When you link your bank account to a budgeting app like YNAB or Monzo, you’re using open banking. But what happens when that same app starts pulling in your investment portfolio, your small business loan, or even your crypto wallet? That’s open finance-and it’s already starting to change how money works.

What Exactly Is Open Banking?

Open banking is about giving you control over your bank account data. It lets you safely share information from your checking and savings accounts with third-party apps-like spending trackers, loan comparators, or payment services-without handing over your login details. Instead, it uses secure APIs built by your bank. This isn’t magic. It’s regulation. In the European Union, it started with PSD2, which went fully live in September 2019. The UK, Australia, and Brazil followed with their own rules. These laws forced banks to open up their systems. Before this, if you wanted to see all your accounts in one place, you had to manually log into each one-or worse, give your password to a third-party app. That was risky. Open banking fixed that. Today, open banking lets you:- Connect your bank accounts to apps like Mint or PocketGuard to track spending automatically

- Compare personal loan rates using real income and balance data

- Send money through apps like PayPal or Revolut without switching between banking platforms

- Get faster mortgage approvals because lenders can verify income in real time

Open Finance Is Open Banking’s Bigger Cousin

Open finance takes everything open banking does-and expands it beyond checking and savings accounts. It includes:- Investment accounts (stocks, ETFs, retirement funds)

- Credit cards and loans

- Insurance policies

- Pension plans

- Crypto wallets

- Small business financial data

Why the Difference Matters

The line between open banking and open finance isn’t just technical-it’s legal and practical. Open banking is mostly about payment accounts. That’s it. Under PSD2, banks only have to share data from current and savings accounts. Credit cards? Not required. Investments? Not included. Crypto? Forget it. Open finance says: if it’s financial data, it should be shareable-with your permission. That’s a huge shift. It means your robo-advisor could see your mortgage payments and adjust your investment strategy. Your lender could see your rental income from Airbnb and approve a bigger loan. Your retirement planner could track your crypto holdings and warn you if you’re overexposed. In the U.S., where regulation is lighter, open finance is already happening-but unevenly. Fintechs like Wealthfront and Robinhood are quietly building data-sharing tools. Banks are partnering with them. But because there’s no national standard, each integration is custom-built. That slows things down. In Europe, the push is top-down. Regulators are pushing for uniform APIs, clear consent rules, and strict security standards. That means slower rollout-but more reliable, safer systems long-term.

How It Actually Works: The Four Steps

Whether you’re using open banking or open finance, the process is the same:- Consent: You click “Allow access” in your budgeting app or financial dashboard. You choose what data to share and for how long.

- API Access: The app connects to your bank or financial provider through a secure, encrypted channel. No passwords are shared.

- Data Usage: The app uses your data to give you insights, automate transfers, or find better deals.

- Security: Everything is encrypted. Access is time-limited. You can revoke permission anytime.

Who Benefits the Most?

Consumers win. You get control. You see your whole financial picture. You can find better rates, automate savings, and avoid hidden fees. Fintechs win. They can build smarter tools without having to convince every bank to build custom integrations. They use standardized APIs to reach millions of users at once. Banks? They’re caught in the middle. Some see it as a threat. Others are turning it into a service. JPMorgan Chase, for example, now offers its own API platform so developers can build apps on top of its data. They’re not just reacting-they’re leading. Small businesses benefit too. A restaurant owner can now connect their point-of-sale system, business bank account, and payroll service to one dashboard. They can see cash flow trends, forecast taxes, and apply for loans-all without jumping between software.

The Road Ahead: What’s Coming Next?

The European Commission’s public consultation on open finance ended in early 2023. A legislative proposal-likely called PSD3-is expected in 2025 or 2026. If it passes, it will make open finance mandatory across the EU, just like PSD2 did for open banking. In the U.S., the Consumer Financial Protection Bureau (CFPB) is drafting rules under the 2021 Order on Data Sharing. If finalized, it could create a federal standard for financial data access, closing the gap between open banking and open finance. Meanwhile, crypto is becoming part of the conversation. Platforms like Coinbase and Kraken are starting to offer API access to wallet balances and transaction history. That means your financial app could soon show your Bitcoin holdings alongside your checking account. The biggest challenge? Standardization. Right now, every bank, every fintech, every country uses slightly different APIs. That makes it hard for apps to scale. The solution? Industry-wide standards-like those being developed by the Financial Data Exchange (FDX) in the U.S. and the European Banking Authority (EBA).What This Means for You

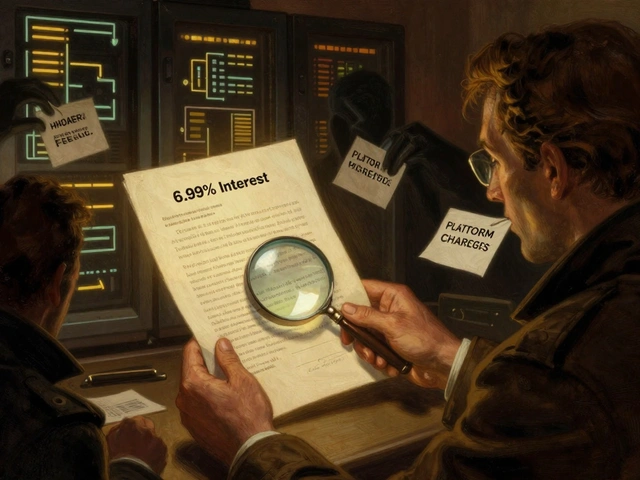

You don’t need to understand APIs or regulations to benefit. But you do need to know one thing: your financial data belongs to you. If you’re using a budgeting app, a loan comparison tool, or an investment tracker-check what data it’s accessing. Can you see which accounts are connected? Can you turn access off? If not, it’s time to switch. Start small. Link your checking account to a free app like Empower or Cleo. See how it categorizes your spending. Then, if you have investments or a credit card, try connecting those too. You might be surprised how much you’re paying in fees-or how much you could be earning. Open finance isn’t about giving up control. It’s about taking it back-from banks, from outdated systems, from fragmented tools. And it’s happening faster than most people realize.Is Open Finance Just a Fancy Name for Open Banking?

Some experts say yes. Others say no. The truth? It’s both. Open banking laid the groundwork. It proved that consumers want control. It proved that secure data sharing works. It proved that banks can’t hide behind secrecy anymore. Open finance is the next chapter. It’s not replacing open banking-it’s expanding it. Where open banking gave you access to your checking account, open finance gives you access to your entire financial life. And that’s why it matters.Is open finance the same as open banking?

No. Open banking lets you share data from your checking and savings accounts. Open finance expands that to include investments, loans, insurance, pensions, and even crypto wallets. Open banking is a subset of open finance.

Is open finance regulated everywhere?

Not yet. The EU, UK, Australia, and Brazil have strong open banking rules. Open finance is still emerging. The EU is working on PSD3 to expand those rules. In the U.S., there’s no federal law yet, but the CFPB is drafting one. Most open finance tools here are built by companies, not required by law.

Can I use open finance if I live in the U.S.?

Yes. Even without federal rules, many U.S. banks and fintechs offer API access to investment accounts, credit cards, and loans. Apps like Empower, YNAB, and Wealthfront already connect to these. You just need to grant permission-just like with open banking.

Are my financial details safe with open finance?

Yes-if you use trusted apps. Open finance uses encrypted APIs, not passwords. You control who gets access and for how long. You can turn it off anytime. It’s safer than sharing your login info. Look for apps that are certified by FDX or use bank-grade security like Plaid or MX.

What’s the difference between PSD2 and what’s coming with PSD3?

PSD2 forced banks to open up payment accounts (checking and savings) to third parties. PSD3 is expected to extend those rules to investments, insurance, pensions, and other financial products-making it open finance by law. It’s the next step in the same direction.

Will open finance replace my bank app?

Not replace-enhance. Your bank app will still show your balance and let you transfer money. But open finance lets you use other apps to manage your money smarter: comparing rates, tracking investments, automating savings across accounts. Think of it as adding a financial assistant, not replacing your bank.

Comments

Laura W

October 31, 2025Yo, open finance is literally the future and if you're still manually checking your bank statements, you're living in 2012. I connected my crypto wallet, brokerage, and business account to Empower last week-saw I was paying $87/month in hidden fees across three different apps. Cut two of them, moved cash to a 4.2% yield account, and now I'm earning more than my damn salary. This isn't tech hype-it's financial liberation. Stop letting banks gatekeep your data.

PS: If your app doesn't use FDX-certified APIs, it's not secure. Period.

Graeme C

October 31, 2025Let’s be brutally honest: open banking was a regulatory afterthought that accidentally empowered consumers. Open finance? That’s the real paradigm shift. The EU’s PSD3 isn’t just an update-it’s a constitutional amendment for financial autonomy. The fact that the U.S. still relies on Plaid’s brittle middleware instead of a unified federal standard is a national embarrassment. We’ve got fintechs building rocket ships while regulators are still arguing over whether the ignition key is required.

And yes, I’ve seen the data-consumers using open finance tools save an average of 19% on financial fees annually. This isn’t convenience. It’s economic justice.

Kenny McMiller

November 2, 2025It’s funny how we call this ‘open’ finance when all we’re really doing is outsourcing our financial agency to a new set of gatekeepers-fintechs with venture capital backing and terms of service no one reads. The data’s ‘yours’ until it’s not. What happens when the API provider gets acquired by a bank? Or when the app starts selling anonymized spending patterns to advertisers under ‘enhanced user experience’? We traded one kind of opacity for another.

Open banking was a necessary step. But open finance feels like we’re handing over the keys to our financial soul in exchange for a prettier dashboard. The real question isn’t whether we can connect our crypto to our budget app-it’s whether we should.

And honestly? I miss the days when ‘financial wellness’ meant not overspending on coffee.

Dave McPherson

November 4, 2025Ugh. Another LinkedIn post dressed up as a whitepaper. Open finance? Please. It’s just ‘banking with more buttons’ and a fancy TED Talk title. You think connecting your Coinbase to YNAB makes you a financial guru? Congrats, you now know you spent $1,200 on Dogecoin in February. Big whoop.

The real revolution? When your bank *stops* charging you $5 for an ACH transfer. Not when some app tells you your 401(k) is ‘underperforming’-which, spoiler, it always is because Wall Street is a casino with a 401(k) sticker on it.

Meanwhile, I’m over here paying $0 fees, using cash, and not trusting a single API. The only thing ‘open’ here is the gullibility of the masses. Go ahead, connect your crypto. I’ll be here, in the analog dark, sipping my oat milk latte and laughing.

Write a comment