e-commerce platform-connects to a licensed lender or fintech provider through secure APIs. These connections let the platform share real-time data about a customer’s behavior: sales history, order frequency, return rates, even how often they log in. The lender uses that data to make a loan decision in seconds.

Traditional loans rely on credit scores, tax returns, and bank statements. Embedded lending uses something different: context. If you’ve sold $500,000 worth of products in the last six months on Shopify, and you’ve never missed a payment or had a chargeback, you’re a low-risk borrower-even if your personal credit score is mediocre. The system doesn’t just ask, “Do you have good credit?” It asks, “Are you a reliable business?”

The technology stack behind this is simple but powerful: banking-as-a-service (BaaS) platforms like Stripe Capital or Synapse, loan origination software, and real-time underwriting engines. These tools handle everything from identity verification to risk scoring without human intervention. Approval times? Often under 30 seconds. Funding? Instant for pre-approved users, under 48 hours for others.

Why It’s Beating Traditional Lending

Traditional small business loans take 3 to 7 days. Sometimes longer. You need collateral. You need a business plan. You need to prove you’re not going to fail. Embedded lending throws all that out.

Take Shopify sellers. Before embedded lending, many had to wait weeks to get a loan from a bank or alternative lender. Now, Shopify offers inventory financing directly inside the dashboard. According to Stripe’s 2023 case study, one merchant named Bella & Duke saw a 37% increase in average order value after adding embedded credit. Why? Because customers could now pay in installments at checkout-and the merchant got paid upfront.

For the business owner, the benefits are clear:

- No application forms

- No credit score checks (in many cases)

- Funding in hours, not weeks

- Loans tied to actual performance, not past history

For the platform, it’s a win too. They earn revenue from interest or fees, keep customers from leaving to find financing elsewhere, and increase sales volume across their marketplace. A 2024 McKinsey report found that platforms offering embedded lending see 15-25% higher conversion rates at checkout compared to those that don’t.

Where It’s Used-And Where It’s Not

Embedded lending isn’t everywhere. It thrives where data is rich and decisions can be automated.

E-commerce leads the pack. 58% of all embedded lending today happens here. Shopify, Amazon, and eBay offer credit to sellers. Customers get BNPL (buy now, pay later) at checkout. It’s seamless.

Point-of-sale (POS) systems like Square and Clover now let restaurants and retail shops offer financing to customers buying expensive items-think a $2,000 treadmill or a custom kitchen setup. The loan is approved while the customer is still standing in front of the register.

B2B platforms like QuickBooks and FreshBooks are starting to offer working capital loans to freelancers and small businesses based on their invoicing history. If you’ve sent 10 invoices this month and got paid on time, you might qualify for $15,000 right inside your accounting software.

But embedded lending struggles where things get messy. Need a $500,000 equipment loan with a 10-year term? Need to prove 3 years of tax returns? Need a personal guarantee? That’s still a bank job. Embedded lending works best for smaller, faster, transaction-based loans-under $100,000, under 12 months, tied to real-time behavior.

The Dark Side: Hidden Costs and Risky Behavior

It’s not all smooth sailing. The same convenience that makes embedded lending powerful also makes it dangerous.

Some platforms aggressively push credit at checkout. You’re buying a $300 pair of shoes. The system says, “Pay $75/month for 4 months.” You click “Yes.” No one explains the APR. No one tells you that if you miss a payment, late fees stack up. The Consumer Financial Protection Bureau warned in 2023 about “dark patterns”-design tricks that make borrowing feel harmless.

And the data? It’s shared between platforms and lenders. That’s great for accuracy. But what if your shopping habits, return rates, or login times get used to decide how much you can borrow? There’s no federal law in the U.S. governing how this data can be used. The EU is moving fast with PSD3, but here? It’s a free-for-all.

Some small businesses report higher effective interest rates with embedded loans compared to traditional ones. A LinkedIn discussion in May 2024 found that 31% of SMBs using embedded lending paid more in fees than they would’ve with a bank loan. Why? Because lenders take more risk, so they charge more. And because the borrower doesn’t shop around-they just click “accept.”

Fraud is also rising. Alloy’s 2024 analysis found embedded lending has a fraud rate of 1.2-1.8%, higher than traditional credit’s 0.8-1.2%. Why? Because automated systems can’t always catch synthetic identities or stolen account credentials.

What’s Next? Regulation, Specialization, and Expansion

The market is exploding. The global embedded finance sector is projected to hit $385 billion by 2029. Embedded lending alone is growing at 33% a year.

But growth brings pressure. The Consumer Financial Protection Bureau plans to release formal guidance on embedded credit disclosures by Q3 2025. Expect rules on how lenders must show interest rates, fees, and repayment terms-right at the point of approval.

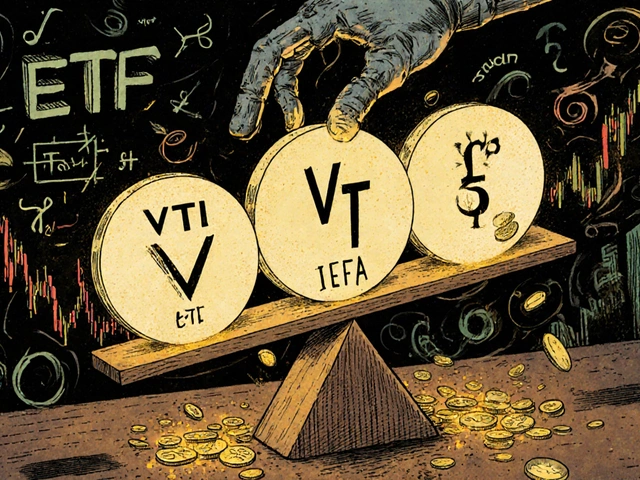

Platforms are also getting smarter. Stripe’s April 2024 update, “Capital Connect,” lets merchants compare multiple lenders inside one interface. Plaid’s “Instant Risk Signals” API gives lenders access to real-time bank account behavior-like cash flow patterns and transaction volume-without needing full account access.

And it’s spreading beyond e-commerce. Healthcare platforms are testing embedded loans for patients to pay for procedures. Education platforms are offering tuition financing. Automotive dealerships are embedding loans into their online booking tools.

By 2026, LendFoundry predicts 45% of embedded lending will be vertical-specific-tailored to one industry, not one-size-fits-all. That’s where the real innovation is happening.

Should You Use It?

If you’re a small business owner, embedded lending can be a game-changer. Use it to:

- Stock up before peak season

- Upgrade equipment without draining cash

- Offer flexible payments to customers

But don’t treat it like free money. Always check:

- What’s the actual APR? (Not just the monthly payment)

- Are there hidden fees? (Origination, late payment, early payoff)

- What happens if you miss a payment?

- Is the lender licensed? (Ask for their NMLS number)

And if you’re building a platform? Embedded lending isn’t optional anymore. It’s table stakes. Customers expect it. Competitors are using it. If you don’t offer it, you’re leaving money on the table-and making your users go elsewhere.

What’s the difference between embedded lending and BNPL?

BNPL (buy now, pay later) is a type of embedded lending, but not all embedded lending is BNPL. BNPL lets customers split a purchase into small payments at checkout. Embedded lending is broader-it includes loans to businesses for inventory, working capital, equipment, or even payroll, all offered inside non-financial apps. BNPL is customer-facing; embedded lending can be business-facing too.

Do I need a good credit score to get embedded lending?

Not always. Many embedded lenders skip traditional credit scores entirely. Instead, they look at your platform behavior: sales volume, payment history, customer retention, and transaction frequency. If you’re a consistent seller on Shopify or have steady invoicing in QuickBooks, you might qualify even with a low personal credit score.

Is embedded lending safe?

It’s as safe as the platform and lender behind it. Reputable platforms like Shopify, Stripe, and Square use bank-grade encryption and are regulated. But some smaller platforms partner with unknown lenders. Always check if the lender is licensed (ask for their NMLS number) and read the fine print. Watch out for unclear fees or automatic renewals.

Can I get embedded lending if I’m outside the U.S.?

Yes, but it’s limited. The U.S. leads in adoption, but platforms like Shopify and Amazon offer embedded lending in Canada, the UK, Australia, and parts of Europe. Regulatory rules vary by country. The EU’s PSD3 will standardize this by 2026, but right now, availability depends on your platform and region.

How long does it take to set up embedded lending on my platform?

It depends. A simple BNPL integration (like Klarna or Afterpay) can take 2-4 weeks. A full loan origination system with custom underwriting and API connections takes 8-12 weeks. You’ll need engineers familiar with REST APIs, data security, and compliance. Most providers offer dedicated support, but expect to dedicate at least 2-3 team members during setup.

Comments

Jonathan Turner

February 10, 2026So let me get this straight-you're telling me a Shopify store owner can get $10K in 30 seconds just because they sold a bunch of junk? No credit check? No collateral? This isn't innovation, it's a Ponzi scheme with better UX. The Feds are gonna come down hard when the first wave of defaults hits. These platforms aren't lenders-they're debt traps with a slick interface. And don't even get me started on how they're mining your data like it's oil. Next thing you know, your return rate on socks is gonna determine if you can buy a house.

Robert Shurte

February 11, 2026There's something deeply poetic about how finance is becoming invisible...

We used to have ledgers, notaries, signatures, waiting rooms. Now, money appears like a ghost-no ceremony, no warning, no weight. It’s not just convenience; it’s alienation. We’ve outsourced trust to algorithms that don’t care if you’re sick, if your kid’s in the hospital, if your supplier ghosted you. The data doesn’t care about context-it only sees patterns. And patterns, once broken, don’t forgive. We’re building a financial world that’s efficient, yes-but also brittle. One glitch. One API outage. One misread metric. And the whole house of cards... vanishes. No one calls it a crisis. They just say, ‘Try again tomorrow.’

Mark Vale

February 12, 2026Funny how they call it 'embedded lending' like it's some kind of natural evolution... but let's be real: it's just Wall Street in disguise, sneaking into your dashboard while you're busy picking out a new hoodie. I've seen it-small biz owners thinking they're 'smart' for using it, not realizing they're signing away their future cashflow for a 32% APR disguised as '4 monthly payments.' And don't even mention the data-sharing... who's really behind those 'secure APIs'? You think Stripe's just being nice? Nah. They're feeding your sales data to hedge funds who bet on whether your business survives next quarter. It's surveillance capitalism with a credit card. And yes, I'm paranoid. But I'm paranoid because I'm right.

Write a comment