Neobank Feature Selector

Find your perfect match based on what matters most for your finances

Your Perfect Match

is ideal for you because:

What Makes a Neobank Stand Out in 2025?

Neobanks aren’t just apps with checking accounts anymore. By 2025, they’ve become full financial hubs-offering savings with 5%+ APY, crypto trading, business tools, and even instant overdrafts. The ones that win aren’t the ones with the flashiest design. They’re the ones that actually save you money, work reliably, and don’t hide fees behind confusing tiers. If you’re tired of monthly fees, slow transfers, and customer service that takes days to reply, you’re not alone. Over 98 million Americans now use a neobank, and the top players have learned how to deliver real value.

Top Neobanks in 2025: Who’s Leading the Pack?

Not all neobanks are built the same. Some focus on the U.S. market. Others go global. Some are profitable. Others are still burning cash to grow. Here’s who’s winning in 2025 based on real user feedback, fees, and features.

Varo: Best for High Savings and No Hidden Fees

Varo is the only neobank in the U.S. with a full national bank charter. That means your money is FDIC-insured up to $250,000, just like at Chase or Bank of America. But unlike those big banks, Varo pays 5.15% APY on savings accounts-with no minimum balance or direct deposit required as of July 2025. That’s more than most traditional banks pay in a year.

They also launched Varo Advance in March 2025: a $100 overdraft buffer with 0% APR. No more $35 overdraft fees. Users on Reddit’s r/PersonalFinance call it "the first neobank that feels like a real bank." TrustPilot gives it a 4.7/5 from over 18,500 reviews. The catch? Customer service can take up to 48 hours for email replies. But if you just want a simple, high-yield checking and savings account with no fees, Varo is the easiest choice.

Chime: Best for Early Paychecks and Fee-Free Banking

Chime has over 15 million users in the U.S. and still dominates for one reason: early direct deposit. If your employer pays via direct deposit, Chime often gets your paycheck up to two days early. That’s huge if you’re living paycheck to paycheck.

They also have no monthly fees, no overdraft fees, and access to 90,000+ fee-free ATMs. But here’s what they don’t offer: savings interest above 0.10%, business accounts, or international transfers. And while their app is simple, users report glitches during peak hours-especially around payday. Reddit users in r/Chime complain about inconsistent early deposit timing and the lack of credit-building tools beyond their basic Credit Builder account. Still, if you want a no-frills, fee-free bank account that gets you paid faster, Chime is still the go-to.

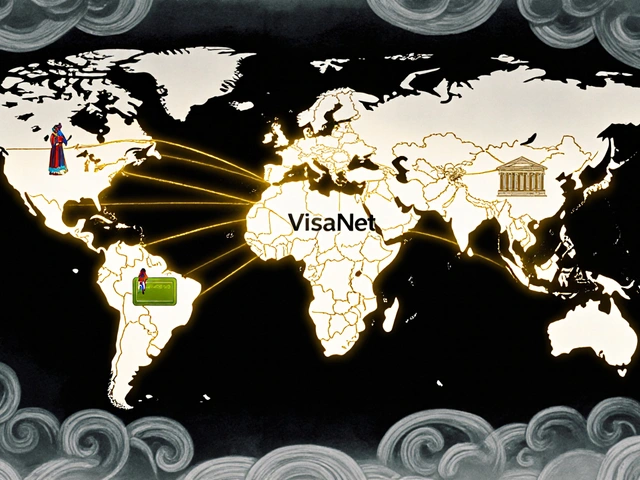

Revolut: Best for Global Travelers and Crypto Users

Revolut has over 40 million users worldwide. It’s the most powerful neobank if you travel, trade crypto, or handle multiple currencies. You can hold and exchange 150+ currencies with real-time exchange rates. Crypto trading is available for 50+ coins, and you can send money abroad with fees as low as 0.5%-far better than traditional banks.

But here’s the catch: Revolut’s free tier is full of traps. Currency exchange fees sneak in after you hit your monthly limit. Airport lounge access, higher withdrawal limits, and travel insurance? All locked behind $9.99-$29.99 monthly plans. Over 63% of negative reviews on TrustPilot mention unexpected fees. Still, if you’re someone who regularly sends money overseas, pays in euros or yen, or dabbles in Bitcoin, Revolut’s power outweighs the complexity. It’s the only neobank that feels like a Swiss bank account in your pocket.

Starling Bank: Best for Business Owners (UK Only)

If you’re in the UK and run a small business, Starling is the clear winner. It’s not available in the U.S., but for UK-based freelancers and startups, it’s unmatched. You get real-time spending alerts, integrated accounting tools, and 24/7 live chat with an average response time of just 47 seconds. They process over £6.2 billion in business transactions every month.

Starling’s business accounts cost £0-£15/month, depending on features. Compare that to traditional banks charging £50+ just for a business current account. Their app is clean, intuitive, and built by people who actually understand small business pain points. TrustPilot users give it a 4.8/5 from 27,000 reviews. If you’re in the UK and need banking that works for your business-not against it-Starling is the only choice.

Monzo: Best for Budgeting (UK Only)

Monzo’s "Pots" feature lets you split your money into virtual envelopes for rent, groceries, or vacation. In 2025, they upgraded it to "Pots Pro," adding automated tax savings for freelancers. If you’re bad at budgeting, this is the tool that fixes it. Their app shows real-time spending, categorizes every transaction, and even predicts when you’ll run out of money.

But Monzo’s U.S. functionality is almost nonexistent. You can’t use their debit card at most American merchants, and their customer support doesn’t handle U.S. inquiries. If you’re in the UK, Monzo is the most user-friendly bank for personal finance. If you’re in the U.S., it’s not worth downloading.

Acorns: Best for Investing Beginners

Acorns isn’t just a bank-it’s a bank that invests for you. It rounds up your purchases to the nearest dollar and automatically invests the spare change. Buy coffee for $4.25? $0.75 goes into a diversified portfolio of ETFs. You can also open a checking account, get a debit card, and earn 1% cash back on purchases.

With 5 million users and a 4.7/5 rating on TrustPilot, Acorns is perfect for people who want to save without thinking about it. But users complain that access to human financial advisors is limited and expensive. It’s not a replacement for a full-service broker, but if you’re just starting to invest and want automation built into your everyday spending, Acorns works better than any app on the market.

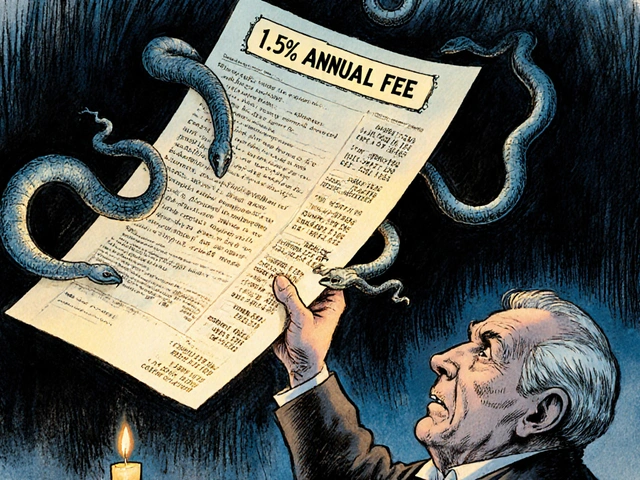

How Do Fees Really Add Up?

Neobanks love saying "no fees!" But that’s rarely the full story. Here’s what you’re actually paying:

- Chime: $0 monthly fee. $0 ATM fees. $0 overdraft fees. But $0 interest on savings.

- Varo: $0 monthly fee. $0 ATM fees. $0 overdraft fees. 5.15% APY on savings. That’s a $51.50 annual return on $1,000.

- Revolut: Free tier has $1,000 monthly currency exchange limit. After that, 0.5%-1.5% fees. Premium plans start at $9.99/month for higher limits and lounge access.

- Starling: Free personal account. Business accounts: £0-£15/month. No hidden FX fees.

- Acorns: $3/month for checking + investing. $5/month for premium features.

Most users don’t realize Revolut’s free tier charges for currency exchange after a small limit. Chime’s "no fee" model works great if you only use it for checking. But if you need to save, Varo crushes it.

Real User Problems You Should Know

Neobanks aren’t perfect. Here’s what users actually complain about:

- Chime: Early direct deposit doesn’t always come early. Technical glitches during high traffic (like payday).

- Revolut: Confusing fee structure. Users report being charged for currency exchange even when they didn’t intend to.

- Varo: Customer service response time averages 48 hours. No phone support.

- Monzo: Can’t use card in the U.S. for most purchases.

- Acorns: Limited financial advice. You’re on your own for big decisions.

One common thread? If you need help fast, you’re stuck with email or chat. Only Starling offers true 24/7 live chat with quick replies. The rest? You wait.

Who Should Use Which Neobank?

Here’s a simple guide to pick the right one:

- Want high savings interest? Use Varo.

- Get paid early every month? Use Chime.

- Travel often or use foreign currencies? Use Revolut (but pay for the premium plan).

- Live in the UK and run a business? Use Starling.

- Want to invest without thinking? Use Acorns.

- Live in the U.S. and want a full bank experience? Varo is the only one with FDIC insurance and real banking features.

What’s Next for Neobanks?

2025 is the year the neobank bubble starts to pop. Of the 400+ neobanks operating globally, analysts predict 70% will be acquired or shut down by 2027. Why? Because growth without profit isn’t sustainable. Chime made $1.7 billion in revenue last year but still lost money. Revolut made $350 million in profit-but is under regulatory pressure in 12 countries.

The winners will be the ones who focus on real needs: higher interest, better customer service, and clear pricing. Varo and Starling are already there. Chime and Revolut are trying to catch up. N26, despite $1.8 billion in funding, still struggles in the U.S. market.

Don’t chase the hype. Choose based on what you actually use. If you don’t travel, you don’t need Revolut’s 150 currencies. If you don’t invest, Acorns is just a monthly fee.

Frequently Asked Questions

Are neobanks safe?

Yes-if they’re FDIC-insured. Varo and Chime are FDIC-insured through partner banks, so your money is protected up to $250,000. Revolut and Monzo aren’t FDIC-insured in the U.S. Their funds are held in partner banks, but not all accounts carry the same protection. Always check if your specific account is covered.

Can I use a neobank as my primary bank?

Absolutely. Varo and Chime are designed to replace traditional banks. They offer direct deposit, debit cards, bill pay, and mobile check deposits. If you don’t need in-person branches or wire transfers, a neobank can handle all your daily banking. Just make sure you’re comfortable with digital-only support.

Which neobank has the best mobile app?

Monzo and Starling have the cleanest, most intuitive apps for budgeting and spending tracking. Varo and Chime are simpler but less feature-rich. Revolut’s app is powerful but overwhelming for beginners. TrustPilot users rate Monzo highest for usability in the UK, and Varo highest in the U.S. for simplicity.

Do neobanks offer credit cards?

Most don’t. Chime and Varo offer credit builder accounts that report to credit bureaus but aren’t traditional credit cards. Revolut has a credit card option in Europe, but not in the U.S. If you need a credit card, you’ll still need a traditional bank or credit union.

Can I switch from my current bank to a neobank easily?

Yes. Most neobanks offer tools to help you transfer direct deposits and automatic payments. Chime and Varo even let you link your old account and move funds over in a few days. It takes about 10-15 minutes to open the account. The hard part is updating your direct deposits and bill payments, which can take 2-4 weeks.

Next Steps: What to Do Now

If you’re ready to switch:

- Decide what you need: high interest? Early pay? Global spending? Budgeting?

- Download the top 2 apps that match your needs.

- Open the account-it takes under 10 minutes.

- Link your direct deposit and update automatic payments.

- Keep your old account open for 30 days until everything transfers smoothly.

Don’t wait for the "perfect" neobank. The best one is the one you actually use. Start with Varo if you want to earn more on savings. Start with Chime if you want to get paid faster. And if you travel? Revolut’s premium plan is worth every dollar.

Comments

RAHUL KUSHWAHA

October 31, 2025Varo's 5.15% APY is insane compared to my local bank's 0.05%... I switched last month and already made $26 in interest on $5k. No fees, no drama. Just pure growth. 😊

Julia Czinna

October 31, 2025I've been using Chime for three years and still stand by it. The early direct deposit saved me during my freelance dry spells. Yes, the app glitches sometimes-especially around payday-but the peace of mind from no overdraft fees is worth it. I wish they offered higher savings yields, though. Still, it's my primary for a reason.

Laura W

November 1, 2025Revolut’s free tier is a trap if you’re not paying attention. I got hit with a 1.2% FX fee because I didn’t realize my monthly limit was exhausted. Now I’m on the Premium plan-$19.99/month-but honestly? Worth it. I’m traveling to Japan next month and I’ve already locked in 100k JPY at 0.3% spread. That’s a $300 saving vs. my old bank. Also, crypto trading is smooth as butter. Don’t be fooled by ‘no fees’-read the fine print, folks.

Astha Mishra

November 2, 2025I find it fascinating how neobanks have evolved from digital wallets into full financial ecosystems-yet still fail to address the deeper psychological barriers people have toward money. We don’t just need higher APY or faster deposits; we need systems that help us feel in control, not just more efficient. Varo gives us interest, but does it give us peace? Monzo’s Pots feel like therapy for overspenders. And Starling’s live chat? That’s not just customer service-it’s emotional support in a system that often feels cold. Maybe the real innovation isn’t in the tech, but in how it heals our relationship with money.

Kenny McMiller

November 3, 2025Honestly? If you’re in the US and want to actually grow your money without jumping through hoops, Varo is the only one that’s not just a glorified prepaid card. Chime’s early pay is cool, but 0.1% APY? That’s inflation in reverse. Acorns is for people who think ‘rounding up’ is investing. Real investing requires intention. Varo’s FDIC insurance + 5.15% APY + no overdraft fees? That’s the trifecta. I’ve been using it as my primary since January. No complaints. No hidden traps. Just money working for me. The 48-hour email support? Fine. I don’t need a human to tell me my balance.

Write a comment